Question: Petrox Oil Co. is considering a project that will have fixed costs of $10,000,000. The product will be sold for $41.50 per unit, and will

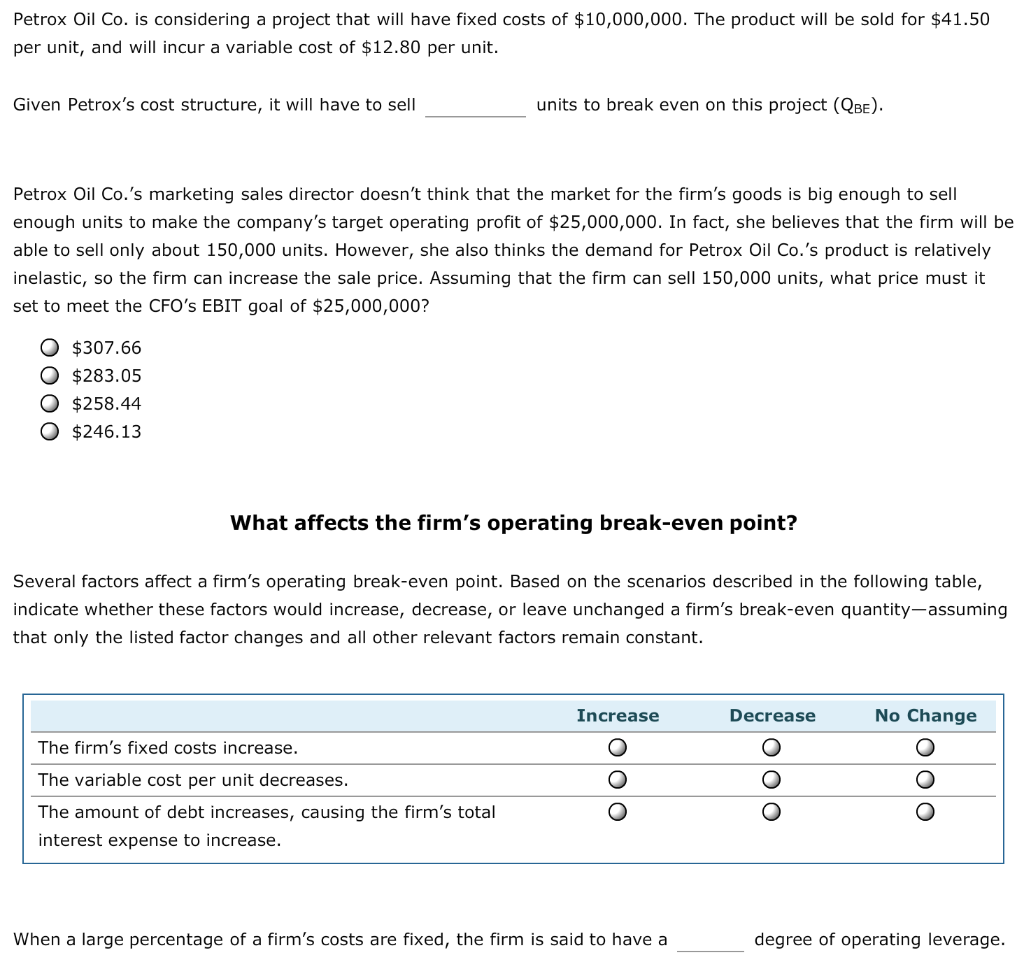

Petrox Oil Co. is considering a project that will have fixed costs of $10,000,000. The product will be sold for $41.50 per unit, and will incur a variable cost of $12.80 per unit. Given Petrox's cost structure, it will have to sell units to break even on this project (QBE). Petrox Oil Co.'s marketing sales director doesn't think that the market for the firm's goods is big enough to sell enough units to make the company's target operating profit of $25,000,000. In fact, she believes that the firm will be able to sell only about 150,000 units. However, she also thinks the demand for Petrox Oil Co.'s product is relatively inelastic, so the firm can increase the sale price. Assuming that the firm can sell 150,000 units, what price must it set to meet the CFO's EBIT goal of $25,000,000? $307.66 $283.05 O $258.44 $246.13 What affects the firm's operating break-even point? Several factors affect a firm's operating break-even point. Based on the scenarios described in the following table, indicate whether these factors would increase, decrease, or leave unchanged a firm's break-even quantity-assuming that only the listed factor changes and all other relevant factors remain constant. Increase Decrease No Change The firm's fixed costs increase. The variable cost per unit decreases. The amount of debt increases, causing the firm's total interest expense to increase. When a large percentage of a firm's costs are fixed, the firm is said to have a degree of operating leverage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts