Question: Peyton Campbell mework 11 PM CDT in a portfollo. A stock's relevant risk is the risk that remains once a stock is in a diversified

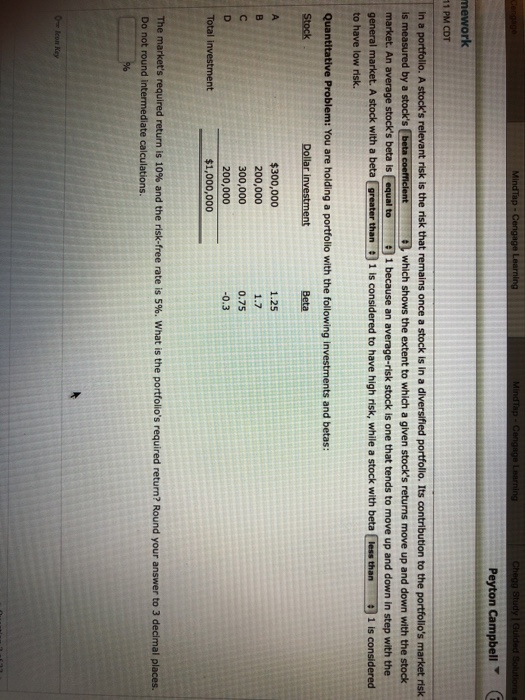

Peyton Campbell mework 11 PM CDT in a portfollo. A stock's relevant risk is the risk that remains once a stock is in a diversified portfollo. Its contribution to the portfolio's market risk is measured by a stock's beta market. An average stock's beta is equal to 1 because an average-risk stock is one that tends to move up and down in step with the general market. A stock with a beta greater than 1 is considered to have high risk, while a stock with beta less than1 is considered nt which shows the extent to which a given stock's returns move up and down with the stock to have low risk. Quantitative Problem: You are holding a portfolio with the following investments and betas: Stock Dollar investment $300,000 200,000 300,000 200,000 $1,000,000 1.25 1.7 0.75 0.3 nt The market's required return is 10% and the risk-free rate is 5%. What is the portfolio's required return? Round your answer to 3 decimal places. Do not round intermediate calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts