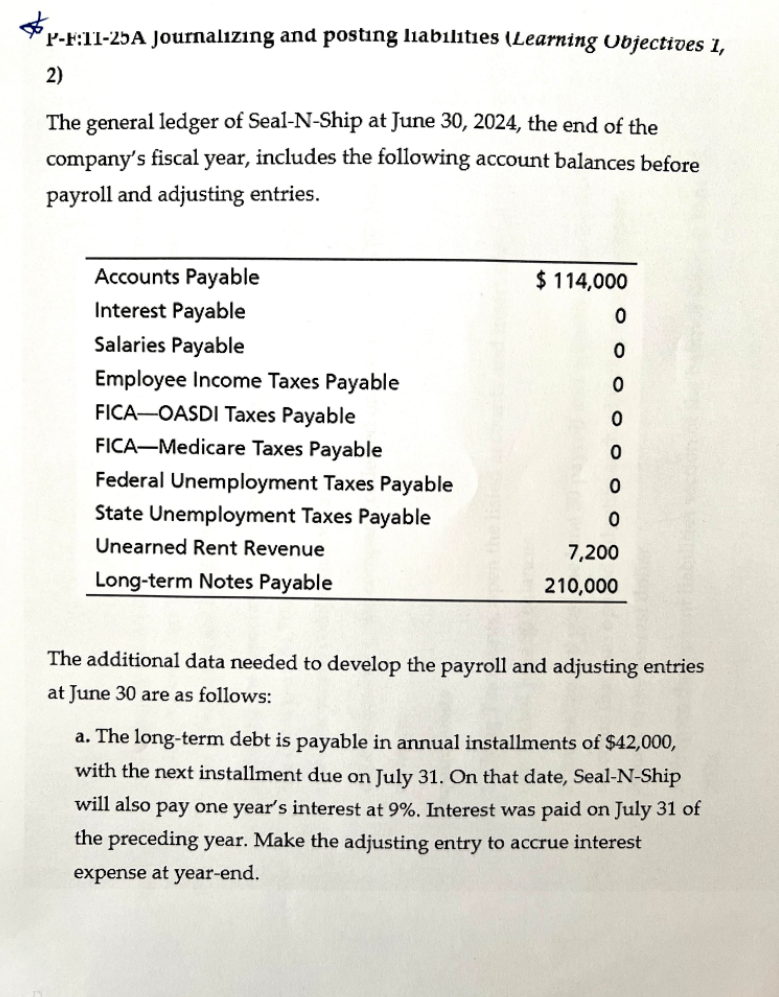

Question: P-F:11-25A Journalizing and posting liabilities (Learning Objectives 1, 2) The general ledger of Seal-N-Ship at June 30, 2024, the end of the company's fiscal

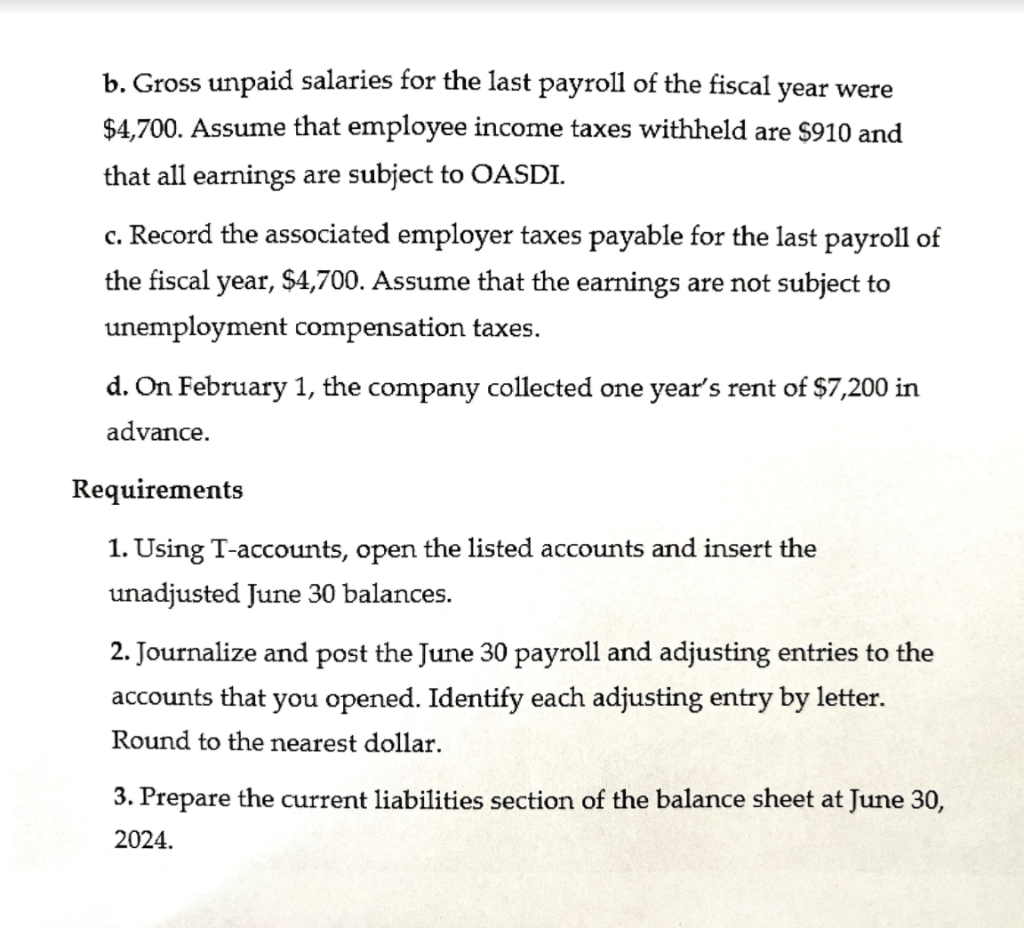

P-F:11-25A Journalizing and posting liabilities (Learning Objectives 1, 2) The general ledger of Seal-N-Ship at June 30, 2024, the end of the company's fiscal year, includes the following account balances before payroll and adjusting entries. Accounts Payable Interest Payable Salaries Payable Employee Income Taxes Payable FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable Federal Unemployment Taxes Payable State Unemployment Taxes Payable Unearned Rent Revenue Long-term Notes Payable $ 114,000 0 0 0 0 0 0 0 7,200 210,000 The additional data needed to develop the payroll and adjusting entries at June 30 are as follows: a. The long-term debt is payable in annual installments of $42,000, with the next installment due on July 31. On that date, Seal-N-Ship will also pay one year's interest at 9%. Interest was paid on July 31 of the preceding year. Make the adjusting entry to accrue interest expense at year-end.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts