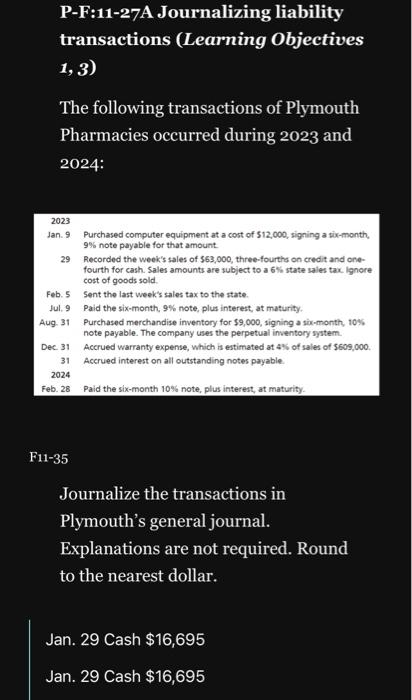

Question: P-F:11-27A Journalizing liability transactions (Learning Objectives 1, 3) The following transactions of Plymouth Pharmacies occurred during 2023 and 2024: 2023 Jan. 9 Purchased computer equipment

P-F:11-27A Journalizing liability transactions (Learning Objectives 1, 3) The following transactions of Plymouth Pharmacies occurred during 2023 and 2024: 2023 Jan. 9 Purchased computer equipment at a cost of $12,000, signing a wix-month, 9% note payable for that amount. 29 Recorded the week's sales of $63,000, three-fourths on credit and onefourth for cash. Sales amounts are subject to a 6% state sales tax. Ignore cost of goods sold. Feb. 5 Sent the last week's sales tax to the state. Jul, 9 Paid the six-month, 9% note, plus interest, at maturity. Aug. 31 Purchased merchandise inventory for $9,000, signing a six-month, 10% note payable. The company uses the perpetual inventory system. Dec. 31 Accrued warranty expense, which is estimated at 4 of sales of $609,000. 31 Accrued interest on all outstanding notes payable. 2024 Feb. 28 Paid the six-month 10% note, plus interest, at maturity. F11-35 Journalize the transactions in Plymouth's general journal. Explanations are not required. Round to the nearest dollar. Jan. 29 Cash $16,695 Jan. 29 Cash $16,695

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts