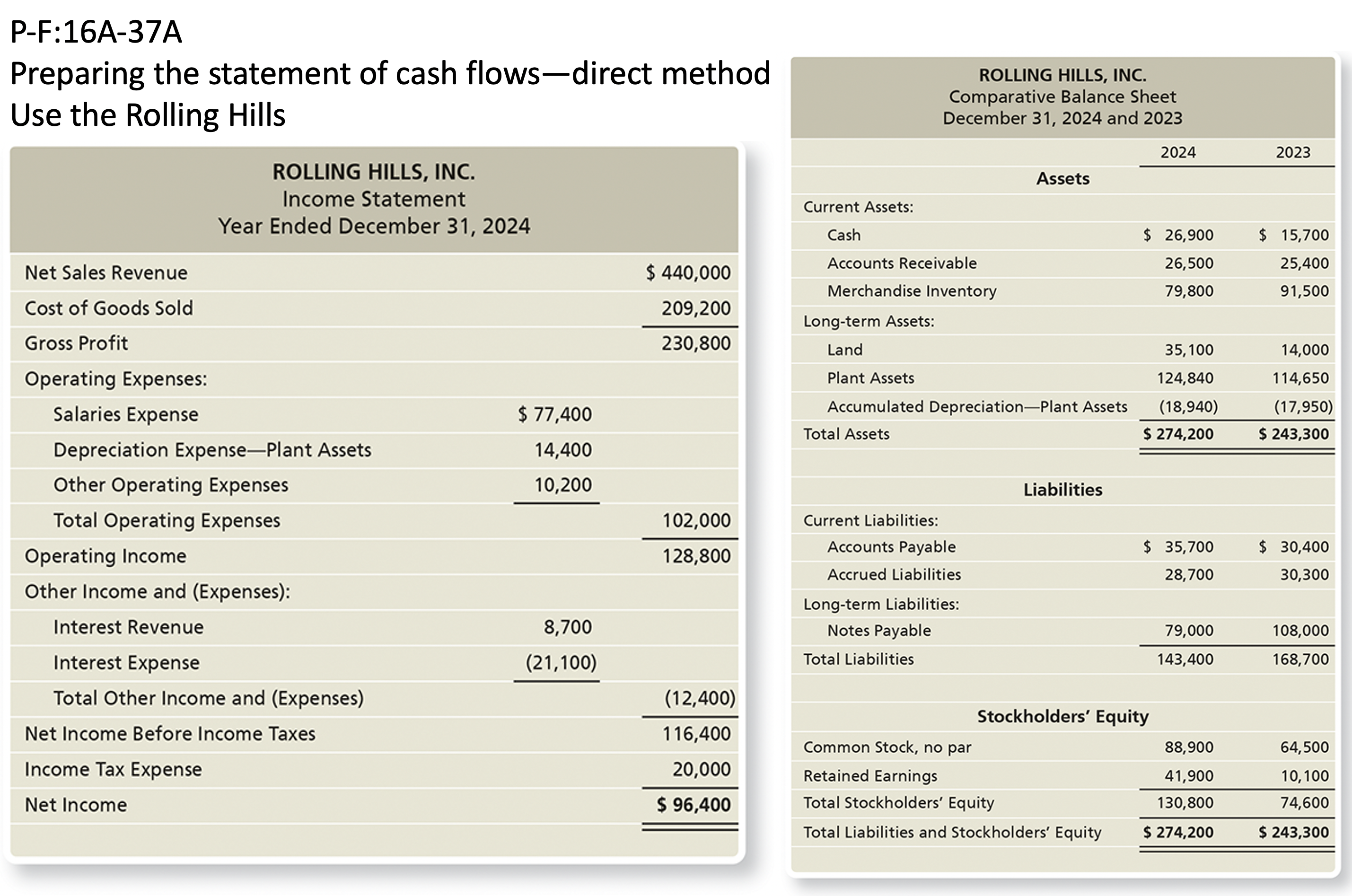

Question: PF:16A37A Preparing the statement of cash flowsdirect method Use the Rolling Hills ROLLING HILLS, INC. Income Statement Year Ended December 31, 2024 Net Sales Revenue

PF:16A37A Preparing the statement of cash flowsdirect method Use the Rolling Hills ROLLING HILLS, INC. Income Statement Year Ended December 31, 2024 Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses: Salaries Expense Depreciation ExpensePlant Assets Other Operating Expenses Total Operating Expenses Operating Income Other Income and (Expenses): Interest Revenue Interest Expense Total Other Income and (Expenses) Net Income Before Income Taxes Income Tax Expense Net Income $ 77,400 14,400 10,200 8,700 (21,100) $ 440,000 209,200 230,800 102,000 128,800 (12,400) 1 16,400 20,000 5 96,400 ROLLING HILLS, INC. Comparative Balance Sheet December 31, 2024 and 2023 2024 Assets Current Assets: Cash 5 26,900 Accounts Receivable 26,500 Merchandise Inventory 79,800 Long-term Assets: Land 35,100 Plant Assets 124,840 Accumulated DepreciationPlant Assets (18,940) Total Assets 5 274,200 Liabilities Current Liabilities: Accounts Payable $ 35,700 Accrued Liabilities 28,700 Long-term Liabilities: Notes Payable 79,000 Total Liabilities 143,400 Stockholders' Equity Common Stock, no par 88,900 Retained Earnings 41,900 Total Stockholders' Equity 130,800 Total Liabilities and Stockholders' Equity S 274,200 2023 S 1 5,700 25,400 91,500 14,000 114,650 (17,950) 5 243,300 5 30,400 30,300 108,000 168,700 64, 500 10,100 74,600 5 243,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts