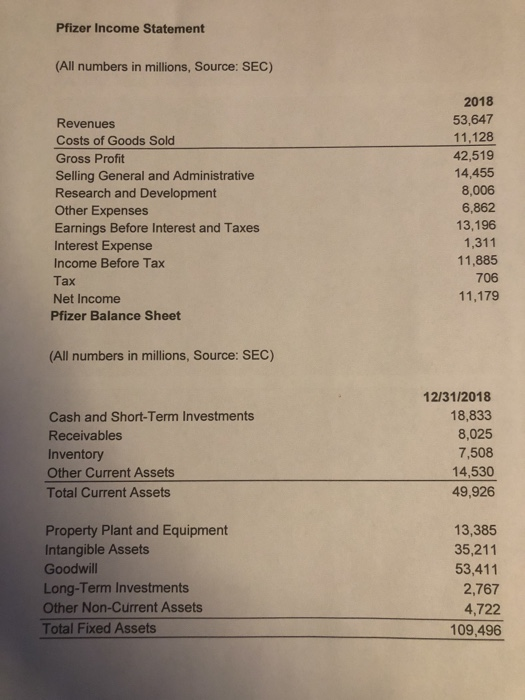

Question: Pfizer Income Statement All numbers in millions, Source: SEC) 2018 53,647 Revenues 11,128 42,519 14,455 Costs of Goods Sold Gross Profit Selling General and Administrative

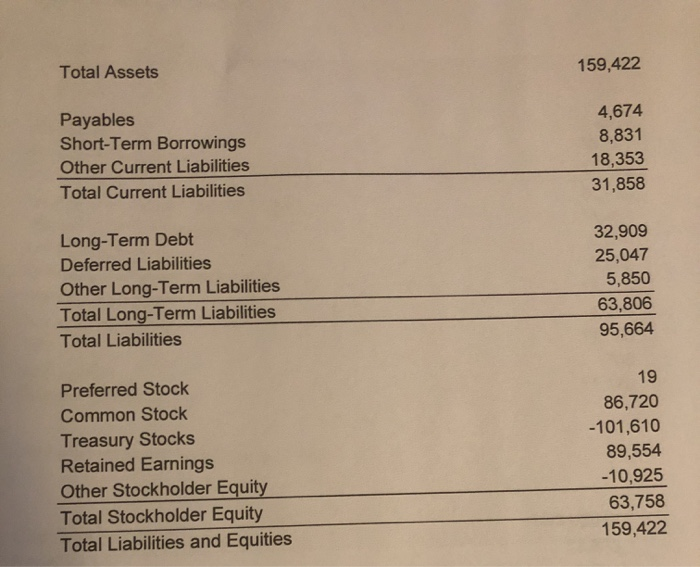

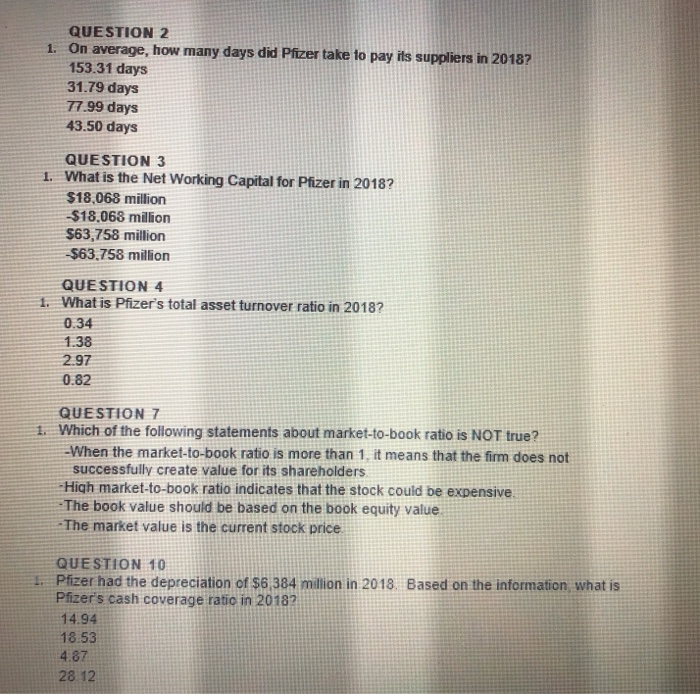

Pfizer Income Statement All numbers in millions, Source: SEC) 2018 53,647 Revenues 11,128 42,519 14,455 Costs of Goods Sold Gross Profit Selling General and Administrative Research and Development Other Expenses Earnings Before Interest and Taxes Interest Expense 8,006 6,862 13,196 1,311 11,885 706 Income Before Tax Tax 11,179 Net Income Pfizer Balance Sheet (All numbers in millions, Source: SEC) 12/31/2018 18,833 Cash and Short-Term Investments 8,025 7,508 14,530 Receivables Inventory Other Current Assets Total Current Assets 49,926 Property Plant and Equipment 13,385 35,211 53,411 2,767 4,722 109,496 Intangible Assets Goodwill Long-Term Investments Other Non-Current Assets Total Fixed Assets Total Assets 159,422 Payables Short-Term Borrowings 4,674 8,831 Other Current Liabilities 18,353 Total Current Liabilities 31,858 Long-Term Debt 32,909 25,047 5,850 Deferred Liabilities Other Long-Term Liabilities Total Long-Term Liabilities 63,806 Total Liabilities 95,664 Preferred Stock 19 86,720 -101,610 89,554 -10,925 Common Stock Treasury Stocks Retained Earnings Other Stockholder Equity Total Stockholder Equity Total Liabilities and Equities 63,758 159,422 QUESTION 2 1. On average, how many days did Pfizer take to pay its suppliers in 20187 153.31 days 31.79 days 77.99 days 43.50 days QUESTION 3 1. What is the Net Working Capital for Pfizer in 2018? $18,068 million -$18,068 million $63,758 million $63.758 million QUESTION 4 1. What is Pizer's total asset turnover ratio in 20182 0.34 1.38 2.97 0.82 QUESTION 7 Which of the following statements about market-to-book ratio is NOT true? 1. When the market-to-book ratio is more than 1, it means that the firm does not successfully create value for its shareholders High market-to-book ratio indicates that the stock could be expensive The book value should be based on the book equity value The market value is the current stock price QUESTION 10 Pfizer had the depreciation of $6,384 milion in 2018. Based on the information, what is Pfzers cash coverage ratic in 2018? 14.94 18.53 4.87 28 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts