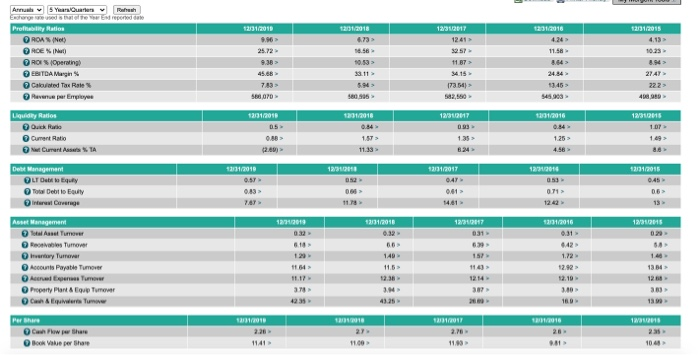

Question: Pfizer's Ratio analyses * Types: Pfizer --> company financials --> ratios o Profitability o Activity o Leverage o Liquidity para 1201/2018 673 12/31/2010 9.96 25.72

Pfizer's Ratio analyses*

Types: Pfizer --> company financials --> ratios

o Profitability

o Activity

o Leverage

o Liquidity

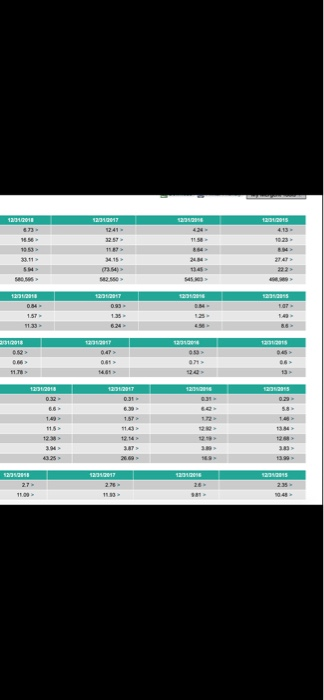

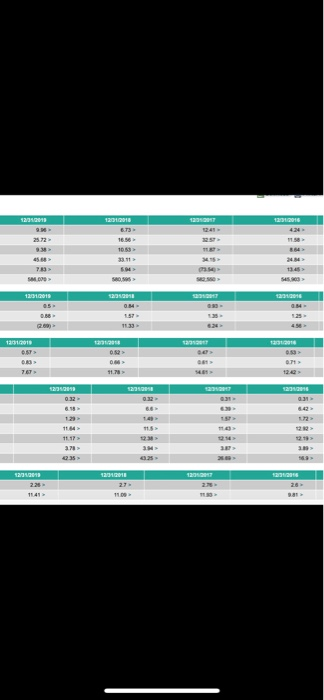

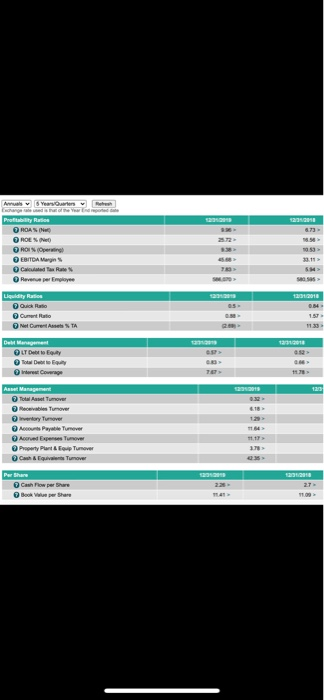

para 1201/2018 673 12/31/2010 9.96 25.72 9.38 > 12/31/2017 1241 257 1201/2018 424 12/01/2018 4.13 10.23 8.58 10:53 11.07 34.15 11.58 844 24.84 Aruba 5 Years Ourens Exchanged Entrepredelo Prototy Ratios ROAN RCEI ROES Operating EBITDA Margin Calousted Tax Rates Revenue per Employee Liquidity Ratios Quick Rate Current Ratio Current ASTA 222 > 1725) 582,560 588 OPD 54.903 1231010 12/31 01/2016 1201/2018 0.84 12/31018 1. OP 1.25 > 11.33 13031/2010 129410200 12/2014 31/2015 120122017 047 0.57 Debe Monagement LTD Total Debt to Euty Interest Coverage 0:45 06 071 > 12.42 14.01 13131/2010 123402017 13031/2016 12/31215 032 18 6 66 140 Asset Management Anal Turn Robes Turnover tarkey Tu Trai Accounts Payable Tower Are Tumor Property Fort & Cup Tumor Car Tun 642 1.72 12.92 11.5 180 13 23 Cu Flow Share Book Value per Share 104 12010010 12010019 129 1053 118 SH ch 22 > 121/2018 1.57 83 129907 OF 0.61 1465 07 06 11.7 123/2018 0.31 1:43 15 1.8T 11 26 12012017 2. 2.7 12010013 12 12010010 8.73 18.56 1231/2016 42 34 S403 SMO SOS 12:510015 49 > O 09 767 1178 032 31 22 1 35 12042013 2.25 114 27 6.73 Profitability Rates ROAN ROEP ROS EBITOA Margins Calculated Tax Rules Revenue per Emgloyee 5053 3311 SM Sas 1251/2018 65 Liquidity Ratios Quick Ratio Cunetatio Net Current TA Det Management LT Debt to y . rower 118 1203 Asset Management Total Tumowe Receivables Tumover 16 4 17 Accounts Payable Tumover Acred Expenses Tumover Property Plant Tumover Cash Trial Tumover CashPower the Booper Share para 1201/2018 673 12/31/2010 9.96 25.72 9.38 > 12/31/2017 1241 257 1201/2018 424 12/01/2018 4.13 10.23 8.58 10:53 11.07 34.15 11.58 844 24.84 Aruba 5 Years Ourens Exchanged Entrepredelo Prototy Ratios ROAN RCEI ROES Operating EBITDA Margin Calousted Tax Rates Revenue per Employee Liquidity Ratios Quick Rate Current Ratio Current ASTA 222 > 1725) 582,560 588 OPD 54.903 1231010 12/31 01/2016 1201/2018 0.84 12/31018 1. OP 1.25 > 11.33 13031/2010 129410200 12/2014 31/2015 120122017 047 0.57 Debe Monagement LTD Total Debt to Euty Interest Coverage 0:45 06 071 > 12.42 14.01 13131/2010 123402017 13031/2016 12/31215 032 18 6 66 140 Asset Management Anal Turn Robes Turnover tarkey Tu Trai Accounts Payable Tower Are Tumor Property Fort & Cup Tumor Car Tun 642 1.72 12.92 11.5 180 13 23 Cu Flow Share Book Value per Share 104 12010010 12010019 129 1053 118 SH ch 22 > 121/2018 1.57 83 129907 OF 0.61 1465 07 06 11.7 123/2018 0.31 1:43 15 1.8T 11 26 12012017 2. 2.7 12010013 12 12010010 8.73 18.56 1231/2016 42 34 S403 SMO SOS 12:510015 49 > O 09 767 1178 032 31 22 1 35 12042013 2.25 114 27 6.73 Profitability Rates ROAN ROEP ROS EBITOA Margins Calculated Tax Rules Revenue per Emgloyee 5053 3311 SM Sas 1251/2018 65 Liquidity Ratios Quick Ratio Cunetatio Net Current TA Det Management LT Debt to y . rower 118 1203 Asset Management Total Tumowe Receivables Tumover 16 4 17 Accounts Payable Tumover Acred Expenses Tumover Property Plant Tumover Cash Trial Tumover CashPower the Booper Share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts