Question: Pharma Traders received their Bank Statement on 30/6/2017 and compared it with their Cash Receipt Journal and Cash Payment Journal. The following facts came

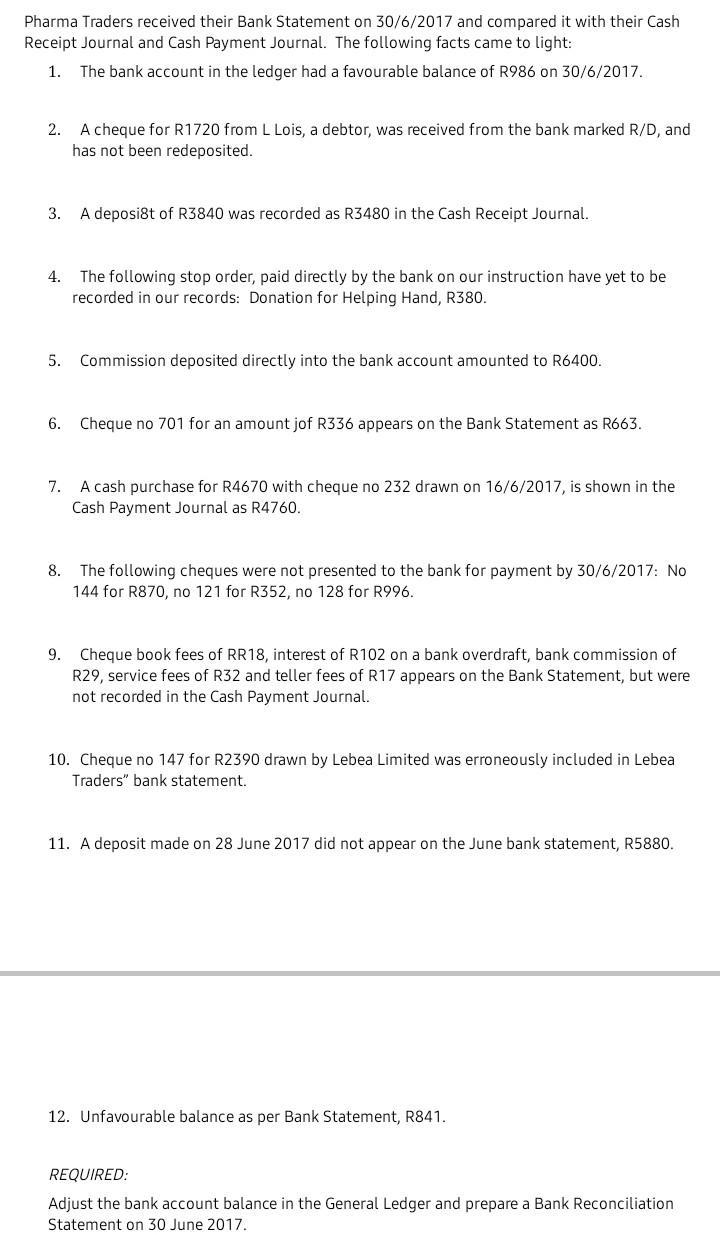

Pharma Traders received their Bank Statement on 30/6/2017 and compared it with their Cash Receipt Journal and Cash Payment Journal. The following facts came to light: 1. The bank account in the ledger had a favourable balance of R986 on 30/6/2017. 2. A cheque for R1720 from L Lois, a debtor, was received from the bank marked R/D, and has not been redeposited. 3. A deposi8t of R3840 was recorded as R3480 in the Cash Receipt Journal. 4. 5. The following stop order, paid directly by the bank on our instruction have yet to be recorded in our records: Donation for Helping Hand, R380. Commission deposited directly into the bank account amounted to R6400. 6. Cheque no 701 for an amount jof R336 appears on the Bank Statement as R663. 7. A cash purchase for R4670 with cheque no 232 drawn on 16/6/2017, is shown in the Cash Payment Journal as R4760. 8. The following cheques were not presented to the bank for payment by 30/6/2017: No 144 for R870, no 121 for R352, no 128 for R996. 9. Cheque book fees of RR18, interest of R102 on a bank overdraft, bank commission of R29, service fees of R32 and teller fees of R17 appears on the Bank Statement, but were not recorded in the Cash Payment Journal. 10. Cheque no 147 for R2390 drawn by Lebea Limited was erroneously included in Lebea Traders" bank statement. 11. A deposit made on 28 June 2017 did not appear on the June bank statement, R5880. 12. Unfavourable balance as per Bank Statement, R841. REQUIRED: Adjust the bank account balance in the General Ledger and prepare a Bank Reconciliation Statement on 30 June 2017. Pharma Traders received their Bank Statement on 30/6/2017 and compared it with their Cash Receipt Journal and Cash Payment Journal. The following facts came to light: 1. The bank account in the ledger had a favourable balance of R986 on 30/6/2017. 2. A cheque for R1720 from L Lois, a debtor, was received from the bank marked R/D, and has not been redeposited. 3. A deposi8t of R3840 was recorded as R3480 in the Cash Receipt Journal. 4. 5. The following stop order, paid directly by the bank on our instruction have yet to be recorded in our records: Donation for Helping Hand, R380. Commission deposited directly into the bank account amounted to R6400. 6. Cheque no 701 for an amount jof R336 appears on the Bank Statement as R663. 7. A cash purchase for R4670 with cheque no 232 drawn on 16/6/2017, is shown in the Cash Payment Journal as R4760. 8. The following cheques were not presented to the bank for payment by 30/6/2017: No 144 for R870, no 121 for R352, no 128 for R996. 9. Cheque book fees of RR18, interest of R102 on a bank overdraft, bank commission of R29, service fees of R32 and teller fees of R17 appears on the Bank Statement, but were not recorded in the Cash Payment Journal. 10. Cheque no 147 for R2390 drawn by Lebea Limited was erroneously included in Lebea Traders" bank statement. 11. A deposit made on 28 June 2017 did not appear on the June bank statement, R5880. 12. Unfavourable balance as per Bank Statement, R841. REQUIRED: Adjust the bank account balance in the General Ledger and prepare a Bank Reconciliation Statement on 30 June 2017.

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

a b Date Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Account Titles Beginning ... View full answer

Get step-by-step solutions from verified subject matter experts