Question: Pharoah Capital Ltd . issued ( 6 2 0 $ 1 , 0 0 0 ) bonds at 1 0 2 .

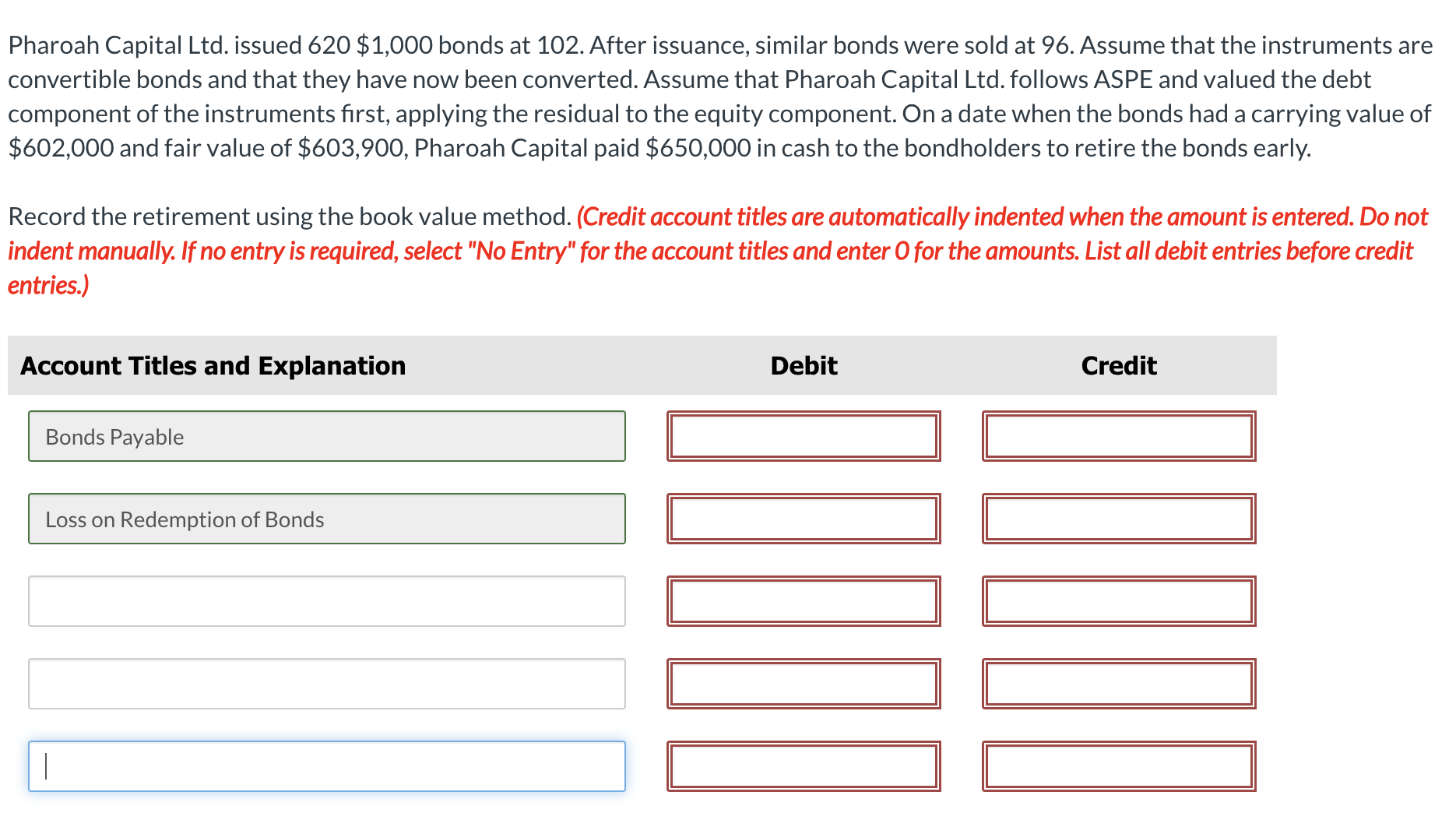

Pharoah Capital Ltd issued $ bonds at After issuance, similar bonds were sold at Assume that the instruments are convertible bonds and that they have now been converted. Assume that Pharoah Capital Ltd follows ASPE and valued the debt component of the instruments first, applying the residual to the equity component. On a date when the bonds had a carrying value of $ and fair value of $ Pharoah Capital paid $ in cash to the bondholders to retire the bonds early.

Record the retirement using the book value method. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter for the amounts. List all debit entries before credit entries.

Account Titles and Explanation

Debit

Credit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock