Question: Pharoah Inc. ' s only temporary difference at the beginning and end of 2 0 2 4 is caused by a $ 3 . 1

Pharoah Inc.s only temporary difference at the beginning and end of is caused by a $ million deferred gain for tax purposes

for an installment sale of a plant asset, and the related receivable only onehalf of which is classified as a current asset is due in equal

installments in and The related deferred tax liability at the beginning of the year is $ In the third quarter of

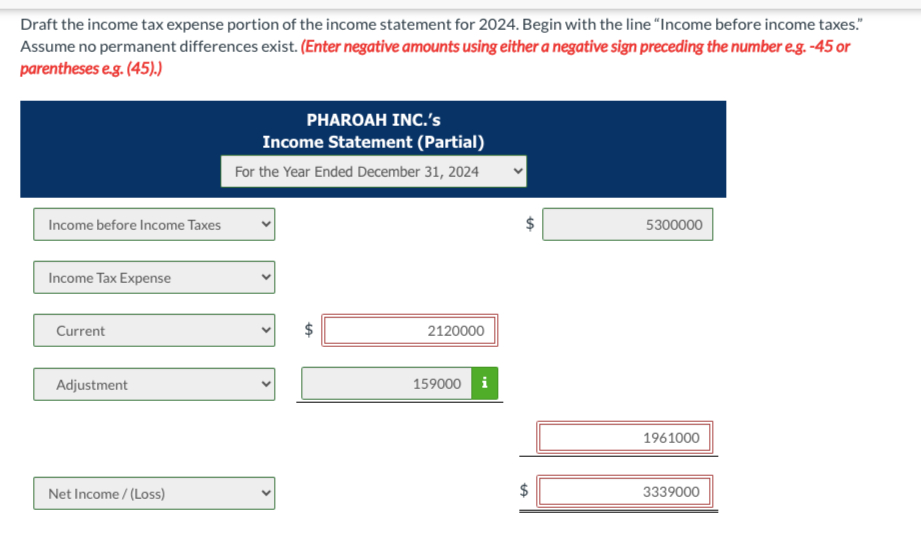

a new tax rate of is enacted into law and is scheduled to become effective for Taxable income for is $ andDraft the income tax expense portion of the income statement for Begin with the line "Income before income taxes."

Assume no permanent differences exist. Enter negative amounts using either a negative sign preceding the number eg or

parentheses eg

PHAROAH INC.s

Income Statement Partial

For the Year Ended December

$

taxable income is expected in all future years.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock