Question: Pharoah's unit production cost under variable costing is $22, and $29 under absorption costing. Net income under variable costing was $243000 and $185600 under absorption

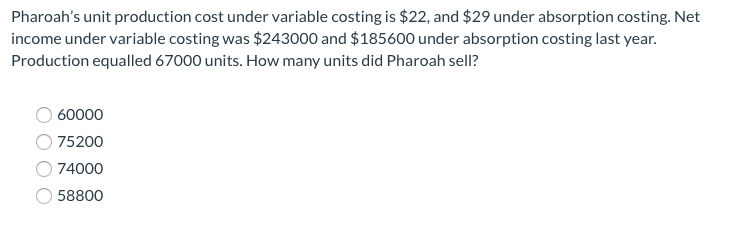

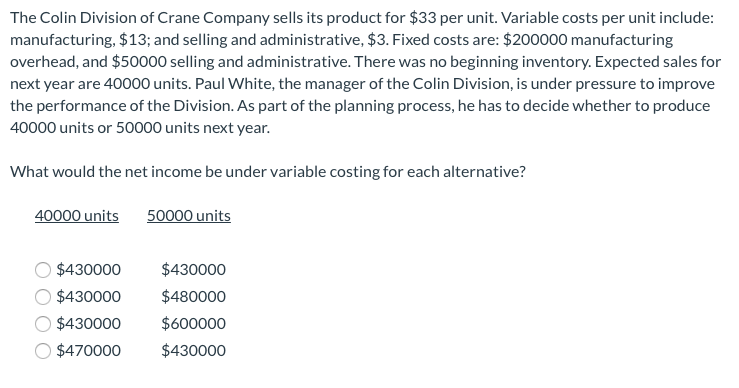

Pharoah's unit production cost under variable costing is $22, and $29 under absorption costing. Net income under variable costing was $243000 and $185600 under absorption costing last year. Production equalled 67000 units. How many units did Pharoah sell? 60000 75200 74000 58800 The Colin Division of Crane Company sells its product for $33 per unit. Variable costs per unit include: manufacturing, $13; and selling and administrative, $3. Fixed costs are: $200000 manufacturing overhead, and $50000 selling and administrative. There was no beginning inventory. Expected sales for next year are 40000 units. Paul White, the manager of the Colin Division, is under pressure to improve the performance of the Division. As part of the planning process, he has to decide whether to produce 40000 units or 50000 units next year. What would the net income be under variable costing for each alternative? 40000 units 50000 units $430000 $430000 $430000 $470000 $430000 $480000 $600000 $430000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts