Question: Philbrick Company signed a three-year contract to develop custom sales training materials and provide training to the employees of Elliot Company. The contract price is

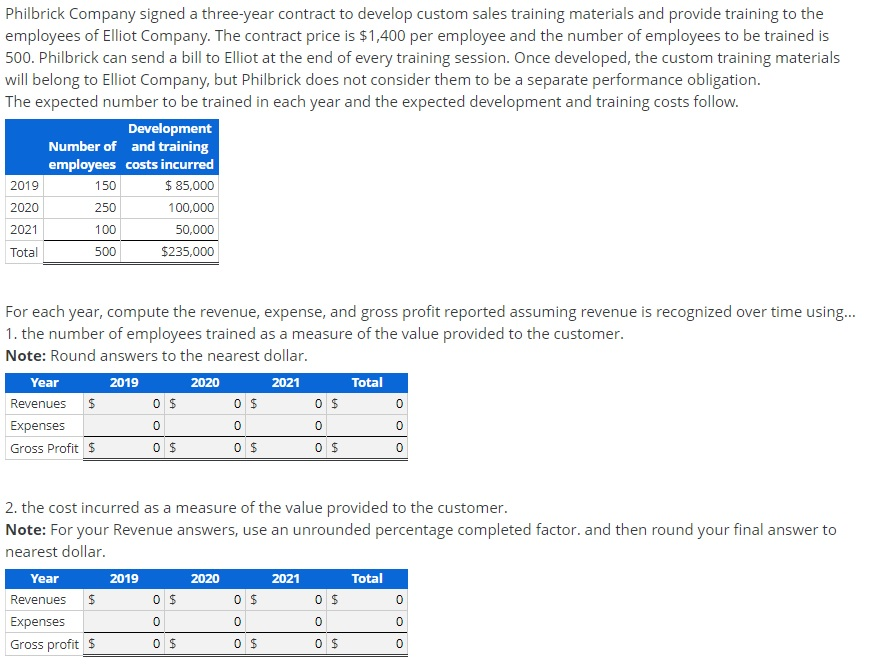

Philbrick Company signed a three-year contract to develop custom sales training materials and provide training to the employees of Elliot Company. The contract price is $1,400 per employee and the number of employees to be trained is 500. Philbrick can send a bill to Elliot at the end of every training session. Once developed, the custom training materials will belong to Elliot Company, but Philbrick does not consider them to be a separate performance obligation. The expected number to be trained in each year and the expected development and training costs follow. Development Number of and training employees costs incurred 2019 $ 85,000 2020 250 100,000 2021 50,000 Total 500 $235,000 52 150 100 For each year, compute the revenue, expense, and gross profit reported assuming revenue is recognized over time using... 1. the number of employees trained as a measure of the value provided to the customer. Note: Round answers to the nearest dollar. Year 2019 2020 2021 Total Revenues $ 0 $ 0 $ 0 $ Expenses 0 0 0 0 Gross Profit $ 0 $ 0 $ 0$ 0 2. the cost incurred as a measure of the value provided to the customer. Note: For your Revenue answers, use an unrounded percentage completed factor. and then round your final answer to nearest dollar. Year 2019 2020 2021 Total Revenues $ 0 $ 0 $ 0 $ 0 Expenses 0 0 0 0 Gross profit $ 0 $ 0 $ 0$ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts