Question: Pic 1- Instructions Pic 2- QUESTION Pic 3- Template Example Description For Excel Assignment #2 you will prepare an Excel spreadsheet to calculate the answer

Pic 1- Instructions

Pic 1- Instructions

Pic 2- QUESTION

Pic 3- Template Example

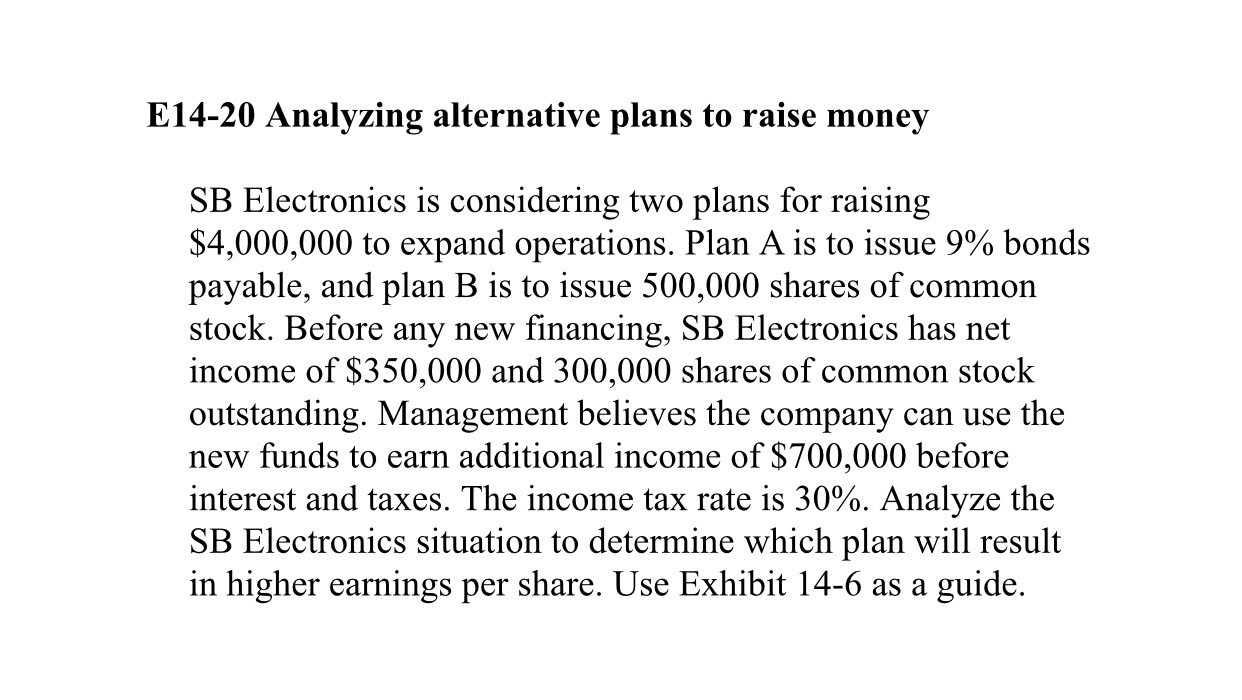

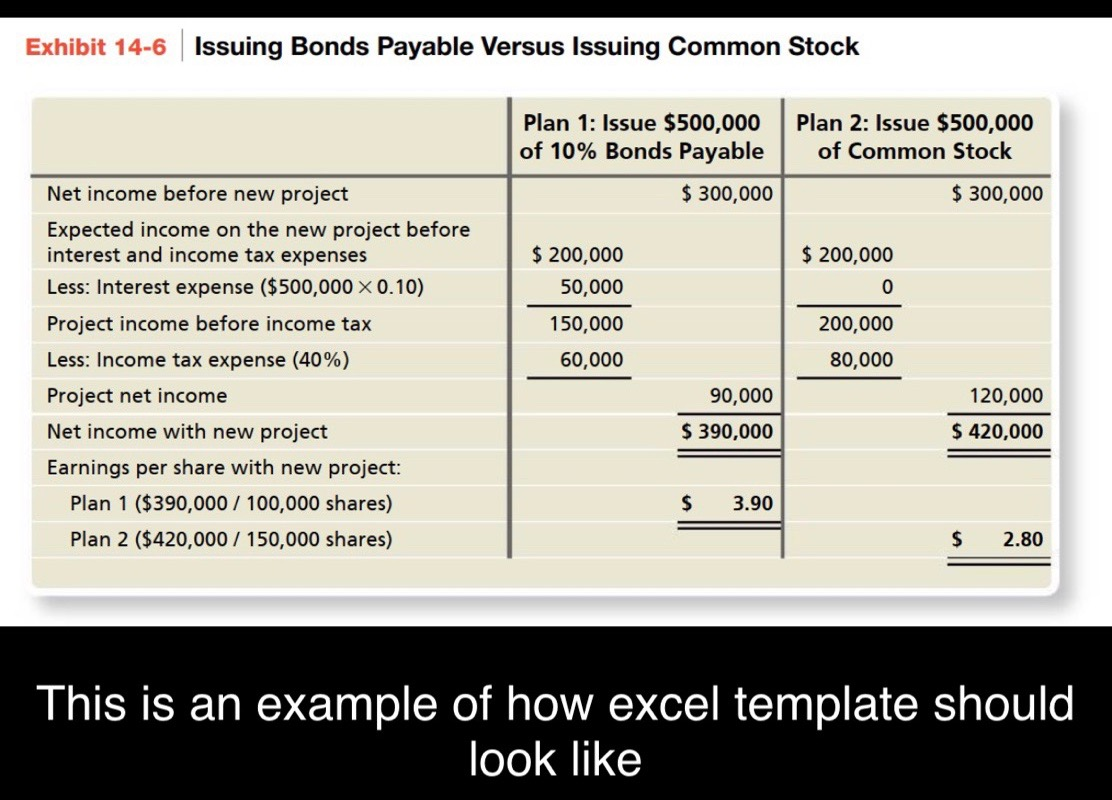

Description For Excel Assignment #2 you will prepare an Excel spreadsheet to calculate the answer the following Exercise. Format the spreadsheet to resemble Exhibit 14-6 on page 754 of your text. Use your spreadsheet program to do the math involved or it will result in a loss of points. Remember that is the object of this assessment. Be sure to save your file with an xls or xlsx extension. E14-20 Analyzing alternative plans to raise money SB Electronics is considering two plans for raising $4,000,000 to expand operations. Plan A is to issue 9% bonds payable, and plan B is to issue 500,000 shares of common stock. Before any new financing, SB Electronics has net income of $350,000 and 300,000 shares of common stock outstanding. Management believes the company can use the new funds to earn additional income of $700,000 before interest and taxes. The income tax rate is 30%. Analyze the SB Electronics situation to determine which plan will result in higher earnings per share. Use Exhibit 14-6 as a guide. Exhibit 14-6 Issuing Bonds Payable Versus Issuing Common Stock Plan 1: Issue $500,000 of 10% Bonds Payable Plan 2: Issue $500,000 of Common Stock $ 300,000 $ 300,000 Net income before new project Expected income on the new project before interest and income tax expenses Less: Interest expense ($500,000 x 0.10) Project income before income tax Less: Income tax expense (40%) Project net income Net income with new project Earnings per share with new project: Plan 1 ($390,000 / 100,000 shares) Plan 2 ($420,000 / 150,000 shares) $ 200,000 50,000 150,000 60,000 $ 200,000 0 200,000 80,000 90,000 $ 390,000 120,000 $ 420,000 $ 3.90 $ 2.80 This is an example of how excel template should look like

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts