Question: Pick a new car that you'd be interested in purchasing. This can be anything from a completely realistic purchase that you're considering right now to

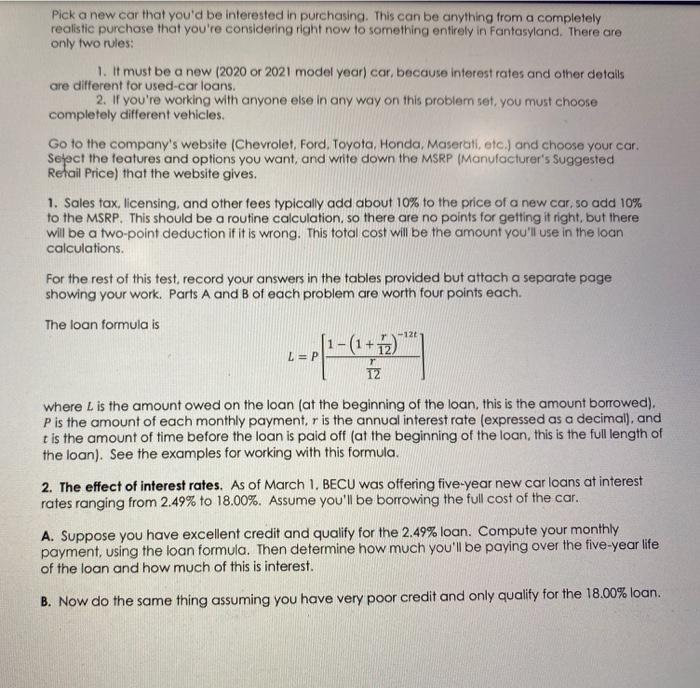

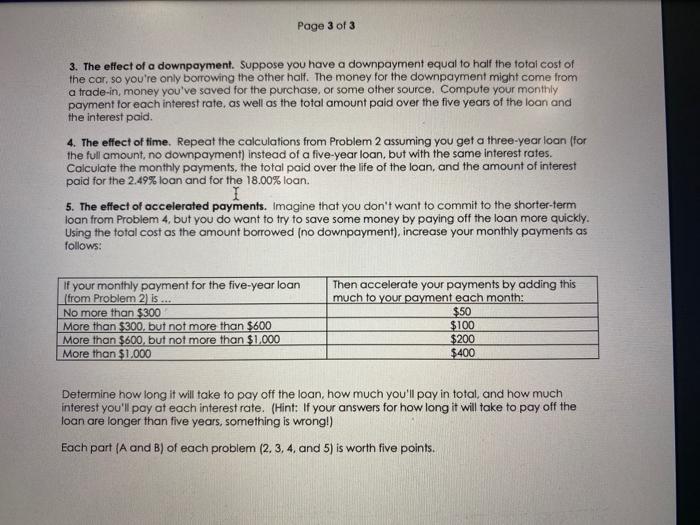

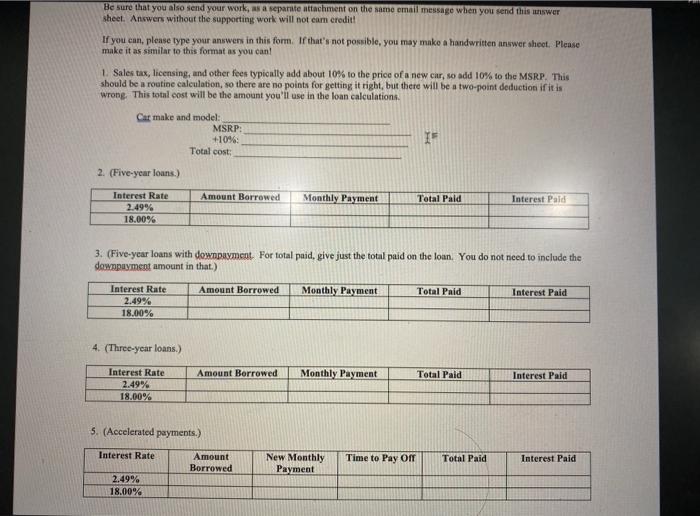

Pick a new car that you'd be interested in purchasing. This can be anything from a completely realistic purchase that you're considering right now to something entirely in Fantasyland. There are only two rules: 1. It must be a new (2020 or 2021 model year) cor, because interest rates and other details are different for used-car loans. 2. If you're working with anyone else in any way on this problem set, you must choose completely different vehicles. Go to the company's website (Chevrolet, Ford, Toyota, Honda, Maserati, etc.) and choose your car. Select the features and options you want, and write down the MSRP (Manufacturer's Suggested Retail Price) that the website gives. 1. Sales tax, licensing, and other fees typically add about 10% to the price of a new car so add 10% to the MSRP. This should be a routine calculation, so there are no points for getting it right, but there will be a two-point deduction if it is wrong. This total cost will be the amount you'll use in the loan calculations. For the rest of this test, record your answers in the tables provided but attach a separate page showing your work. Parts A and B of each problem are worth four points each. The loan formula is -120 L =P 21460 2-(1-12) IZ where L is the amount owed on the loan (at the beginning of the loan, this is the amount borrowed). P is the amount of each monthly payment, r is the annual interest rate (expressed as a decimal), and t is the amount of time before the loan is paid off (at the beginning of the loan, this is the full length of the loan). See the examples for working with this formula. 2. The effect of interest rates. As of March 1, BECU was offering five-year new car loans at interest rates ranging from 2.49% to 18.00%. Assume you'll be borrowing the full cost of the car. A. Suppose you have excellent credit and qualify for the 2.49% loan. Compute your monthly payment, using the loan formula. Then determine how much you'll be paying over the five-year life of the loan and how much of this is interest. B. Now do the same thing assuming you have very poor credit and only quality for the 18.00% loan. Page 3 of 3 3. The effect of a downpayment. Suppose you have a downpayment equal to half the total cost of the car, so you're only borrowing the other half. The money for the downpayment might come from a trade-in, money you've saved for the purchase, or some other source. Compute your monthly payment for each interest rate, as well as the total amount paid over the five years of the loan and the interest paid 4. The effect of time. Repeat the calculations from Problem 2 assuming you get a three-year loan (for the full amount, no downpayment) instead of a five-year loan, but with the same interest rates. Calculate the monthly payments, the total paid over the life of the loan, and the amount of interest paid for the 2.49% loan and for the 18.00% loan. I 5. The effect of accelerated payments. Imagine that you don't want to commit to the shorter-term loan from Problem 4, but you do want to try to save some money by paying off the loan more quickly. Using the total cost as the amount borrowed (no downpayment), increase your monthly payments as follows: If your monthly payment for the five-year loan (from Problem 2) is ... No more than $300 More than $300, but not more than $600 More than $600, but not more than $1,000 More than $1,000 Then accelerate your payments by adding this much to your payment each month: $50 $100 $200 $400 Determine how long it will take to pay off the loan, how much you'll pay in total, and how much interest you'll pay at each interest rate. (Hint: If your answers for how long it will take to pay off the loan are longer than five years, something is wrong!) Each part (A and B) of each problem (2.3, 4, and 5) is worth five points. Be sure that you also send your work, as a separate attachment on the same email message when you send this answer sheel. Answers without the supporting work will not eam credit! If you can, plense type your answers in this form. If that's not possible, you may make a handwritten answer sheet. Please make it as similar to this format as you can! 1. Sales tas, licensing, and other fees typically add about 10% to the price of a new car, so add 10% to the MSRP. This should be a routine calculation, so there are no points for getting it right, but there will be a two-point deduction if it is wrong. This total cost will be the amount you'll use in the loan calculations. Car make and model: MSRP: +10% Total cost: IF 2. (Five-year loans.) Amount Borrowed Monthly Payment Total Pald Interest Paid Interest Rate 2.49% 18.00% 3. (Five-year loans with downpayment. For total paid, give just the total paid on the loan. You do not need to include the downpayment amount in that.) Amount Borrowed Monthly Payment Total Paid Interest Paid Interest Rate 2.49% 18.00% 4. (Three-year loans.) Amount Borrowed Monthly Payment Total Paid Interest Paid Interest Rate 2.49% 18.00% 5. (Accelerated payments.) Interest Rate Amount Borrowed Time to Pay OF Total Paid New Monthly Payment Interest Paid 2.49% 18.00% Pick a new car that you'd be interested in purchasing. This can be anything from a completely realistic purchase that you're considering right now to something entirely in Fantasyland. There are only two rules: 1. It must be a new (2020 or 2021 model year) cor, because interest rates and other details are different for used-car loans. 2. If you're working with anyone else in any way on this problem set, you must choose completely different vehicles. Go to the company's website (Chevrolet, Ford, Toyota, Honda, Maserati, etc.) and choose your car. Select the features and options you want, and write down the MSRP (Manufacturer's Suggested Retail Price) that the website gives. 1. Sales tax, licensing, and other fees typically add about 10% to the price of a new car so add 10% to the MSRP. This should be a routine calculation, so there are no points for getting it right, but there will be a two-point deduction if it is wrong. This total cost will be the amount you'll use in the loan calculations. For the rest of this test, record your answers in the tables provided but attach a separate page showing your work. Parts A and B of each problem are worth four points each. The loan formula is -120 L =P 21460 2-(1-12) IZ where L is the amount owed on the loan (at the beginning of the loan, this is the amount borrowed). P is the amount of each monthly payment, r is the annual interest rate (expressed as a decimal), and t is the amount of time before the loan is paid off (at the beginning of the loan, this is the full length of the loan). See the examples for working with this formula. 2. The effect of interest rates. As of March 1, BECU was offering five-year new car loans at interest rates ranging from 2.49% to 18.00%. Assume you'll be borrowing the full cost of the car. A. Suppose you have excellent credit and qualify for the 2.49% loan. Compute your monthly payment, using the loan formula. Then determine how much you'll be paying over the five-year life of the loan and how much of this is interest. B. Now do the same thing assuming you have very poor credit and only quality for the 18.00% loan. Page 3 of 3 3. The effect of a downpayment. Suppose you have a downpayment equal to half the total cost of the car, so you're only borrowing the other half. The money for the downpayment might come from a trade-in, money you've saved for the purchase, or some other source. Compute your monthly payment for each interest rate, as well as the total amount paid over the five years of the loan and the interest paid 4. The effect of time. Repeat the calculations from Problem 2 assuming you get a three-year loan (for the full amount, no downpayment) instead of a five-year loan, but with the same interest rates. Calculate the monthly payments, the total paid over the life of the loan, and the amount of interest paid for the 2.49% loan and for the 18.00% loan. I 5. The effect of accelerated payments. Imagine that you don't want to commit to the shorter-term loan from Problem 4, but you do want to try to save some money by paying off the loan more quickly. Using the total cost as the amount borrowed (no downpayment), increase your monthly payments as follows: If your monthly payment for the five-year loan (from Problem 2) is ... No more than $300 More than $300, but not more than $600 More than $600, but not more than $1,000 More than $1,000 Then accelerate your payments by adding this much to your payment each month: $50 $100 $200 $400 Determine how long it will take to pay off the loan, how much you'll pay in total, and how much interest you'll pay at each interest rate. (Hint: If your answers for how long it will take to pay off the loan are longer than five years, something is wrong!) Each part (A and B) of each problem (2.3, 4, and 5) is worth five points. Be sure that you also send your work, as a separate attachment on the same email message when you send this answer sheel. Answers without the supporting work will not eam credit! If you can, plense type your answers in this form. If that's not possible, you may make a handwritten answer sheet. Please make it as similar to this format as you can! 1. Sales tas, licensing, and other fees typically add about 10% to the price of a new car, so add 10% to the MSRP. This should be a routine calculation, so there are no points for getting it right, but there will be a two-point deduction if it is wrong. This total cost will be the amount you'll use in the loan calculations. Car make and model: MSRP: +10% Total cost: IF 2. (Five-year loans.) Amount Borrowed Monthly Payment Total Pald Interest Paid Interest Rate 2.49% 18.00% 3. (Five-year loans with downpayment. For total paid, give just the total paid on the loan. You do not need to include the downpayment amount in that.) Amount Borrowed Monthly Payment Total Paid Interest Paid Interest Rate 2.49% 18.00% 4. (Three-year loans.) Amount Borrowed Monthly Payment Total Paid Interest Paid Interest Rate 2.49% 18.00% 5. (Accelerated payments.) Interest Rate Amount Borrowed Time to Pay OF Total Paid New Monthly Payment Interest Paid 2.49% 18.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts