Question: Pick any call option from problem 4, and consider delta and gamma hedging a short position on this call, using the underlying stock and a

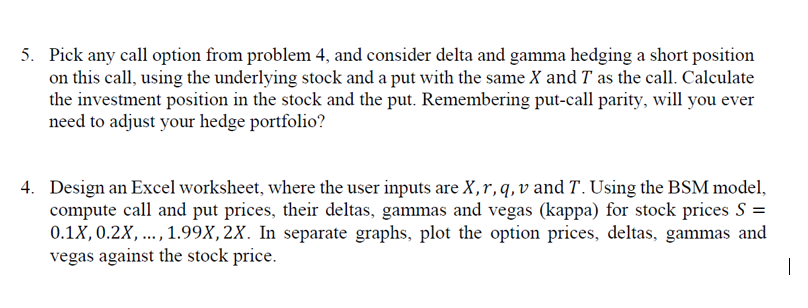

Pick any call option from problem 4, and consider delta and gamma hedging a short position on this call, using the underlying stock and a put with the same and as the call. Calculate the investment position in the stock and the put. Remembering put-call parity, will you ever need to adjust your hedge portfolio?

Question 4 was answered in: https://www.chegg.com/homework-help/questions-and-answers/design-excel-worksheet-user-inputs-x-r-q-v-t-using-bsm-model-compute-call-put-prices-delta-q81248554?trackid=UTfd2nnt

5. Pick any call option from problem 4, and consider delta and gamma hedging a short position on this call, using the underlying stock and a put with the same X and T as the call. Calculate the investment position in the stock and the put. Remembering put-call parity, will you ever need to adjust your hedge portfolio? 4. Design an Excel worksheet, where the user inputs are X,r,q,v and T. Using the BSM model, compute call and put prices, their deltas, gammas and vegas (kappa) for stock prices S = 0.1X, 0.2X, ..., 1.998, 2X. In separate graphs, plot the option prices, deltas, gammas and vegas against the stock price. 5. Pick any call option from problem 4, and consider delta and gamma hedging a short position on this call, using the underlying stock and a put with the same X and T as the call. Calculate the investment position in the stock and the put. Remembering put-call parity, will you ever need to adjust your hedge portfolio? 4. Design an Excel worksheet, where the user inputs are X,r,q,v and T. Using the BSM model, compute call and put prices, their deltas, gammas and vegas (kappa) for stock prices S = 0.1X, 0.2X, ..., 1.998, 2X. In separate graphs, plot the option prices, deltas, gammas and vegas against the stock price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts