Question: Pick the best answer based on the following information: Harold transfers the following to a newly formed corporation: Land (basis of $50,000 and FMV of

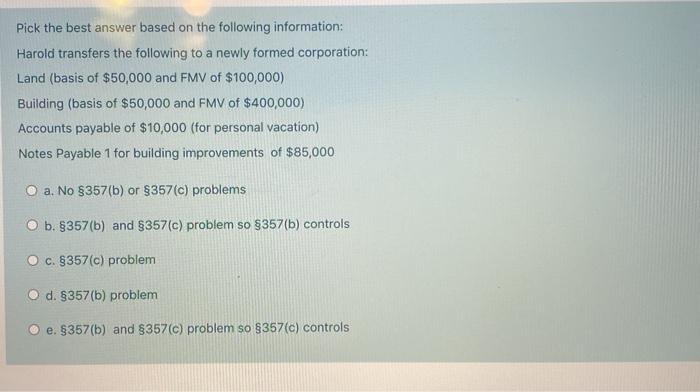

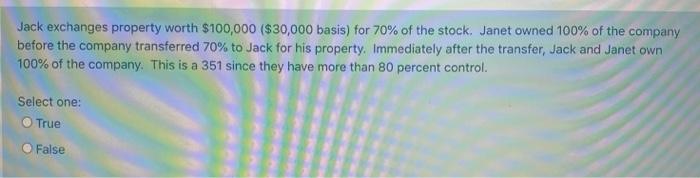

Pick the best answer based on the following information: Harold transfers the following to a newly formed corporation: Land (basis of $50,000 and FMV of $100,000) Building (basis of $50,000 and FMV of $400,000) Accounts payable of $10,000 (for personal vacation) Notes Payable 1 for building improvements of $85,000 a. No $357(b) or $357(c) problems b. 8357(b) and $357(c) problem so $357(b) controls O c.8357(c) problem d. 8357(b) problem e. $357(b) and $357(c) problem so $357(c) controls Jack exchanges property worth $100,000 ($30,000 basis) for 70% of the stock. Janet owned 100% of the company before the company transferred 70% to Jack for his property. Immediately after the transfer, Jack and Janet own 100% of the company. This is a 351 since they have more than 80 percent control. Select one: True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts