Question: pid ... ... DOMUS who GIGA WA IP- CASE STUDY I ... IN: Regression-Based Site Selection at La Quinta Hotels The old adage that says

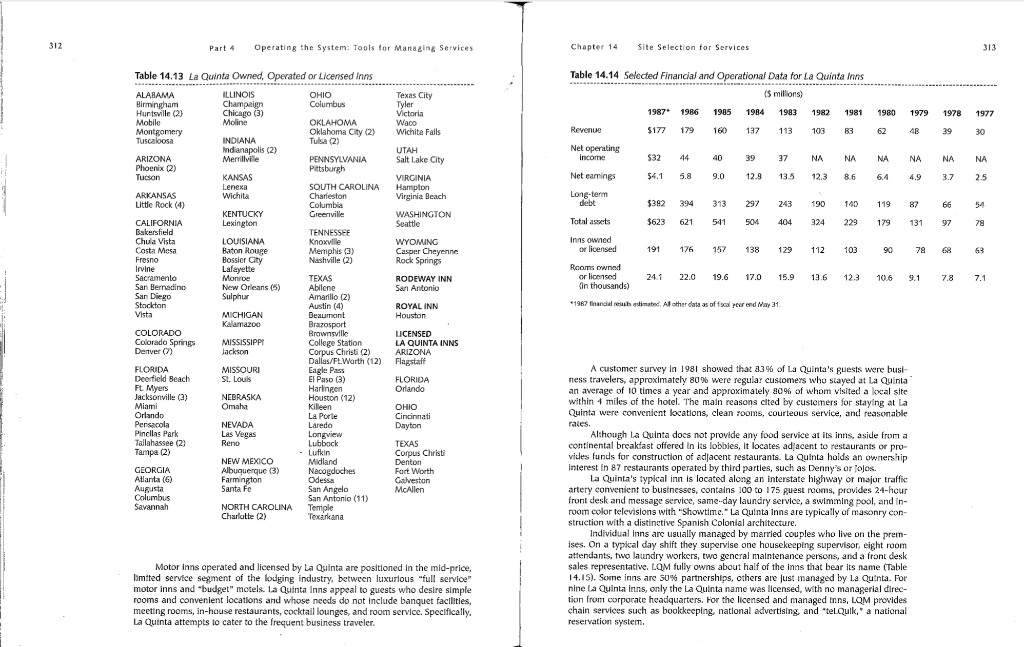

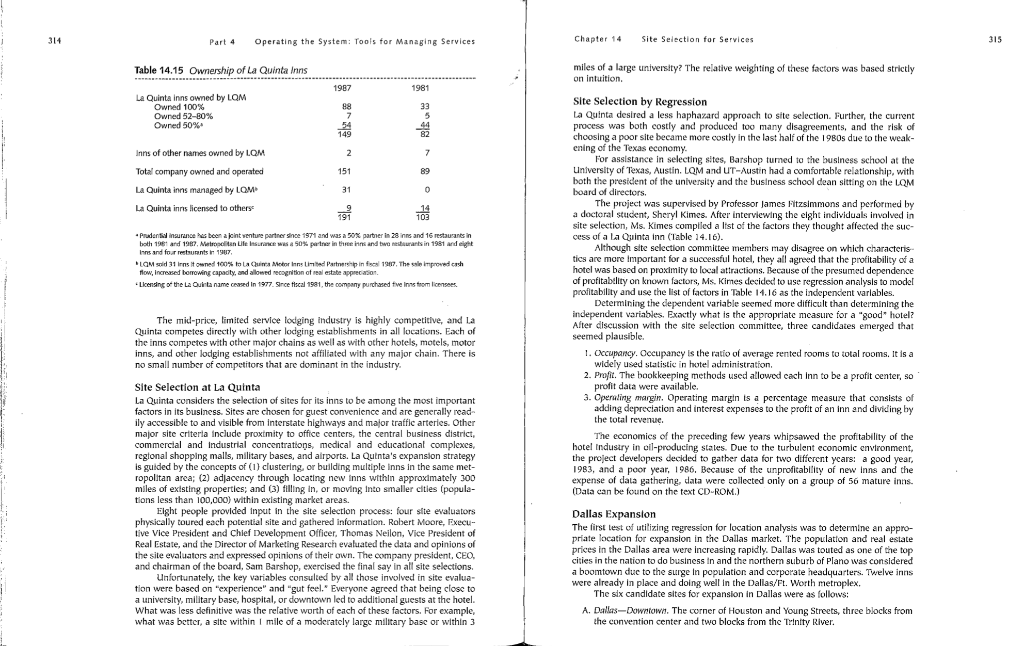

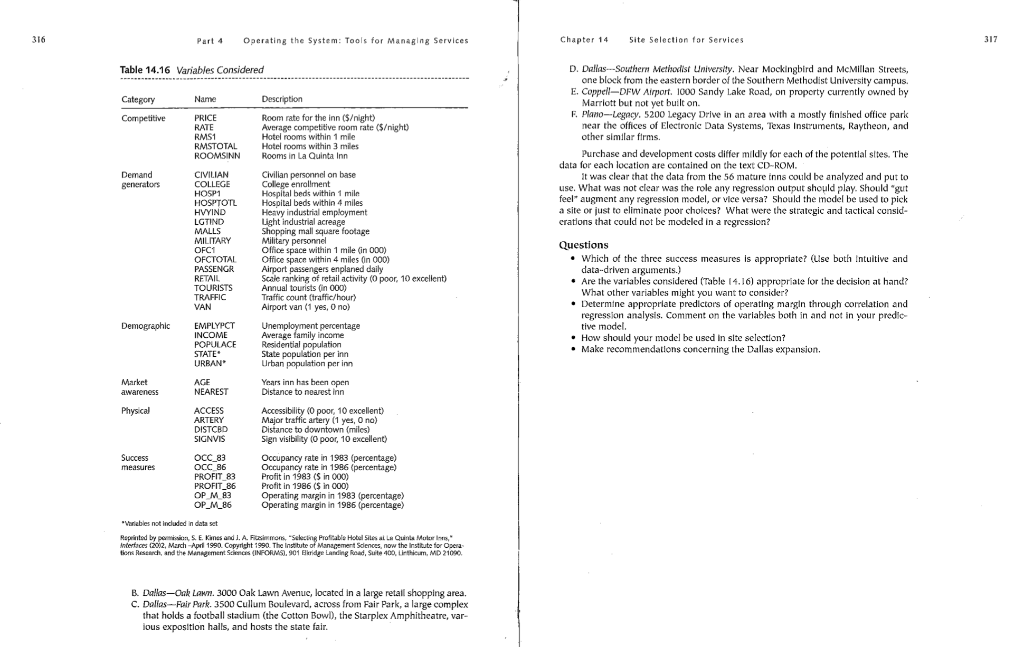

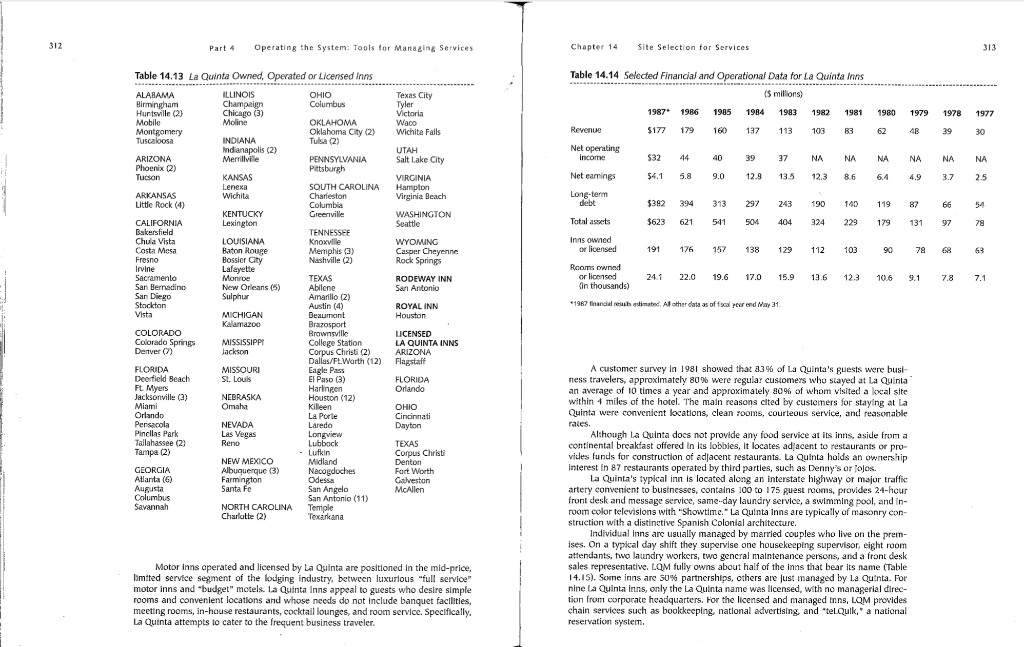

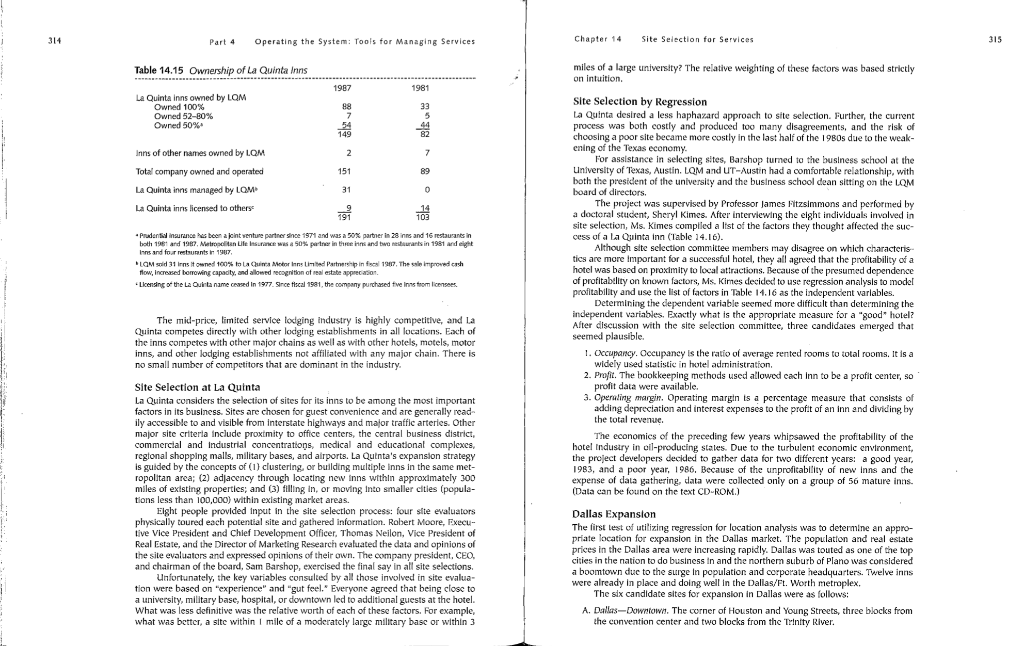

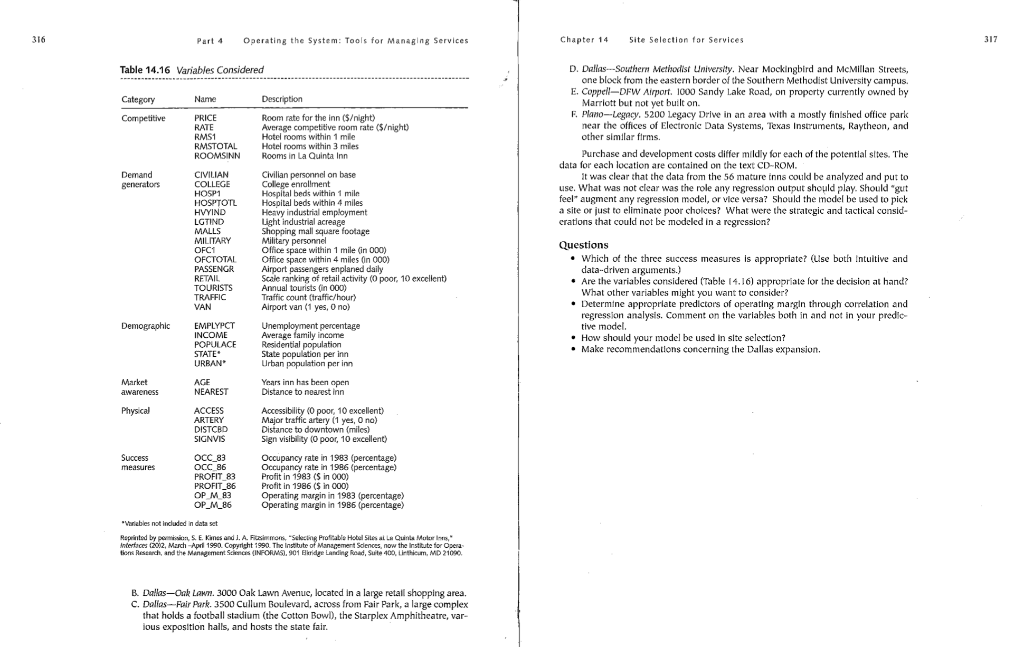

pid ... ... DOMUS who GIGA WA IP- CASE STUDY I ... IN: Regression-Based Site Selection at La Quinta Hotels The old adage that says the three most important aspects of real estate are "location, location, location," is especially true in the transient hotel business. The physical site is an essential attribute of a new hotel. No amount of marble in the foyer can bring cus- tomers to a poor location, and a good location could profit under mediocre management. Unfortunately, considerable disagreement can still arise over which sites are better than others. Everyone could agree that a Death Valley Hotel probably would be a poor choice, but it is difficult to determine exactly what makes for a good choice. To be considered beyond the most preliminary investigation, cach potential site must have a number of positive aspects. Historically, selecting a site for new La Quinta Inns proved to be decidedly more art than science. Although objective data could be gath- ered, sifting through the data and finding a good site still requires "gut feel. And everyone's gut feel is a little different. With more difficult economic times and increased industry capacity squeezing La Quinta's profits in early 1987, location deci- sions required more scrutiny. La Quinta decided to try a new approach to selecting sites: using regression analy- sis of the current performance of their installed inn base to determine sites for new inns. The first test of the approach would be to select a site in the growing Dallas market. The La Quinta Hotel Chain Sam Barshop started Barshop Motel Enterprises, Inc., in 1962. In 1972, Barshop Motel Enterprises, Inc., became La Quinta Motor Inns, Inc. (LQM), with 30 inns and started to expand rapidly. La Quinta grew steadily over the next decade, and by 1987 owned or operated 191 inns in 29 states (Table 14.13). LQM locations are centered in Texas, but LQM expanded throughout the Southeast, Southwest, and Midwest, employing 5,800 people, and showed a profit in the 10 years 1977-1987 (Table 14.14). 4. Source: This case is based on the work of Sheryl Kimes and James Fitzsimmons, "Selecting Profitabie Hotel Sites at La Quinta Motor Inns," Interfaces, 20(2), 1990, pp. 12-20, Information regarding the company background and the site location project for La Quinta Motor Inns, Inc., was obtained from published reports, but the proposed Dallas expan- sion is fictitious. 312 Part 4 Operating the System: Tools for Managing Services Chapter 14 Site Selection for Services 313 Texas City Tyler Victoria Waco Wichita Falls Table 14.14 Selected Financial and Operational Data for La Quinta Inns (5 millions) 1987 1986 1985 1984 1983 1982 1981 Revenue $177 179 160 137 113 103 83 1980 1979 1978 1977 62 30 $32 44 40 39 37 NA NA NA NA NA NA Net operating income Net earnings Long-term debt $4.1 5.8 9.0 12. 135 12.3 8.6 6.4 4.9 3.7 UTAH Salt Lake City VIRGINIA Hampton Virginia Beach WASHINGTON Seattle 2.5 $382 394 313 243 190 140 119 87 66 54 Total asets $623 621 541 504 404 324 229 179 131 97 78 Bakersfield Inns owned or licensed 191 176 157 138 129 112 103 78 63 WYOMING Casper Cheyenne Rock Springs RODEWAY INN San Antonio ROYAL INN Houston 13.6 12.3 10.6 7.8 Table 14.13 La Quinta Owned, Operated or Licensed Inns , ALABAMA ILLINOIS OHIO Birmingham Champaign Columbus Huntsville (2) Chicago (3) Mobile Moline OKLAHOMA Montgomery Oklahoma City (2) Tuscaloosa INDIANA Tulsa (2) Indianapolis (2) ARIZONA Merrillville PENNSYLVANIA Phoenix (2) Pittsburgh Tucson KANSAS Lenexa SOUTH CAROLINA ARKANSAS Wichita Charleston Little Rock (4) Columbia KENTUCKY Greenville CALIFORNIA Lexington TENNESSEE Chula Vista LOUISIANA Knoxville Costa Mesa Baton Rouge Memphis (3) Fresno Bossier City Nashville (2) Irvine Lafayette Sacramento Monroe TEXAS San Bernadine New Orleans (5) Abilene San Diego Sulphur Amarillo (2) Stockton Austin (4) Vista MICHIGAN Beaumont Kalamazoo Brazosport COLORADO Brownsville Colorado Springs MISSISSIPPI College Station Denver Jackson Corpus Christi (2) Dallas/Ft. Warth (12) FLORIDA MISSOURI Eagle: Pass Deerfield Beach St. Louis El Paso (3) Ft Myers Harlingen Jacksonville (a) NEBRASKA Houston (12) Miami Omaha Killeen Orlando La Porte Persacola NEVADA Laredo Pincllas Park Las Vegas Longview Tallahassee (2) Reno Lubbock Tampa (2) Lufkin NEW MEXICO Midland GEORGIA Albuquerque (3) Necogdoches Atlanta (6) Farmington Odessa Augusta Santa Fe San Angelo Columbus San Antonio (11) Savannah NORTH CAROLINA Temple Charlotte (2) Texarkana 7.1 Rooms owned or licensed 24.1 22.0 19.6 17.0 15.9 On thousands) *1967 financial stainated. Al other data as of focal year end May 31 LICENSED LA QUINTA INNS ARIZONA Flagstaff FLORIDA Orlando OHIO Cincinnati Dayton TEXAS Corpus Christ Denton Fort Worth Galveston McAllen A customer survey in 1981 showed that 23% of La Quinta's guests were busi- ness travelers, approximately 80% were regular customers who stayed at La Quinta an average of 10 times a year and approximately 20% of whom visited a local site within 4 miles of the hotel. The main reasons cited by customers for staying at La Quinta were convenient locations, clean rooms, courteous service, and reasonable Although La Quinta does not provide any food service at its inns, aside from a continental breakfast offered in its lobbles, It locates adjacent to restaurants or pro- vicles funds for construction of adjacent restaurants. La Quinta holds an ownership interest in 87 restaurants operated by third parties, such as Denny's ar folos. La Quinta's typical inn is located along an interstate highway or major traffic artery convenient to businesses, contains 100 to 175 guest rooms, provides 24-hour front desk and message service, same-day laundry service, a swimming pool, and in- room color televisions with "Showtime." La Quinta Inns are typically of masonry con- struction with a distinctive Spanish Colonial architecture. Individual inns are usually managed by married couples who live on the pre- ises. On a typical day shift they supervise one housekeeping supervisor, eight room attendants, two laundry workers, two general maintenance persons, and a front desk sales representative. LOM fully owns about half of the inns that bear its name Table 14.15). Some inns are 50% partnerships, others are just managed by 1.2 Quinta. For nine La Quinta inns, only the La Quinta name was licensed, with no managerial direc- tion from corporate headquarters. For the licensed and managed inns, LOM provides chain services such as bookkeeping national advertising and tel Quik," a national reservation system. Motor inns operated and licensed by La Quinta are positioned in the mid-price, limited service segment of the lodging industry, between luxurious "full service motor inns and budget" motels. La Quinta Inns appeal to guests who desire simple rooms and convenient locations and whose needs do not include banquet facilities, meeting rooms, in-house restaurants, cocktail lounges, and room service. Specifically. La Quinta attempts to cater to the frequent business traveler. 314 Part 4 Operating the System: fools for Managing Services Chapter 14 Site Selection for Services 315 Table 14.15 Ownership of La Quinta Inns miles of a large university? The relative weighting of these factors was based strictly on intuition. 1987 1981 La Quinta Inns owned by LOM Owned 100% Owned 52-80% Owned 50% 88 7 33 5 149 22 2 7 151 89 Inns of other names owned by LOM Total company owned and operated La Quinta inns managed by LOM La Quinta inris licensed to others 31 0 es 19 Prudential insurance Les been act senture partner since 1971 and was a 50% partner in 28 ins and 16 restaurants in both 1987 and 1987. Metropolitan Life Insurance was a 50% partner in the ins and two neurants in 1981 and eight Inns and fourrunt in 1907 LGM said 31 Is it owned 100% to Laura Midorinns inte Partnership in focal 1947. These improved cash flow, increased borrowing capacity, and allowed recognition of real estate appreciation Licensing of the La Quinta name cened in 1977. Srce fiscal 1981, the company purchased the instrom licenses. The mid-price, limited service lodging industry is highly competitive, and La Quinta competes directly with other lodging establishments in all locations. Each of the inns competes with other major chains as well as with other hotels, motels, motor inns, and other lodging establishments not affiliated with any major chain. There is no small number of competitors that are dominant in the industry. Site Selection by Regression La Quinta desired a less haphazard approach to site selection. Further, the current process was both costly and produced too many disagreements, and the risk of choosing a poor site became more costly in the last half of the 1980s due to the weak- ening of the Texas economy. For assistance in selecting sites, Barshop turned to the business school at the University of Texas, Austin, LQM and UT-Austin had a comfortable relationship, with both the president of the university and the business school dean sitting on the LOM board of directors. The project was supervised by Professor James Fitzsimmons and performed by a doctoral student, Sheryl Kimes. After interviewing the eight individuals involved in site selection, Ms. Kimes compiled a list of the factors they thought affected the suc- cess of a La Quinta Inn (Table 14.16). Although site selection committee members may disagree on which characteris tics are more important for a successful hotel, they all agreed that the profitability of a hotel was based on proximity to local attractions. Because of the presumed dependence of profitability on known factors, Ms. Kimes decided to use regression analysis to model profitability and use the list of factors in 'Table 14.16 as the independent variables. Determining the dependent variable seemed more difficult than determining the independent variables. Exactly what is the appropriate measure for a "good* hotel? Alter discussion with the site selection committee, three candidates emerged that seemed plausible. 1. Occupancy. Occupancy is the ratio of average rented rooms to total rooms. It is a widely used statistic in hotel administration 2. Profit. The bookkeeping methods used allowed cach Inn to be a profit center, so profit data were available. 3. Operuling margir. Operating margin is a percentage measure that consists of adding depreciation and interest expenses to the profit of an inn and dividing by the total revenue. The economics of the preceding few years whipsawed the profitability of the hotel Industry in oil-producing stales. Due to the turbulent economic environment, the project developers decided to gather data for two different years: a good year, 1983, and a poor year, 1986. Because of the unprofitability of new Inns and the expense of data gathering, data were collected only on a group of 56 mature inns. (Data can be found on the text CD-ROM.) Dallas Expansion The first lest of utilizing regression for location analysis was to determine an appro- priate location for expansion in the Dallas market. The population and real estate prices in the Dallas area were increasing rapidly. Dallas was touted as one of the top cities in the nation to do business in and the northem suburb of Plano was considered a boomtown due to the surge in population and corporate headquarters. Twelve inns were already in place and doing well in the Dallas/Ft. Worth metroplex. The six candidate sites for expansion in Dallas were as follows: A. Dallas-Downtown. The corner of Houston and Young Streets, three blocks from the convention center and two blocks from the Trinity River. Site Selection at La Quinta La Quinta considers the selection of sites for its inns to be among the most important factors in its business. Sites are chosen for guest convenience and are generally read ily accessible to and visible from interstate highways and major traffic arteries. Other major site criteria include proximity to office centers, the central business district, commercial and Industrial concentrations, medical and educational complexes, regional shopping malls, military bases, and alrports. La Quinta's expansion strategy is guided by the concepts of (1) clustering, or building multiple Inns in the same met- ropolitan area; (2) adjacency through locating new inns within approximately 300 miles of existing properties; and (3) filling in, or moving into smaller cities (popula- tions less than 100.000) within existing market areas. Elght people provided input in the site selection process: four site evaluators physically toured each potential site and gathered information. Robert Moore, Execu- Live Vice President and Chief Development Officer, Thomas Neilon, Vice President of Real Estate, and the Director of Marketing Research evaluated the data and opinions of the site evaluators and expressed opinions of their own. The company president. CEO and chairman of the board, Sam Barshop, exercised the final say in all site selections. Unfortunately, the key variables consulted by all those involved in site evalua- tion were based on experience" and "gut feel. Everyone agreed that being close to a university, military base, hospital, or downtown led to additional guests at the hotel. What was less definitive was the relative worth of each of these factors. For example, what was better, a site within 1 mile of a moderately large military base or within 3 316 Part 4 Operating the System: Tools for Managing Services Chapter 14 Site Selection for Services 317 Table 14.16 Variables Considered D. Dallas --Southern Methodist University, Near Mockingbird and McMillan Streets, one block from the eastern border of the Southern Methodist University campus. E. Coppell-DFW Airport. 1000 Sandy Lake Road, on property currently owned by Marriott but not yet built on. F. Plano--Legacy. 5200 Legacy Drive in an area with a mostly finished office park near the offices of Electronic Data Systems, Texas Instruments, Raytheon, and other similar forms Purchase and development costs differ mildly for each of the potential sites. The data for each location are contained on the text CD-ROM. it was clear that the data from the 56 mature inns could be analyzed and put to use. What was not clear was the role any regression output should play. Should "gut feel augment any regression model, or vice versa? Should the model be used to pick a site or just to eliminate poor choices? What were the strategic and tactical consid- crations that could not be modeled in a regression? Category Name Description Competitive PRICE Room rate for the Inn (5ight) RATE Average competitive room rate ($ight) RMS1 Hotel rooms within 1 mile RMSTOTAL Hotel rooms within 3 miles ROOMSINN Rooms in La Quinta Inn Demand CIVILIAN Civilian personnel on base generators COLLEGE College enrollment HOSP1 Hospital beds within 1 mile HOSPTOR Hospital beds within 4 miles HVYIND Heavy industrial employment LGTIND Light industrial acreage MALLS Shopping mall square footage MILITARY Military personnel OFC1 Office space within 1 mile (in 000) OFCTOTAL Office space within 4 miles on 000) PASSENGR Airport passengers enplaned daily RETAIL Scale ranking of retail activity (o poor, 10 excellent) TOURISTS Annual tourists in 000) TRAFFIC Traffic count (traffic/hour) VAN Airport van (1 yes, o no) Demographic EMPLYPCT Unemployment percentage INCOME Average family income POPULACE Residential population STATE State population per inn URRAN Urban population perinn Market AGE Years inn has been open awareness NEAREST Distance to nearest inn Physical ACCESS Accessibility (O poor, 10 excellent) ARTERY Major traffic artery (1 yes, O na) DISTCBD Distance to downtown (miles) SIGNVIS Sign visibility to poor, 10 excellent) Success OCC_89 Occupancy rate in 1983 (percentage) measures OCC 86 Occupancy rate in 1986 (percentage) PROFIT 83 Profit in 1983 (Sin 000) PROFIT 86 Profit in 1986 (S in 000) OP M22 Operating margin in 1983 (percentage) OP M_86 Operating margin in 1986 (percentage) "Variables not included in data set Rated by po S. E. Kines and I.A. Filimon Selecting Profitable Hotel Siles al La Quinta Muler, Interfaces (2012 March-April 1990. Copyright 1990. The Institute of Management Solences, now the Institute for Opera tion Research, and the Management Seks (INFORM1.901 Skridge Landing Road, Suite 400. Lithium, MD 21000 Questions Which of the three success measures is appropriate? (Use both Intuitive and data-driven arguments.) Are the variables considered (Table 14.16) appropriate for the decision at hand? What other variables might you want to consider? Determine appropriate predictors of operating margin through correlation and regression analysis. Comment on the variables both in and net in your predic tive model How should your model be used in site selection? Make recommendations concerning the Dallas expansion B. Dallas-Oak Law. 3000 Oak Lawn Avenue, located in a large retail shopping area. C. Dallas-Fair Park 3500 Cullum Boulevard, across from Fair Park, a large complex that holds a football stadium (the Cotton Bowl), the Starplex Amphitheatre, var- lous exposition halls, and hosts the state fair pid ... ... DOMUS who GIGA WA IP- CASE STUDY I ... IN: Regression-Based Site Selection at La Quinta Hotels The old adage that says the three most important aspects of real estate are "location, location, location," is especially true in the transient hotel business. The physical site is an essential attribute of a new hotel. No amount of marble in the foyer can bring cus- tomers to a poor location, and a good location could profit under mediocre management. Unfortunately, considerable disagreement can still arise over which sites are better than others. Everyone could agree that a Death Valley Hotel probably would be a poor choice, but it is difficult to determine exactly what makes for a good choice. To be considered beyond the most preliminary investigation, cach potential site must have a number of positive aspects. Historically, selecting a site for new La Quinta Inns proved to be decidedly more art than science. Although objective data could be gath- ered, sifting through the data and finding a good site still requires "gut feel. And everyone's gut feel is a little different. With more difficult economic times and increased industry capacity squeezing La Quinta's profits in early 1987, location deci- sions required more scrutiny. La Quinta decided to try a new approach to selecting sites: using regression analy- sis of the current performance of their installed inn base to determine sites for new inns. The first test of the approach would be to select a site in the growing Dallas market. The La Quinta Hotel Chain Sam Barshop started Barshop Motel Enterprises, Inc., in 1962. In 1972, Barshop Motel Enterprises, Inc., became La Quinta Motor Inns, Inc. (LQM), with 30 inns and started to expand rapidly. La Quinta grew steadily over the next decade, and by 1987 owned or operated 191 inns in 29 states (Table 14.13). LQM locations are centered in Texas, but LQM expanded throughout the Southeast, Southwest, and Midwest, employing 5,800 people, and showed a profit in the 10 years 1977-1987 (Table 14.14). 4. Source: This case is based on the work of Sheryl Kimes and James Fitzsimmons, "Selecting Profitabie Hotel Sites at La Quinta Motor Inns," Interfaces, 20(2), 1990, pp. 12-20, Information regarding the company background and the site location project for La Quinta Motor Inns, Inc., was obtained from published reports, but the proposed Dallas expan- sion is fictitious. 312 Part 4 Operating the System: Tools for Managing Services Chapter 14 Site Selection for Services 313 Texas City Tyler Victoria Waco Wichita Falls Table 14.14 Selected Financial and Operational Data for La Quinta Inns (5 millions) 1987 1986 1985 1984 1983 1982 1981 Revenue $177 179 160 137 113 103 83 1980 1979 1978 1977 62 30 $32 44 40 39 37 NA NA NA NA NA NA Net operating income Net earnings Long-term debt $4.1 5.8 9.0 12. 135 12.3 8.6 6.4 4.9 3.7 UTAH Salt Lake City VIRGINIA Hampton Virginia Beach WASHINGTON Seattle 2.5 $382 394 313 243 190 140 119 87 66 54 Total asets $623 621 541 504 404 324 229 179 131 97 78 Bakersfield Inns owned or licensed 191 176 157 138 129 112 103 78 63 WYOMING Casper Cheyenne Rock Springs RODEWAY INN San Antonio ROYAL INN Houston 13.6 12.3 10.6 7.8 Table 14.13 La Quinta Owned, Operated or Licensed Inns , ALABAMA ILLINOIS OHIO Birmingham Champaign Columbus Huntsville (2) Chicago (3) Mobile Moline OKLAHOMA Montgomery Oklahoma City (2) Tuscaloosa INDIANA Tulsa (2) Indianapolis (2) ARIZONA Merrillville PENNSYLVANIA Phoenix (2) Pittsburgh Tucson KANSAS Lenexa SOUTH CAROLINA ARKANSAS Wichita Charleston Little Rock (4) Columbia KENTUCKY Greenville CALIFORNIA Lexington TENNESSEE Chula Vista LOUISIANA Knoxville Costa Mesa Baton Rouge Memphis (3) Fresno Bossier City Nashville (2) Irvine Lafayette Sacramento Monroe TEXAS San Bernadine New Orleans (5) Abilene San Diego Sulphur Amarillo (2) Stockton Austin (4) Vista MICHIGAN Beaumont Kalamazoo Brazosport COLORADO Brownsville Colorado Springs MISSISSIPPI College Station Denver Jackson Corpus Christi (2) Dallas/Ft. Warth (12) FLORIDA MISSOURI Eagle: Pass Deerfield Beach St. Louis El Paso (3) Ft Myers Harlingen Jacksonville (a) NEBRASKA Houston (12) Miami Omaha Killeen Orlando La Porte Persacola NEVADA Laredo Pincllas Park Las Vegas Longview Tallahassee (2) Reno Lubbock Tampa (2) Lufkin NEW MEXICO Midland GEORGIA Albuquerque (3) Necogdoches Atlanta (6) Farmington Odessa Augusta Santa Fe San Angelo Columbus San Antonio (11) Savannah NORTH CAROLINA Temple Charlotte (2) Texarkana 7.1 Rooms owned or licensed 24.1 22.0 19.6 17.0 15.9 On thousands) *1967 financial stainated. Al other data as of focal year end May 31 LICENSED LA QUINTA INNS ARIZONA Flagstaff FLORIDA Orlando OHIO Cincinnati Dayton TEXAS Corpus Christ Denton Fort Worth Galveston McAllen A customer survey in 1981 showed that 23% of La Quinta's guests were busi- ness travelers, approximately 80% were regular customers who stayed at La Quinta an average of 10 times a year and approximately 20% of whom visited a local site within 4 miles of the hotel. The main reasons cited by customers for staying at La Quinta were convenient locations, clean rooms, courteous service, and reasonable Although La Quinta does not provide any food service at its inns, aside from a continental breakfast offered in its lobbles, It locates adjacent to restaurants or pro- vicles funds for construction of adjacent restaurants. La Quinta holds an ownership interest in 87 restaurants operated by third parties, such as Denny's ar folos. La Quinta's typical inn is located along an interstate highway or major traffic artery convenient to businesses, contains 100 to 175 guest rooms, provides 24-hour front desk and message service, same-day laundry service, a swimming pool, and in- room color televisions with "Showtime." La Quinta Inns are typically of masonry con- struction with a distinctive Spanish Colonial architecture. Individual inns are usually managed by married couples who live on the pre- ises. On a typical day shift they supervise one housekeeping supervisor, eight room attendants, two laundry workers, two general maintenance persons, and a front desk sales representative. LOM fully owns about half of the inns that bear its name Table 14.15). Some inns are 50% partnerships, others are just managed by 1.2 Quinta. For nine La Quinta inns, only the La Quinta name was licensed, with no managerial direc- tion from corporate headquarters. For the licensed and managed inns, LOM provides chain services such as bookkeeping national advertising and tel Quik," a national reservation system. Motor inns operated and licensed by La Quinta are positioned in the mid-price, limited service segment of the lodging industry, between luxurious "full service motor inns and budget" motels. La Quinta Inns appeal to guests who desire simple rooms and convenient locations and whose needs do not include banquet facilities, meeting rooms, in-house restaurants, cocktail lounges, and room service. Specifically. La Quinta attempts to cater to the frequent business traveler. 314 Part 4 Operating the System: fools for Managing Services Chapter 14 Site Selection for Services 315 Table 14.15 Ownership of La Quinta Inns miles of a large university? The relative weighting of these factors was based strictly on intuition. 1987 1981 La Quinta Inns owned by LOM Owned 100% Owned 52-80% Owned 50% 88 7 33 5 149 22 2 7 151 89 Inns of other names owned by LOM Total company owned and operated La Quinta inns managed by LOM La Quinta inris licensed to others 31 0 es 19 Prudential insurance Les been act senture partner since 1971 and was a 50% partner in 28 ins and 16 restaurants in both 1987 and 1987. Metropolitan Life Insurance was a 50% partner in the ins and two neurants in 1981 and eight Inns and fourrunt in 1907 LGM said 31 Is it owned 100% to Laura Midorinns inte Partnership in focal 1947. These improved cash flow, increased borrowing capacity, and allowed recognition of real estate appreciation Licensing of the La Quinta name cened in 1977. Srce fiscal 1981, the company purchased the instrom licenses. The mid-price, limited service lodging industry is highly competitive, and La Quinta competes directly with other lodging establishments in all locations. Each of the inns competes with other major chains as well as with other hotels, motels, motor inns, and other lodging establishments not affiliated with any major chain. There is no small number of competitors that are dominant in the industry. Site Selection by Regression La Quinta desired a less haphazard approach to site selection. Further, the current process was both costly and produced too many disagreements, and the risk of choosing a poor site became more costly in the last half of the 1980s due to the weak- ening of the Texas economy. For assistance in selecting sites, Barshop turned to the business school at the University of Texas, Austin, LQM and UT-Austin had a comfortable relationship, with both the president of the university and the business school dean sitting on the LOM board of directors. The project was supervised by Professor James Fitzsimmons and performed by a doctoral student, Sheryl Kimes. After interviewing the eight individuals involved in site selection, Ms. Kimes compiled a list of the factors they thought affected the suc- cess of a La Quinta Inn (Table 14.16). Although site selection committee members may disagree on which characteris tics are more important for a successful hotel, they all agreed that the profitability of a hotel was based on proximity to local attractions. Because of the presumed dependence of profitability on known factors, Ms. Kimes decided to use regression analysis to model profitability and use the list of factors in 'Table 14.16 as the independent variables. Determining the dependent variable seemed more difficult than determining the independent variables. Exactly what is the appropriate measure for a "good* hotel? Alter discussion with the site selection committee, three candidates emerged that seemed plausible. 1. Occupancy. Occupancy is the ratio of average rented rooms to total rooms. It is a widely used statistic in hotel administration 2. Profit. The bookkeeping methods used allowed cach Inn to be a profit center, so profit data were available. 3. Operuling margir. Operating margin is a percentage measure that consists of adding depreciation and interest expenses to the profit of an inn and dividing by the total revenue. The economics of the preceding few years whipsawed the profitability of the hotel Industry in oil-producing stales. Due to the turbulent economic environment, the project developers decided to gather data for two different years: a good year, 1983, and a poor year, 1986. Because of the unprofitability of new Inns and the expense of data gathering, data were collected only on a group of 56 mature inns. (Data can be found on the text CD-ROM.) Dallas Expansion The first lest of utilizing regression for location analysis was to determine an appro- priate location for expansion in the Dallas market. The population and real estate prices in the Dallas area were increasing rapidly. Dallas was touted as one of the top cities in the nation to do business in and the northem suburb of Plano was considered a boomtown due to the surge in population and corporate headquarters. Twelve inns were already in place and doing well in the Dallas/Ft. Worth metroplex. The six candidate sites for expansion in Dallas were as follows: A. Dallas-Downtown. The corner of Houston and Young Streets, three blocks from the convention center and two blocks from the Trinity River. Site Selection at La Quinta La Quinta considers the selection of sites for its inns to be among the most important factors in its business. Sites are chosen for guest convenience and are generally read ily accessible to and visible from interstate highways and major traffic arteries. Other major site criteria include proximity to office centers, the central business district, commercial and Industrial concentrations, medical and educational complexes, regional shopping malls, military bases, and alrports. La Quinta's expansion strategy is guided by the concepts of (1) clustering, or building multiple Inns in the same met- ropolitan area; (2) adjacency through locating new inns within approximately 300 miles of existing properties; and (3) filling in, or moving into smaller cities (popula- tions less than 100.000) within existing market areas. Elght people provided input in the site selection process: four site evaluators physically toured each potential site and gathered information. Robert Moore, Execu- Live Vice President and Chief Development Officer, Thomas Neilon, Vice President of Real Estate, and the Director of Marketing Research evaluated the data and opinions of the site evaluators and expressed opinions of their own. The company president. CEO and chairman of the board, Sam Barshop, exercised the final say in all site selections. Unfortunately, the key variables consulted by all those involved in site evalua- tion were based on experience" and "gut feel. Everyone agreed that being close to a university, military base, hospital, or downtown led to additional guests at the hotel. What was less definitive was the relative worth of each of these factors. For example, what was better, a site within 1 mile of a moderately large military base or within 3 316 Part 4 Operating the System: Tools for Managing Services Chapter 14 Site Selection for Services 317 Table 14.16 Variables Considered D. Dallas --Southern Methodist University, Near Mockingbird and McMillan Streets, one block from the eastern border of the Southern Methodist University campus. E. Coppell-DFW Airport. 1000 Sandy Lake Road, on property currently owned by Marriott but not yet built on. F. Plano--Legacy. 5200 Legacy Drive in an area with a mostly finished office park near the offices of Electronic Data Systems, Texas Instruments, Raytheon, and other similar forms Purchase and development costs differ mildly for each of the potential sites. The data for each location are contained on the text CD-ROM. it was clear that the data from the 56 mature inns could be analyzed and put to use. What was not clear was the role any regression output should play. Should "gut feel augment any regression model, or vice versa? Should the model be used to pick a site or just to eliminate poor choices? What were the strategic and tactical consid- crations that could not be modeled in a regression? Category Name Description Competitive PRICE Room rate for the Inn (5ight) RATE Average competitive room rate ($ight) RMS1 Hotel rooms within 1 mile RMSTOTAL Hotel rooms within 3 miles ROOMSINN Rooms in La Quinta Inn Demand CIVILIAN Civilian personnel on base generators COLLEGE College enrollment HOSP1 Hospital beds within 1 mile HOSPTOR Hospital beds within 4 miles HVYIND Heavy industrial employment LGTIND Light industrial acreage MALLS Shopping mall square footage MILITARY Military personnel OFC1 Office space within 1 mile (in 000) OFCTOTAL Office space within 4 miles on 000) PASSENGR Airport passengers enplaned daily RETAIL Scale ranking of retail activity (o poor, 10 excellent) TOURISTS Annual tourists in 000) TRAFFIC Traffic count (traffic/hour) VAN Airport van (1 yes, o no) Demographic EMPLYPCT Unemployment percentage INCOME Average family income POPULACE Residential population STATE State population per inn URRAN Urban population perinn Market AGE Years inn has been open awareness NEAREST Distance to nearest inn Physical ACCESS Accessibility (O poor, 10 excellent) ARTERY Major traffic artery (1 yes, O na) DISTCBD Distance to downtown (miles) SIGNVIS Sign visibility to poor, 10 excellent) Success OCC_89 Occupancy rate in 1983 (percentage) measures OCC 86 Occupancy rate in 1986 (percentage) PROFIT 83 Profit in 1983 (Sin 000) PROFIT 86 Profit in 1986 (S in 000) OP M22 Operating margin in 1983 (percentage) OP M_86 Operating margin in 1986 (percentage) "Variables not included in data set Rated by po S. E. Kines and I.A. Filimon Selecting Profitable Hotel Siles al La Quinta Muler, Interfaces (2012 March-April 1990. Copyright 1990. The Institute of Management Solences, now the Institute for Opera tion Research, and the Management Seks (INFORM1.901 Skridge Landing Road, Suite 400. Lithium, MD 21000 Questions Which of the three success measures is appropriate? (Use both Intuitive and data-driven arguments.) Are the variables considered (Table 14.16) appropriate for the decision at hand? What other variables might you want to consider? Determine appropriate predictors of operating margin through correlation and regression analysis. Comment on the variables both in and net in your predic tive model How should your model be used in site selection? Make recommendations concerning the Dallas expansion B. Dallas-Oak Law. 3000 Oak Lawn Avenue, located in a large retail shopping area. C. Dallas-Fair Park 3500 Cullum Boulevard, across from Fair Park, a large complex that holds a football stadium (the Cotton Bowl), the Starplex Amphitheatre, var- lous exposition halls, and hosts the state fair