Question: Pierce Corp. has a December 31 year end. It received its property tax invoice of $57,000 for the calendar year on April 30. The

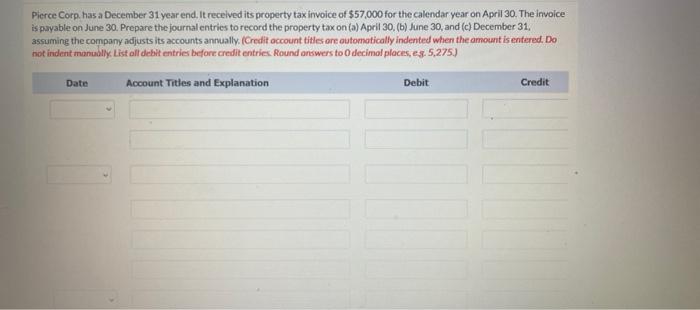

Pierce Corp. has a December 31 year end. It received its property tax invoice of $57,000 for the calendar year on April 30. The invoice is payable on June 30. Prepare the journal entries to record the property tax on (a) April 30, (b) June 30, and (c) December 31, assuming the company adjusts its accounts annually. (Credit account titles ore automatically indented when the omount is entered. Do not indent manuolly. List all debit entries before credit entries. Round onswers to O decimal places, eg. 5,275.) Date Account Titles and Explanation Debit Credit

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

A C D 4 Date Account title and explanation Debit Credit 5 A... View full answer

Get step-by-step solutions from verified subject matter experts