Question: Pina Inc's only temporary difference at the beginning and end of 2019 is caused by a $3,360.000 deferred gain for tax purposes for an installment

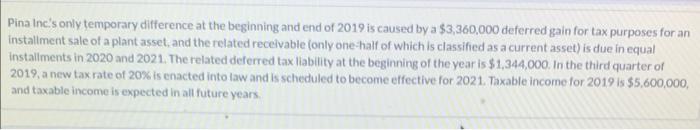

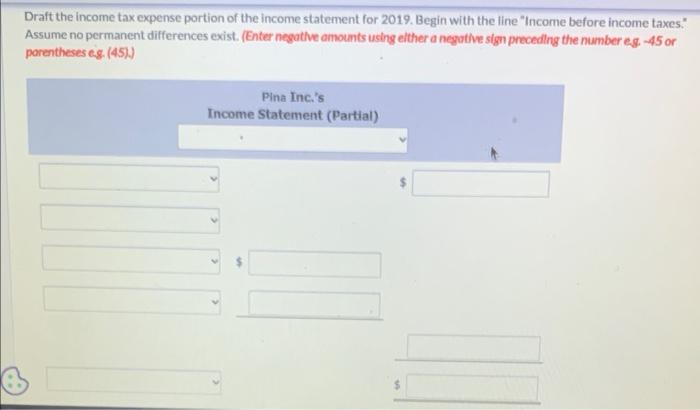

Pina Inc's only temporary difference at the beginning and end of 2019 is caused by a $3,360.000 deferred gain for tax purposes for an installment sale of a plant asset, and the related receivable (only one-half of which is classified as a current asset) is due in equal instaliments in 2020 and 2021 . The related deferred tax liability at the beginning of the year is $1,344,000. In the third quarter of 2019, a new tax rate of 20% is enacted into law and is scheduled to become effective for 2021 . Taxable income for 2019 is $5,600,000, and taxable income is expected in all future years Draft the income tax expense portion of the income statement for 2019 . Begin with the line "Income before income taxes." Assume no permanent differences exist. (Enter negathve amounts using elther a negutive sign precedlng the number eg. 45 or porentheses eg. (45).)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts