Question: Pinder Ltd needs to use a truck for its operations. The truck costs $180,000 and is expected to last for 8 years. The salvage value

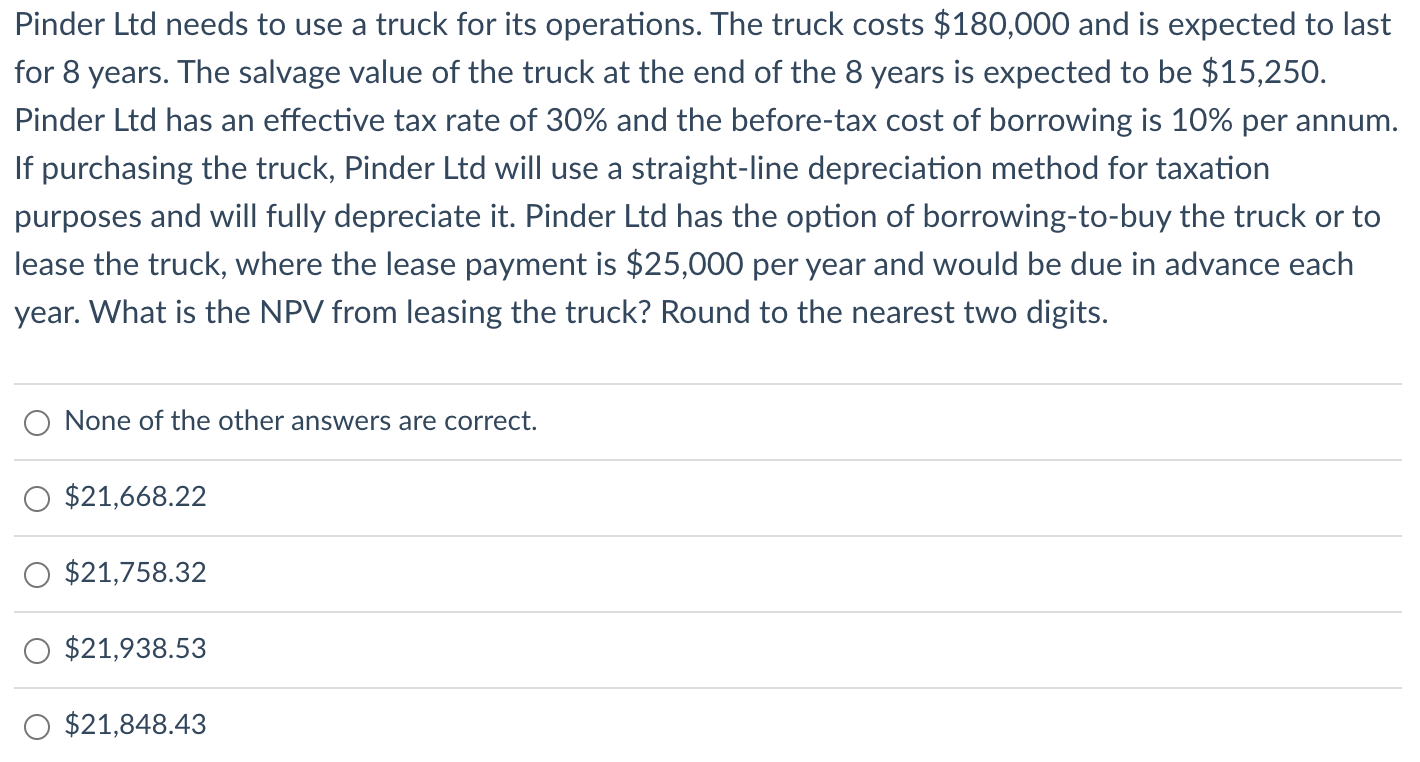

Pinder Ltd needs to use a truck for its operations. The truck costs $180,000 and is expected to last for 8 years. The salvage value of the truck at the end of the 8 years is expected to be $15,250. Pinder Ltd has an effective tax rate of 30% and the before-tax cost of borrowing is 10% per annum. If purchasing the truck, Pinder Ltd will use a straight-line depreciation method for taxation purposes and will fully depreciate it. Pinder Ltd has the option of borrowing-to-buy the truck or to lease the truck, where the lease payment is $25,000 per year and would be due in advance each year. What is the NPV from leasing the truck? Round to the nearest two digits. None of the other answers are correct. $21,668.22 $21,758.32$21,938.53 $21,848.43

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts