Question: Pine Resources Ltd. has a SARs program for managers. These individuals receive a cash payment after four years of service, calculated as the excess of

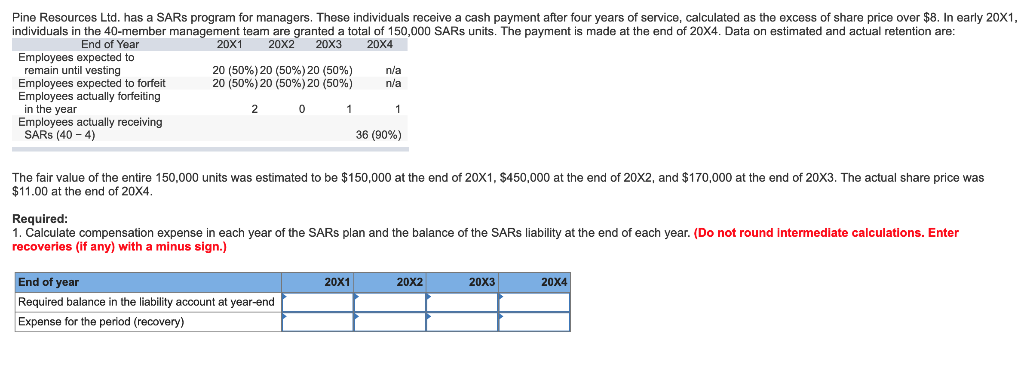

Pine Resources Ltd. has a SARs program for managers. These individuals receive a cash payment after four years of service, calculated as the excess of share price over $8. In early 20X1 individuals in the 40-member management team are granted a total of 150,000 SARs units. The payment is made at the end of 20X4. Data on estimated and actual retention are End of Year Employees expected to 20X1 20X2 20X3 20X4 remain until vesting Employees expected to forfeit Employees actually forfeiting 20 (50%) 20 (50%) 20 (50%) 20 (50%) 20 (50%) 20 (50%) n/a n/a in the year Employees actually receiving SARs (40 -4) 36 (90%) The fair value of the entire 150,000 units was estimated to be $150,000 at the end of 20X1, $450,000 at the end of 20X2, and $170,000 at the end of 20X3. The actual share price was $11.00 at the end of 20X4 Required 1. Calculate compensation expense in each year of the SARs plan and the balance of the SARs liability at the end of each year. (Do not round intermediate calculations. Enter recoveries (if any) with a minus sign.) End of year Required balance in the liability account at year-end Expense for the period (recovery) 20X1 20X2 20X3 20X4 Pine Resources Ltd. has a SARs program for managers. These individuals receive a cash payment after four years of service, calculated as the excess of share price over $8. In early 20X1 individuals in the 40-member management team are granted a total of 150,000 SARs units. The payment is made at the end of 20X4. Data on estimated and actual retention are End of Year Employees expected to 20X1 20X2 20X3 20X4 remain until vesting Employees expected to forfeit Employees actually forfeiting 20 (50%) 20 (50%) 20 (50%) 20 (50%) 20 (50%) 20 (50%) n/a n/a in the year Employees actually receiving SARs (40 -4) 36 (90%) The fair value of the entire 150,000 units was estimated to be $150,000 at the end of 20X1, $450,000 at the end of 20X2, and $170,000 at the end of 20X3. The actual share price was $11.00 at the end of 20X4 Required 1. Calculate compensation expense in each year of the SARs plan and the balance of the SARs liability at the end of each year. (Do not round intermediate calculations. Enter recoveries (if any) with a minus sign.) End of year Required balance in the liability account at year-end Expense for the period (recovery) 20X1 20X2 20X3 20X4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts