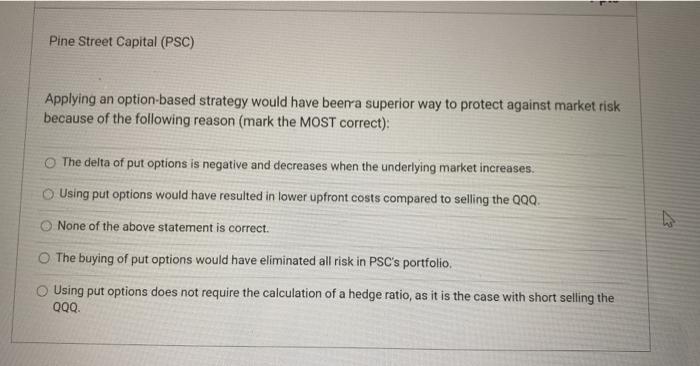

Question: Pine Street Capital (PSC) Applying an option-based strategy would have beenra superior way to protect against market risk because of the following reason (mark the

Pine Street Capital (PSC) Applying an option-based strategy would have beenra superior way to protect against market risk because of the following reason (mark the MOST correct): The delta of put options is negative and decreases when the underlying market increases. Using put options would have resulted in lower upfront costs compared to selling the QQQ. None of the above statement is correct. The buying of put options would have eliminated all risk in PSC's portfolio. Using put options does not require the calculation of a hedge ratio, as it is the case with short selling the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts