Question: Ping Corporation ( a U . S . company ) paid $ 3 5 0 , 0 0 0 cash for 7 0 % of

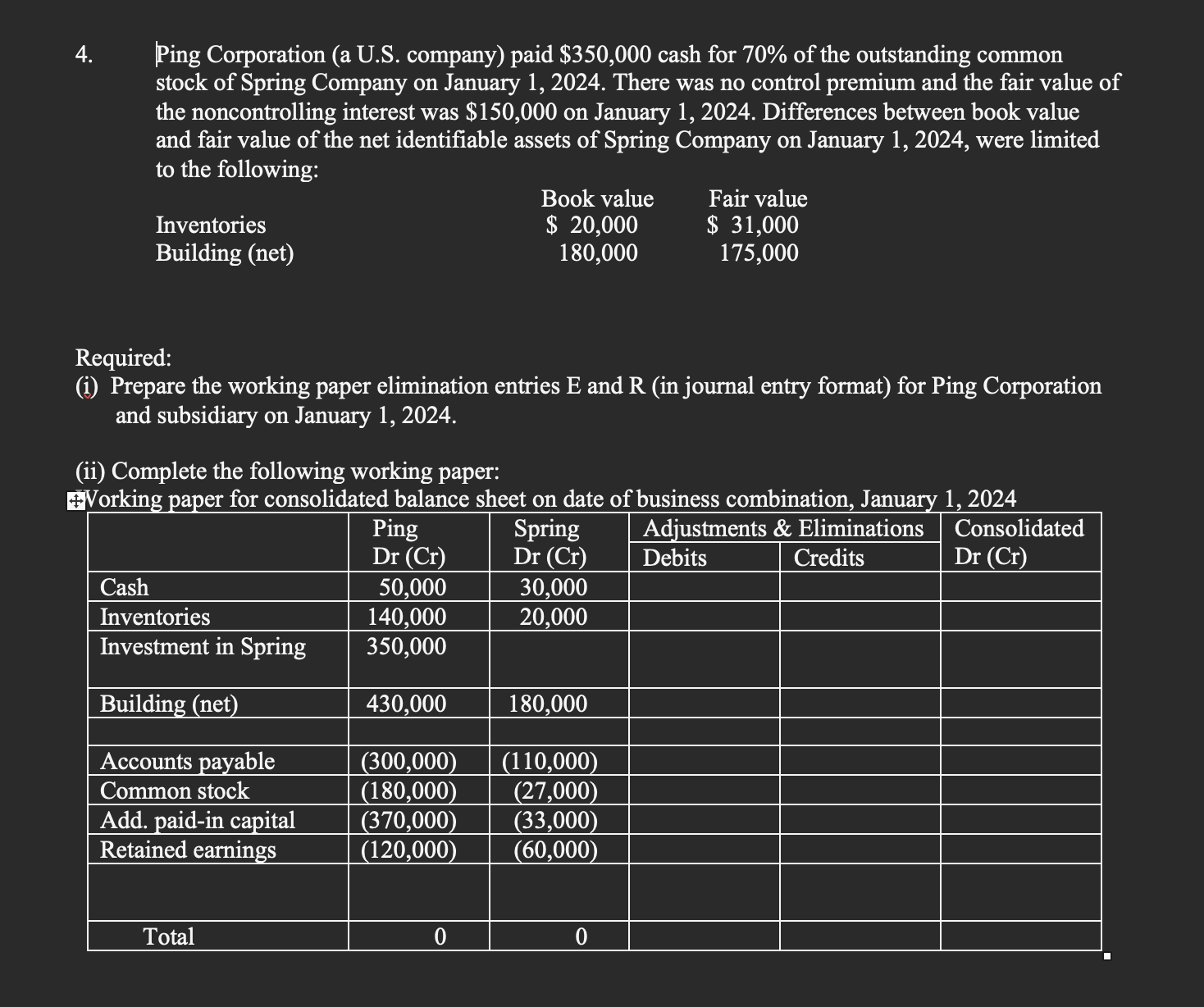

Ping Corporation a US company paid $ cash for of the outstanding common stock of Spring Company on January There was no control premium and the fair value of the noncontrolling interest was $ on January Differences between book value and fair value of the net identifiable assets of Spring Company on January were limited to the following:

Inventories

Book value

Fair value

Building net

$

$

Required:

i Prepare the working paper elimination entries E and R in journal entry format for Ping Corporation and subsidiary on January

ii Complete the following working paper:

Vorking paper for consolidated balance sheet on date of business combination, January

tabletablebar Ping Spring,Adjust,Elimina,tableConsolidatedDrCrDrCrDebits,Credits,DrCrCashInventoriesInvestment in Spring,Building netAccounts payable,Common stock,Add paidin capital,Retained earnings,Total

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock