Question: - Pipa COMUNALU WULLSTILL, Problem 11-4 (LO 3. 5) Translation and elimination entries. On October 1, 2013, Kemper Intemational acquired a 90% interest in the

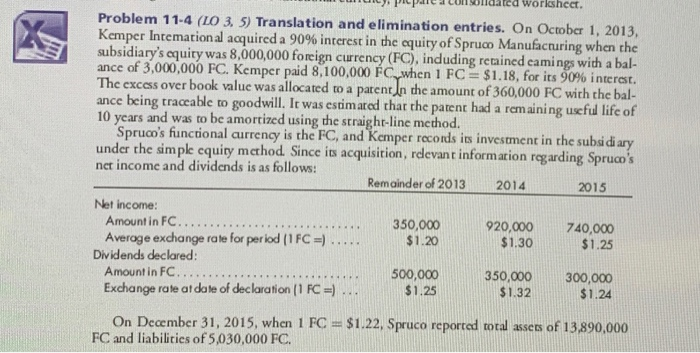

- Pipa COMUNALU WULLSTILL, Problem 11-4 (LO 3. 5) Translation and elimination entries. On October 1, 2013, Kemper Intemational acquired a 90% interest in the equity of Spruc Manufacturing when the subsidiary's equiry was 8,000,000 foreign currency (FC), induding retained camings with a bal- ance of 3,000,000 FC. Kemper paid 8,100,000 FC when 1 FC = $1.18, for its 90% interest. The excess over book value was allocated to a patent In the amount of 360,000 FC with the bal- ance being traceable to goodwill. It was estimated that the patent had a remaining useful life of 10 years and was to be amortized using the straight-line method. Spruco's functional currency is the FC, and Kemper records its investment in the subsidiary under the simple equiry method Since its acquisition, rdevant information regarding Spruco's net income and dividends is as follows: Remainder of 2013 2014 2015 Net income: Amount in FC.... 350,000 920,000 740,000 Average exchange rate for period (1 FC =) $1.20 $1.30 $1.25 Dividends declared: Amount in FC....... 500,000 350,000 300,000 Exchange rate at date of declaration (1 FC =) .. $1.25 $1.32 $1.24 On December 31, 2015, when 1 FC =$1.22, Spruco reported total assets of 13.890.000 FC and liabilities of 5,030,000 FC. - Pipa COMUNALU WULLSTILL, Problem 11-4 (LO 3. 5) Translation and elimination entries. On October 1, 2013, Kemper Intemational acquired a 90% interest in the equity of Spruc Manufacturing when the subsidiary's equiry was 8,000,000 foreign currency (FC), induding retained camings with a bal- ance of 3,000,000 FC. Kemper paid 8,100,000 FC when 1 FC = $1.18, for its 90% interest. The excess over book value was allocated to a patent In the amount of 360,000 FC with the bal- ance being traceable to goodwill. It was estimated that the patent had a remaining useful life of 10 years and was to be amortized using the straight-line method. Spruco's functional currency is the FC, and Kemper records its investment in the subsidiary under the simple equiry method Since its acquisition, rdevant information regarding Spruco's net income and dividends is as follows: Remainder of 2013 2014 2015 Net income: Amount in FC.... 350,000 920,000 740,000 Average exchange rate for period (1 FC =) $1.20 $1.30 $1.25 Dividends declared: Amount in FC....... 500,000 350,000 300,000 Exchange rate at date of declaration (1 FC =) .. $1.25 $1.32 $1.24 On December 31, 2015, when 1 FC =$1.22, Spruco reported total assets of 13.890.000 FC and liabilities of 5,030,000 FC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts