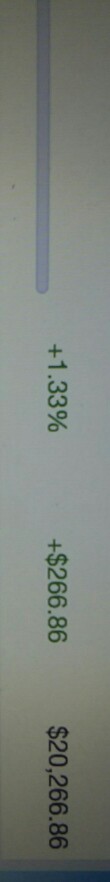

Question: P&L (%) P&L ($) Net Liquidity ($) P&L (%) is +1.33% P&L ($) is +$266.86 Net Liquidity ($) is 20,266.86 My initial purchases in module

P&L (%) P&L ($) Net Liquidity ($)

P&L (%) is +1.33% P&L ($) is +$266.86 Net Liquidity ($) is 20,266.86

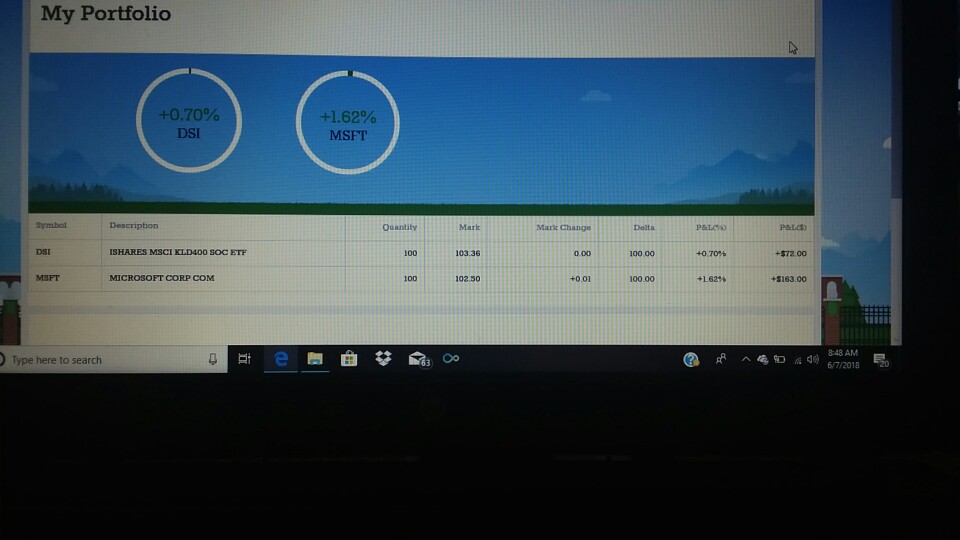

My initial purchases in module two was wal mart, Microsoft, and jcpennys. I kept Microsoft, added DSI, and sold wal mart (under performance). I bought 100 shares of Microsoft and 100 shares of DSI.

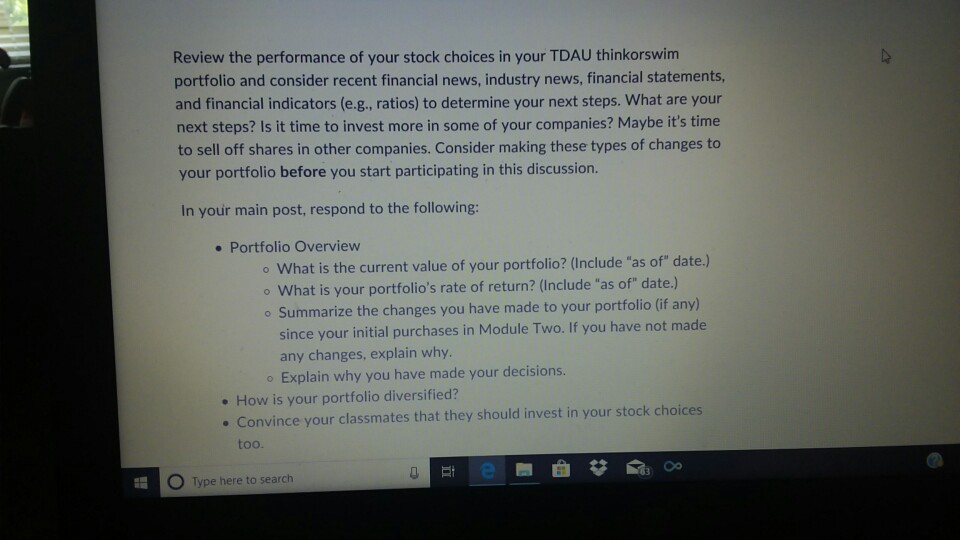

Review the performance of your stock choices in your TDAU thinkorswim portfolio and consider recent financial news, industry news, financial statements, and financial indicators (e.g., ratios) to determine your next steps. What are your next steps? Is it time to invest more in some of your companies? Maybe it's time to sell off shares in other companies. Consider making these types of changes to your portfolio before you start participating in this discussion. In your main post, respond to the following: . Portfolio Overview o What is the current value of your portfolio? (Include "as of" date.) o What is your portfolio's rate of return? (Include "as of" date.) summarize the changes you have made to your portfolio (if any) since your initial purchases in Module Two. If you have not made any changes, explain why. o Explain why you have made your decisions. . How is your portfolio diversified? Convince your classmates that they should invest in your stock choices too. O Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts