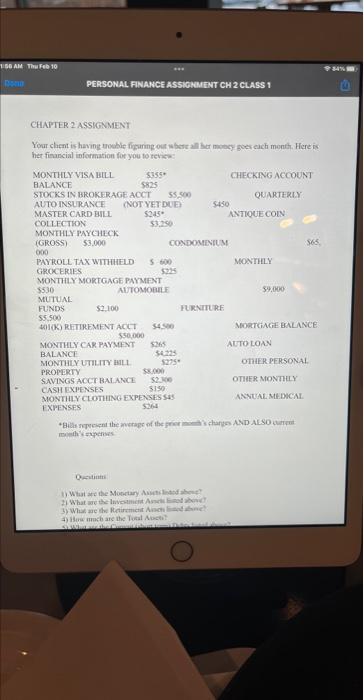

Question: pla answer the question at the bottom USB AM Thu Feb 10 PERSONAL FINANCE ASSIGNMENT CH 2 CLASS 1 S6 CHAPTER 2 ASSIGNMENT Your client

USB AM Thu Feb 10 PERSONAL FINANCE ASSIGNMENT CH 2 CLASS 1 S6 CHAPTER 2 ASSIGNMENT Your client is having trouble figuring ouberall her money goes each month. Here is het financial information for you to review MONTHLY VISA BILL $135 CHECKING ACCOUNT BALANCE $825 STOCKS IN BROKERAGE ACCT 55.500 AUTO INSURANCE QUARTERLY (NOT YET DUE 5450 MASTER CARD BILL $245 ANTIQUE COIN COLLECTION MONTHLY PAYCHECK (GROSS) 53.000 CONDOMINIUM 000 PAYROLL TAX WITHHELD 5600 MONTHLY GROCERIES 5035 MONTHLY MORTGAGE PAYMENT $530 AUTOMOBILE 59.000 MUTUAL FUNDS $2.100 FURNITURE 55.500 1) RETIREMENT ACCT 545 MORTGAGE BALANCE $50,000 MONTHLY CAR PAYMENT SMS AUTO LOAN BALANCE 54 MONTHLY UTILITY BILL OTHER PERSONAL PROPERTY S. SAVINGS ACCT BALANCE S200 OTHER MONTHLY CASH EXPENSES S15 MONTHLY CLOTHING EXPENSES 55 ANNUAL MEDICAL EXPENSES *Bila represent the age of the charges AND ALSO expenses Wat the Moon 1 What we the love And 3) Whethemet Anne a) care the Tul Auct Questions: 1) What are the Monetary Assets listed above? 2) What are the Investment Assets listed above? 3) What are the Retirement Assets listed above? 4) How much are the Total Assets? 5) What are the Current (short term) Debts listed above? 6) What are the total debts? 7) What is your client's net worth? 8) What is the Current Ratio? 9) What is the Debt Ratio? HINT: Since they are average amounts you may assume that the credit card and utility bills are both a debt (related to the prior month) and an expense (related to the current month). USB AM Thu Feb 10 PERSONAL FINANCE ASSIGNMENT CH 2 CLASS 1 S6 CHAPTER 2 ASSIGNMENT Your client is having trouble figuring ouberall her money goes each month. Here is het financial information for you to review MONTHLY VISA BILL $135 CHECKING ACCOUNT BALANCE $825 STOCKS IN BROKERAGE ACCT 55.500 AUTO INSURANCE QUARTERLY (NOT YET DUE 5450 MASTER CARD BILL $245 ANTIQUE COIN COLLECTION MONTHLY PAYCHECK (GROSS) 53.000 CONDOMINIUM 000 PAYROLL TAX WITHHELD 5600 MONTHLY GROCERIES 5035 MONTHLY MORTGAGE PAYMENT $530 AUTOMOBILE 59.000 MUTUAL FUNDS $2.100 FURNITURE 55.500 1) RETIREMENT ACCT 545 MORTGAGE BALANCE $50,000 MONTHLY CAR PAYMENT SMS AUTO LOAN BALANCE 54 MONTHLY UTILITY BILL OTHER PERSONAL PROPERTY S. SAVINGS ACCT BALANCE S200 OTHER MONTHLY CASH EXPENSES S15 MONTHLY CLOTHING EXPENSES 55 ANNUAL MEDICAL EXPENSES *Bila represent the age of the charges AND ALSO expenses Wat the Moon 1 What we the love And 3) Whethemet Anne a) care the Tul Auct Questions: 1) What are the Monetary Assets listed above? 2) What are the Investment Assets listed above? 3) What are the Retirement Assets listed above? 4) How much are the Total Assets? 5) What are the Current (short term) Debts listed above? 6) What are the total debts? 7) What is your client's net worth? 8) What is the Current Ratio? 9) What is the Debt Ratio? HINT: Since they are average amounts you may assume that the credit card and utility bills are both a debt (related to the prior month) and an expense (related to the current month)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts