Question: Places answer all question. Thanks Question 8 1.5 pts A firm issues ten-year bonds with a coupon rate of 7.8%, paid semiannually. The credit spread

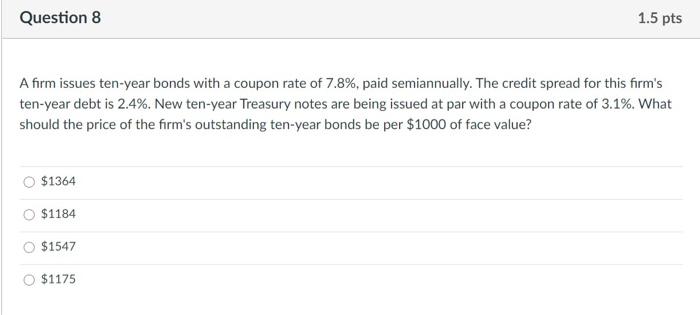

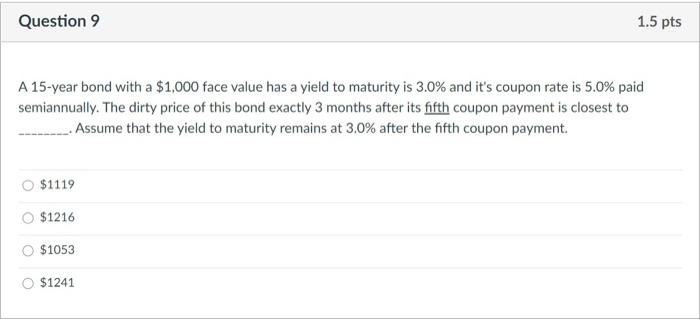

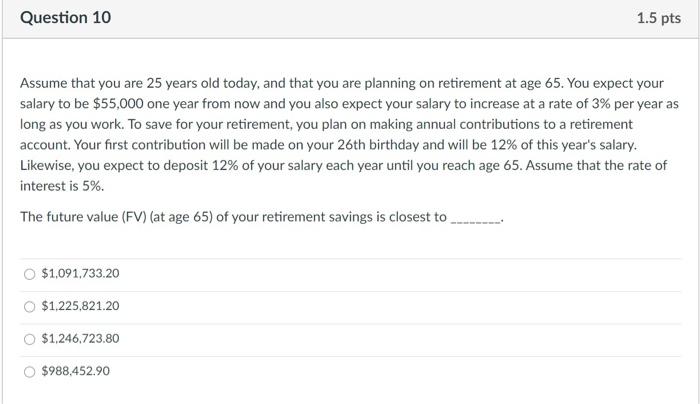

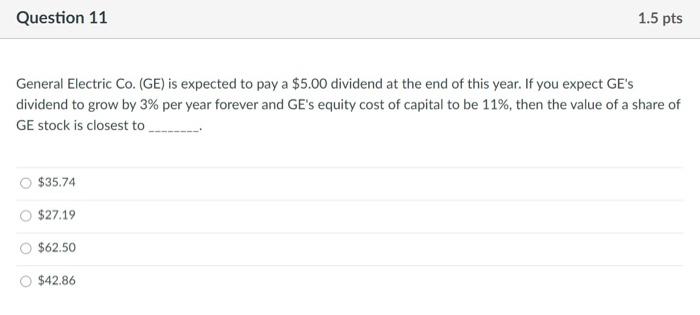

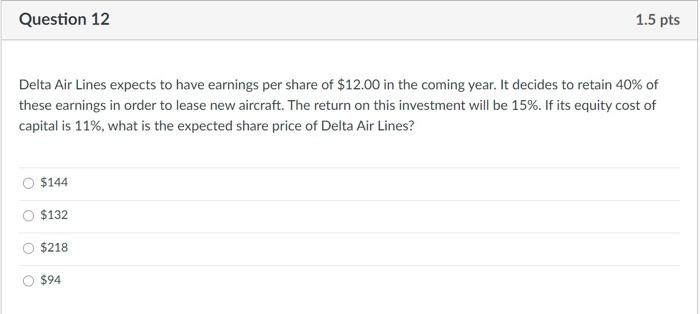

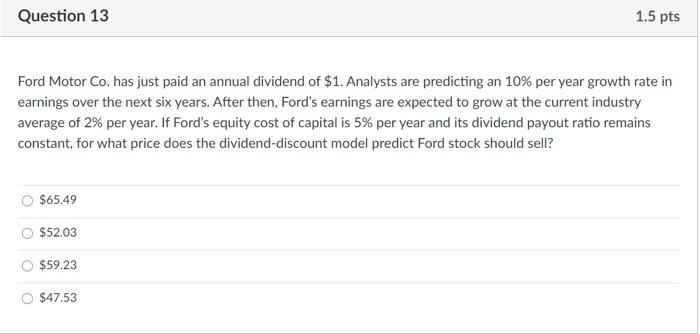

Question 8 1.5 pts A firm issues ten-year bonds with a coupon rate of 7.8%, paid semiannually. The credit spread for this firm's ten-year debt is 2.4%. New ten-year Treasury notes are being issued at par with a coupon rate of 3.1%. What should the price of the firm's outstanding ten-year bonds be per $1000 of face value? $1364 $1184 $1547 $1175 Question 9 1.5 pts A 15-year bond with a $1,000 face value has a yield to maturity is 3.0% and it's coupon rate is 5.0% paid semiannually. The dirty price of this bond exactly 3 months after its fifth coupon payment is closest to . Assume that the yield to maturity remains at 3.0% after the fifth coupon payment $1119 $1216 $1053 $1241 Question 10 1.5 pts Assume that you are 25 years old today, and that you are planning on retirement at age 65. You expect your salary to be $55,000 one year from now and you also expect your salary to increase at a rate of 3% per year as long as you work. To save for your retirement, you plan on making annual contributions to a retirement account. Your first contribution will be made on your 26th birthday and will be 12% of this year's salary. Likewise, you expect to deposit 12% of your salary each year until you reach age 65. Assume that the rate of interest is 5%. The future value (FV) (at age 65) of your retirement savings is closest to $1,091,733.20 $1,225,821.20 $1,246,723.80 $988,452.90 Question 11 1.5 pts General Electric Co. (GE) is expected to pay a $5.00 dividend at the end of this year. If you expect GE's dividend to grow by 3% per year forever and GE's equity cost of capital to be 11%, then the value of a share of GE stock is closest to $35.74 $27.19 $62.50 $42.86 Question 12 1.5 pts Delta Air Lines expects to have earnings per share of $12.00 in the coming year. It decides to retain 40% of these earnings in order to lease new aircraft. The return on this investment will be 15%. If its equity cost of capital is 11%, what is the expected share price of Delta Air Lines? $144 $132 $218 $94 Question 13 1.5 pts Ford Motor Co. has just paid an annual dividend of $1. Analysts are predicting an 10% per year growth rate in earnings over the next six years. After then, Ford's earnings are expected to grow at the current industry average of 2% per year. If Ford's equity cost of capital is 5% per year and its dividend payout ratio remains constant, for what price does the dividend-discount model predict Ford stock should sell? $65.49 $52.03 $59.23 $47.53

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts