Question: Plaease ( avoid plagiarism ) and I'll not forget the to give you like . Q1. HBF company has 50,000 shares outstanding which worth $1

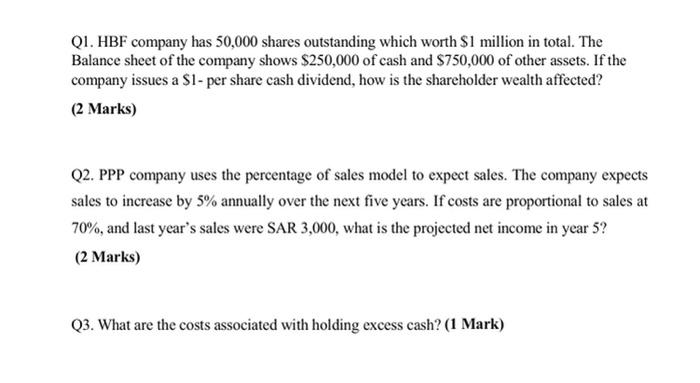

Q1. HBF company has 50,000 shares outstanding which worth $1 million in total. The Balance sheet of the company shows $250,000 of cash and $750,000 of other assets. If the company issues a $1- per share cash dividend, how is the shareholder wealth affected? (2 Marks) Q2. PPP company uses the percentage of sales model to expect sales. The company expects sales to increase by 5% annually over the next five years. If costs are proportional to sales at 70%, and last year's sales were SAR 3,000, what is the projected net income in year 5? (2 Marks) Q3. What are the costs associated with holding excess cash? (1 Mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts