Question: plan to save by making 20 equal annual installments (from ace 20 to aoe 40) into a fairiy risky investment fund that you expect will

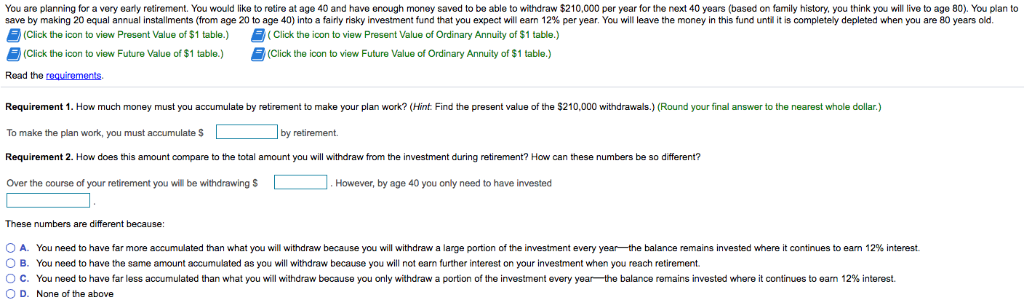

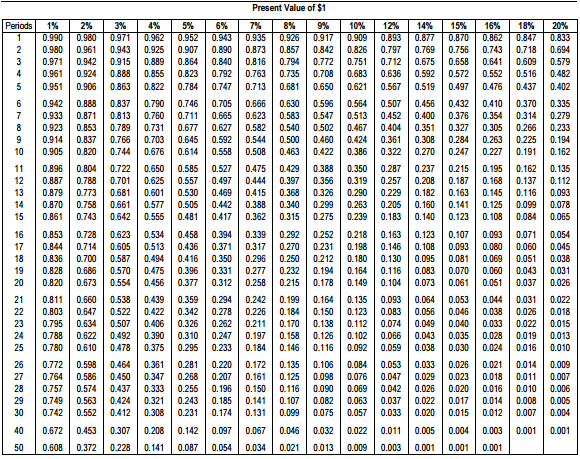

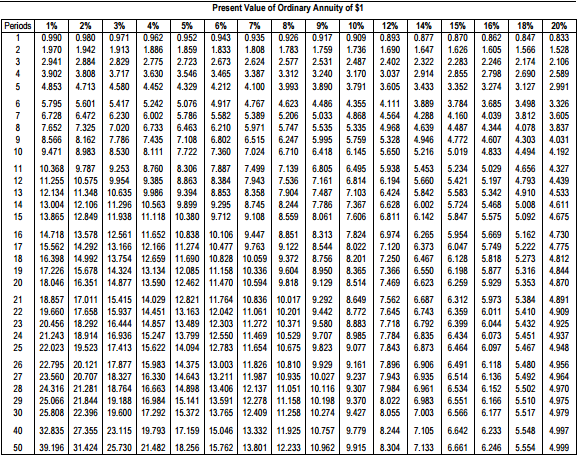

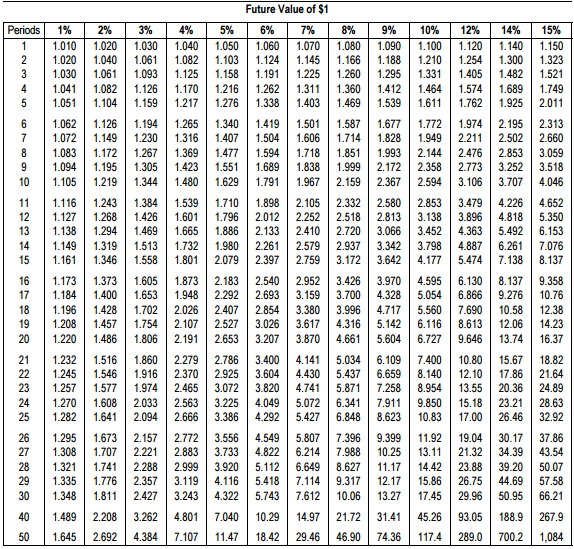

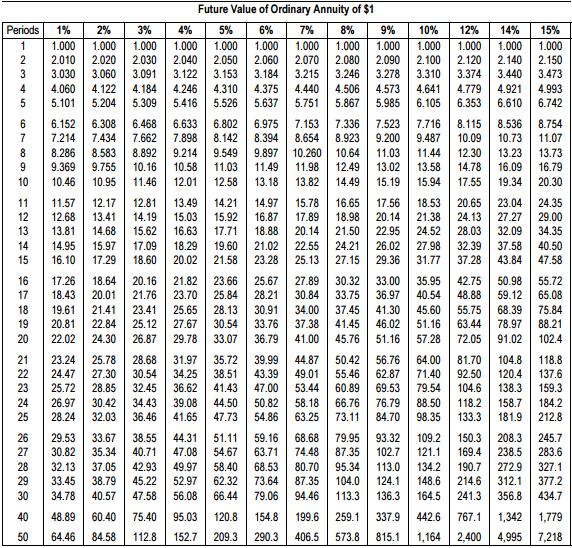

plan to save by making 20 equal annual installments (from ace 20 to aoe 40) into a fairiy risky investment fund that you expect will eam 12 % per vear , You will leave the money in this fund until it is completely depleted when vou are 8o vears old. (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) E(Click the icon t (Click the icon to view Future Value of Ordinary Annuity of $1 table.) view Future Value of $1 table.) Read the requirements yretirement to make your plan work? (Hint Find the present value of the $210,000 withdrawals.) (Round your final answer to the nearest whole dollar.) Requirement 1. How much money must you accumulate by retirement. To make the plan work, vou must accumulate S Requirement 2. How does this amount compare to the total amount you will withdraw from the investment during retirement? How can these numbers be so different? . However, by age 40 you only need to have invested Over the course of your retirement you will be withdrawing S These numbers are different because: You need to have far more accumulated than what you will withdraw because you will withdraw a large portion of the investment every year-the balance remains invested where it continues to eam 12 % interest You need to have the same amor n retirement investment every year the balance remains invested where it continues to ean 12 % interest . on your investment whe ld as you will withdraw because you will not ea * less accumulated than what you withdraw because you only withdraw a portion of None of the above ... Present Value of $1 15% 0.870 Periods 3 % 0.971 12 % 0.893 18 % 1% 2% 4% 5% 6% 7% 8% 9% 10 % 14% 16% 20% 0,.990 0.980 0.962 0.952 0.943 0.935 0.925 0.909 0.862 0.833 0.917 0.877 0.847 2 0,980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.797 0.769 0.756 0.743 0.718 0.694 0.864 0.840 0794 0.772 0,971 0,942 0.915 0.889 0.816 0.751 0.712 0.675 0.658 0.641 0.609 0.579 4. 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0708 0.683 0.636 0,592 0.572 0.552 0.516 0.482 0.906 0.863 0.822 0.784 0.713 0.681 0.650 0.567 0.519 0.402 5 0.951 0.747 0.621 0,497 0.476 0.437 6 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.507 0.456 0.432 0.410 0.370 0.335 7 0.933 0.871 0,813 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.452 0.400 0,376 0.354 0.314 0.279 8 0.923 0.540 0.502 0.266 0.853 0.789 0.731 0.677 0.627 0.582 0.467 0.404 0.351 0,327 0.305 0.233 9 0.914 0.837 0.766 0.703 0.645 0,592 0.544 0.500 0.460 0.424 0.361 0.308 0.284 0.263 0225 0.194 10 0.820 0.614 0,508 0.463 0.422 0.270 0.905 0.744 0.676 0.558 0.386 0.322 0.247 0.227 0.191 0.162 0.722 0.650 0.585 0.429 0.287 0.195 0.162 0.135 11 0.896 0.804 0.527 0.475 0.388 0.350 0.237 0.215 12 13 14 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.257 0,208 0.187 0.168 0.137 0.112 0,093 0,681 0.368 0.326 0.182 0.116 0.879 0.773 0.601 0,530 0.469 0.415 0.290 0.229 0.163 0.145 0.870 0.758 0.661 0.577 0.505 0.442 0,388 0.340 0.299 0.263 0.205 0.160 0.141 0.125 0.099 0.078 0.861 0.642 0.362 0.315 0.123 0.108 15 0.743 0.555 0.481 0.417 0.275 0.239 0.183 0.140 0.084 0.065 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.163 0.123 0.107 0.093 0,071 0.054 17 18 19 0,844 0.371 0.270 0.198 0,093 0,080 0,060 0,045 0.714 0.605 0.513 0.494 0.436 0.317 0.231 0.146 0.108 0.836 0.700 0.587 0.416 0.350 0.296 0.250 0212 0.180 0.130 0.095 0.081 0.069 0.051 0.038 0.475 0.456 0.396 0.277 0.258 0.164 0,060 0.043 0.828 0.686 0.570 0.331 0.232 0.194 0.116 0.083 0.070 0.031 0.820 0.104 20 0.673 0.554 0.377 0.312 0.215 0.178 0.149 0.073 0.061 0.051 0,037 0.026 0.031 0.199 21 0.811 0.660 0.538 0.439 0.359 0.294 0.242 0.164 0.135 0,093 0.064 0,053 0.044 0.022 22 23 0.803 0.647 0.522 0.422 0.342 0.278 0.226 0.184 0.150 0.123 0.083 0.056 0.046 0.038 0.026 0.018 0.634 0.406 0.170 0.795 0.507 0.326 0.262 0.211 0.138 0.112 0.074 0.049 0.040 0.033 0,022 0.015 24 0.788 0.622 0.492 0.390 0.310 0.247 0.197 0.158 0.126 0.102 0.066 0.043 0.035 0.028 0.019 0.013 0.780 0.478 0.375 0.233 0.184 0.146 0.116 0.038 25 0.610 0.295 0.092 0.059 0.030 0.024 0.016 0.010 26 0.772 0.598 0.464 0.361 0.281 0.220 0.172 0.135 0.106 0.084 0.053 0.033 0.026 0.021 0.014 0,009 27 0.764 0.586 0.450 0.347 0.268 0.207 0.161 0.125 0,098 0.076 0.047 0.029 0,023 0.018 0.011 0.007 28 0.333 0.150 0.116 0.010 0,006 0.757 0.574 0.437 0.255 0.196 0,090 0,069 0.042 0.026 0,020 0.016 29 0.749 0.563 0.424 0.321 0.243 0.185 0.141 0.107 0,082 0.063 0.037 0.022 0.017 0.014 0,008 0.005 30 0.742 0.412 0.308 0.231 0.174 0,020 0.552 0.131 0,099 0,075 0.057 0.033 0,015 0.012 0.007 0,004 0.453 0.097 0.011 0,004 0,001 0.001 40 0.672 0.307 0.208 0.142 0.067 0.046 0.032 0,022 0.005 0.003 50 0.608 0.372 0.228 0.141 0.087 0.054 0,034 0,021 0,013 0.009 0.003 0.001 0.001 0,001 Present Value of Ordinary Annuity of $1 9 % 12 % 0.893 16 % 0.862 Periods 1% 2% 3% 4% 5% 6% 7% 8% 10% 14% 15% 18% 20% 0.990 0.980 0.971 0.962 0.952 0.925 0.909 0.877 0.870 0.847 0.943 0.935 0.917 0.833 2 1.970 1.942 1913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1,690 1.647 1,626 1.605 1.566 1,528 2.941 2.723 2.106 2.884 2.829 2.775 2.673 2.624 2,577 2.531 2,487 2.402 2.322 2.283 2.246 2.174 3.902 3.808 3.717 3.630 3,546 3.465 3.387 3312 3.240 3.170 3.037 2.914 2.855 2.798 2690 2.589 3.791 4.713 4,580 4,100 3.890 3.352 5 4.853 4,452 4,329 4.212 3.993 3.605 3.433 3.274 3.127 2.991 3.498 5.795 5,601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4,355 4.111 3.889 3.784 3.685 3.326 4.160 4,487 7 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4,868 4,564 4,288 4.039 3.812 3.605 7.325 7,020 6.733 6.463 6.210 5.535 4,968 4,639 4,078 7,652 5.971 5,747 5.335 4,344 3.837 9 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.328 4.946 4.772 4,607 4,303 4.031 10 8.983 8.530 8.111 7,722 7.360 6.710 6.418 5.019 4.833 4,494 9.471 7,024 6.145 5.650 5.216 4.192 4.327 9.787 9.253 8.760 8.306 7,887 7,499 6.805 6,495 5.453 5.234 4.656 11 10.368 7,139 5.938 5,029 11.255 10.575 7,536 12 9.954 9.385 8.863 8.384 7.943 7.161 6.814 6.194 5,660 5.421 5.197 4.793 4.439 12.134 11.348 10.635 8.853 13 8.358 6.424 4,533 9.986 9.394 7.904 7.487 7.103 5.842 5,583 5,342 4.910 13.004 12.106 11.296 10.563 14 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.724 5.468 5.008 4.611 13.865 12.849 11.938 11.118 4,675 15 10.380 9.712 9.108 8.559 8.061 7.606 6.811 6.142 5.847 5.575 5.092 14.718 13.578 12561 11.652 15.562 14.292 13.166 12.166 18 10.838 10.106 9.447 11.274 10.477 9.763 11.690 10.828 10.059 12.085 11.158 10.336 14.877 13.590 12.462 11.470 10.594 16 8.851 8.313 7.824 6.974 6.265 5.954 5.669 5.162 4.730 9.122 8.544 7.120 6.373 5222 17 8.022 6,047 5.749 4,775 16.398 14.992 13.754 12.659 17.226 15.678 18.046 16.351 9.372 8.756 8.201 7.250 6.467 6.128 5.818 5.273 4.812 8.950 9.129 6.198 5.316 19 14.324 13.134 9.604 8.365 7,366 6.550 5.877 4.844 9.818 8.514 6.623 4,870 20 7.469 6.259 5,929 5.353 17.011 15.415 14.029 12.821 11.764 10.836 13.163 12.042 11.061 13.489 12.303 11.272 13.799 12.550 14.094 12.783 11.654 21 18.857 10.017 9.292 8.649 7.562 6.687 6.312 5,973 5.384 4.891 19.660 17.658 23 22 15.937 14.451 10.201 9.442 8.772 7,645 6.743 6.359 6,011 5.410 4.909 20.456 18.292 16.444 21.243 18.914 16.936 22.023 19.523 17.413 10.371 9.580 6.399 6,044 14.857 8.883 7,718 6.792 5.432 4,925 11.469 10.529 24 15.247 9.707 8.985 7.784 6.835 6.434 6.073 5.451 4,937 15.622 9.823 7.843 6.464 4,948 25 10.675 9.077 6.873 6.097 5.467 22.795 20.121 23.560 20.707 24,316 21.281 17.877 15.983 18.327 16.330 14.643 13.211 11.987 18.764 16.663 14.375 13.003 11.826 26 10.810 9.929 9.161 7.896 6.906 6,491 6.118 5.480 4.956 10.935 10.027 27 9.237 7,943 6.935 6.514 6.136 5.492 4,964 13.406 12.137 28 25.066 21.844 19.188 16.984| 15.141 25.808 22.396 19.600 17.292 14.898 7.984 11.051 10.116 9.307 6.961 6,534 6.152 5.502 4,970 12.278 11.158 10.198 11.258 29 13.591 9.370 8.022 6.983 6.551 6.166 5,510 4,975 15.372 13.765 12.409 10.274 9.427 30 6.566 4,979 8.055 7,003 6.177 5.517 32.835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.244 6.233 40 7.105 6.642 5.548 4.997 39.196 31.424 25.730 21.482 18.256 15.762 13.801 12.233 10.962 9.915 50 8.304 7,133 6.661 6.246 5.554 4.999 Future Value of $1 Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 1 1.010 1.020 1.030 1.040 1,050 1.060 1.070 1.080 1.090 1.100 1.120 1.140 1.150 2 1.020 1.040 1.061 1.082 1.103 1.124 1.145 1.166 1.188 1.210 1.254 1,300 1.323 3 1.030 1.061 1,093 1.125 1.158 1.191 1.225 1.260 1.295 1.331 1.405 1,482 1.521 1.749 4 1.041 1,082 1,126 1.170 1.216 1.262 1.311 1.360 1.412 1,464 1.574 1,689 5 1.051 1.104 1.159 1.217 1,276 1.338 1.403 1.469 1.539 1.611 1.762 1.925 2.011 6 1.062 1.126 1.194 1.265 1.340 1.419 1.501 1.587 1.677 1.772 1.974 2.195 2.313 7 1.072 1.149 1.230 1.316 1,407 1.504 1.606 1.714 1.828 1.949 2.211 2,502 2.660 8 1.083 1.172 1.267 1.369 1.477 1.594 1,718 1.851 1.993 2.172 2.144 2.476 2.853 3.059 9 1.094 1.195 1,305 1.423 1.551 1.689 1.838 1.999 2.358 2.773 3.252 3.518 10 1.105 1.219 1,344 1.480 1.629 1.791 1.967 2.159 2.367 2.594 3.106 3.707 4.046 11 1.116 1.243 1,384 1.539 1.710 1.796 1.898 2.105 2.332 2.580 2.853 3.479 4,226 4,652 12 1.127 1.268 1,426 1.601 2.012 2.252 2.518 2.813 3.138 3.896 4,818 5.492 5.350 6.153 13 1.138 1.294 1.469 1.665 1.886 2.133 2.410 2.720 3.066 3.452 4,363 14 1.149 1.319 1,513 1,732 1.980 2.261 2,579 2.937 3.342 3.798 4.887 6.261 7.076 15 1.161 1,346 1.558 1.801 2.079 2.397 2.759 3.172 3.642 4.177 5.474 7.138 8.137 16 1.173 1.373 1,605 1.873 2.183 2.540 2.952 3.426 3.970 4.595 6.130 8.137 9.358 2.693 10.76 17 1.184 1,400 1.653 1.948 2.292 3.159 3.700 4.328 5.054 6.866 9.276 18 1.196 1,428 1,702 2.026 2.407 2.854 3.380 3.996 4.717 5.560 7.690 10.58 12.38 19 1.208 1.457 1.754 2.107 2.527 3.026 3.617 4.316 5.142 6.116 8.613 12.06 14.23 20 1.220 1.486 1.806 2.191 2.653 3.207 3,870 4.661 5.604 6.727 9.646 13.74 16.37 21 1.232 1.516 1.860 2.279 2.786 3.400 4.141 5.034 6.109 7.400 10.80 15.67 18.82 22 1.245 1.546 1.916 2.370 2.925 3.604 4430 5.437 6.659 8.140 12.10 17.86 21,64 23 1.257 1.577 1.974 2.465 3.072 3.820 4.741 5.871 7.258 8.954 13.55 20.36 24.89 24 1.270 1.608 2.033 2.563 3.225 4.049 5.072 6.341 7.911 9.850 15.18 23.21 28.63 25 1.282 1,641 2.094 2.666 3.386 4.292 5.427 6.848 8.623 10.83 17,00 26.46 32.92 1.295 1,673 2.772 3.556 4,549 5.807 7.396 9.399 11.92 14 30.17 37 27 1.308 1.707 2.221 2.883 3.733 4,822 6.214 7.988 10.25 13.11 21.32 34.39 43.54 28 1.321 1.741 2.288 2.999 3.920 5.112 6.649 8.627 11.17 14.42 23.88 39.20 50.07 29 1.335 1.776 2.357 3.119 4.116 5.418 7.114 9.317 12.17 15.86 26.75 44.69 57.58 30 1.348 1.811 2.427 3.243 4,322 5,743 7,612 10.06 13.27 17.45 29.96 50.95 66.21 40 1.489 2.208 3.262 4.801 7,040 10.29 14.97 21.72 31.41 45.26 93.05 188.9 267.9 50 1.645 2.692 4.384 7.107 11.47 18.42 29.46 46.90 74.36 117.4 289.0 700.2 1,084 Future Value of Ordinary Annuity of $1 Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 1 1.000 1.000 1.000 1.000 1,000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1,000 2.010 2.020 2.030 2.040 2.050 2.060 2.070 2.080 2.090 2.100 2.120 2.140 2.150 3 3.030 3.060 3.091 3.122 3.153 3.184 3.215 3.246 3.278 3.310 3.374 3.440 3.473 4440 4 4.060 4,122 4.184 4,246 4,310 4.375 5.637 4,506 4,573 4,641 4,779 4,921 4.993 5 5.101 5.204 5.309 5.416 5.526 5.751 5.867 5.985 6.105 6.353 6.610 6.742 6 6.152 6.308 6,468 6.633 6.802 6,975 7,153 7,336 7.523 7.716 8.115 8.536 8.754 7 7.214 7.434 7.662 7,898 8.142 8.394 8.654 8.923 9.200 9.487 10.09 10.73 11.07 9.214 8 8.286 8.583 8,892 9.549 9.897 10.260 10.64 11.03 11.44 12.30 13.23 13.73 9 9.369 9.755 10.16 10.58 11.03 11.49 11.98 12.49 13.02 13.58 14.78 16.09 16.79 10 10.46 10.95 11.46 12.01 12.58 13.18 13.82 14.49 15.19 15.94 17.55 19.34 20.30 11 11.57 12.17 12.81 13.49 14.21 14.97 15.78 16.65 17.56 18.53 20.65 23.04 24.35 15.03 15.92 29.00 12 12.68 13.41 14.19 16.87 17.89 18.98 20.14 21.38 24.13 27.27 13 13.81 14.68 15.62 16.63 17.71 18.88 20.14 21.50 22.95 24.52 28.03 32.09 34.35 14 14.95 15.97 17.09 18.29 19.60 21.02 22.55 24.21 26.02 27.98 32.39 37.58 40,50 15 16.10 17.29 18.60 20.02 21.58 23.28 25.13 27.15 29.36 31.77 37.28 43.84 47.58 16 17.26 18.64 20.16 21.82 23.66 25.67 27.89 30.32 33.00 35.95 42,75 50.98 55.72 17 18.43 20.01 21.76 23.70 25.84 28.21 30.84 33.75 36.97 40.54 48,88 59.12 65.08 18 19.61 21.41 23.41 25.65 28.13 30.91 34.00 37.45 41.30 45.60 55.75 68.39 75.84 19 20.81 22,84 25.12 27.67 30.54 33.76 37.38 41.45 46.02 51.16 63.44 78.97 88.21 20 22.02 24.30 26.87 29.78 33.07 36.79 41.00 45.76 51.16 57.28 72.05 91.02 102.4 21 23.24 25.78 28.68 31.97 35.72 39.99 44.87 50.42 56.76 64.00 81.70 104.8 118.8 22 24.47 27.30 30.54 34.25 38.51 43.39 49.01 55.46 62.87 71.40 92.50 120.4 137.6 23 25.72 28.85 32.45 36,62 41.43 47.00 53.44 60.89 69.53 79.54 104.6 138.3 159.3 24 26.97 30.42 34.43 39.08 44.50 50.82 58.18 66.76 76.79 88.50 118.2 158.7 184.2 25 28.24 32.03 36.46 41.65 47.73 54.86 63.25 73.11 84.70 98.35 133.3 181.9 212.8 26 2 33.67 44,31 51 69.16 68.68 79.95 32 109.2 150.3 208.3 245.7 27 30.82 35.34 40.71 47,08 54.67 63.71 74.48 87.35 102.7 121.1 169.4 238.5 283,6 28 32.13 37.05 42.93 49.97 58.40 68.53 80.70 95.34 113.0 134.2 190.7 272.9 327.1 29 33.45 38.79 45.22 52.97 62.32 73.64 87.35 104.0 124.1 148.6 214,6 312.1 377.2 30 34.78 40.57 47,58 56.08 66.44 79.06 94.46 113.3 136.3 164,5 241.3 356.8 434.7 259.1 40 48.89 60.40 75.40 95.03 120.8 154.8 199.6 337.9 442.6 767.1 1,342 1,779 50 64.46 84,58 112.8 152.7 209.3 290.3 406.5 573.8 815.1 1,164 2,400 4,995 7,218

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts