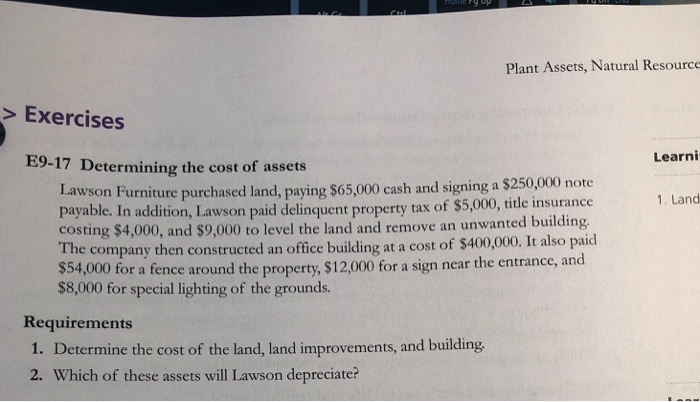

Question: Plant Assets, Natural Resource >Exercises Learni E9-17 Determining the cost of assets on Furniture purchased land, paying $65,000 cash and signing a $250,000 note Laws

Plant Assets, Natural Resource >Exercises Learni E9-17 Determining the cost of assets on Furniture purchased land, paying $65,000 cash and signing a $250,000 note Laws n addition, Lawson paid delinquent property tax of $5,000, title insurance and $9,000 to level the land and remove an unwanted building. 1. Land e company then constructed an office building at a cost of $400,000. It also paid s54,000 for a fence around the property, $12,000 for a sign near the entrance, and $8,000 for special lighting of the grounds. Requirements 1. Determine the cost of the land, land improvements, and building 2. Which of these assets will Lawson depreciate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts