Question: plase show the final answer .30 minutes onlu maximum even if you didnt finish it all. Question 7 Complete the following aging schedule for Curtis

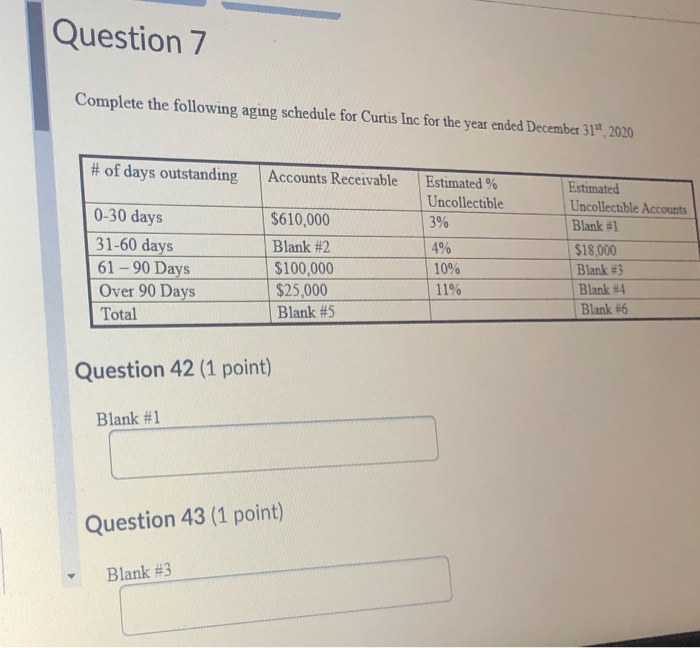

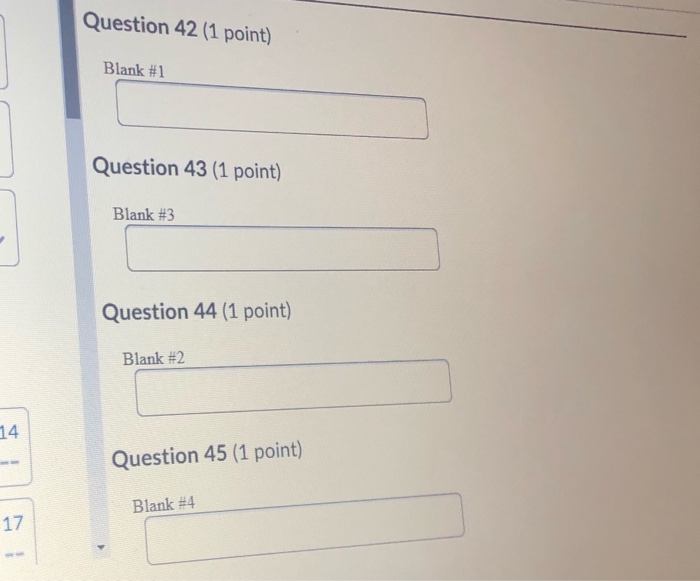

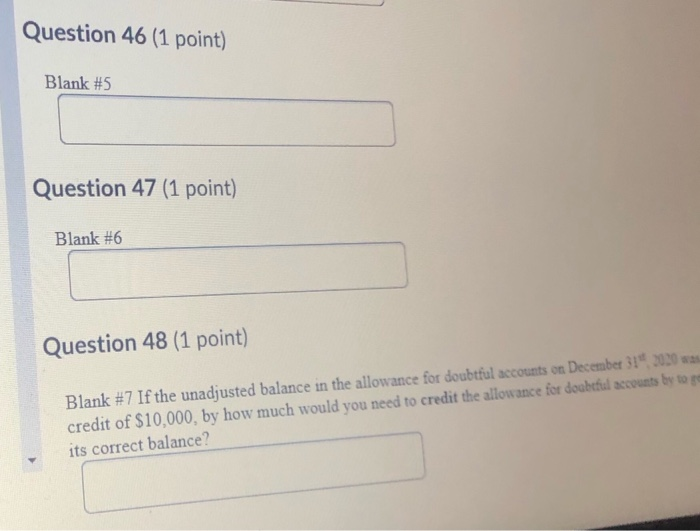

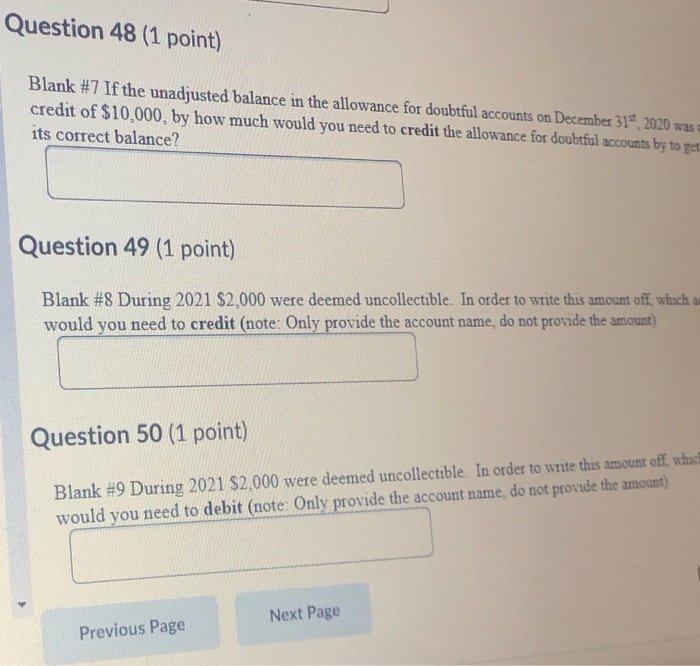

Question 7 Complete the following aging schedule for Curtis Inc for the year ended December 319 2020 # of days outstanding Accounts Receivable Estimated % Uncollectible 3% 0-30 days 31-60 days 61 - 90 Days Over 90 Days Total $610,000 Blank #2 $100,000 $25,000 Blank #5 4% 10% 11% Estimated Uncollectible Accounts Blank #1 $18,000 Blank #3 Blank #4 Blank #6 Question 42 (1 point) Blank #1 Question 43 (1 point) Blank #3 Question 42 (1 point) Blank #1 Question 43 (1 point) Blank #3 Question 44 (1 point) Blank #2 14 Question 45 (1 point) Blank #4 17 Question 46 (1 point) Blank #5 Question 47 (1 point) Blank #6 Question 48 (1 point) Blank #7 If the unadjusted balance in the allowance for doubtful accounts on December 319 2020 credit of $10,000, by how much would you need to credit the allowance for doubtful accounts by to e its correct balance? Question 48 (1 point) Blank #7 If the unadjusted balance in the allowance for doubtful accounts on December 31* 2020 was credit of $10,000, by how much would you need to credit the allowance for doubtful accounts by to get its correct balance? Question 49 (1 point) Blank #8 During 2021 $2,000 were deemed uncollectible. In order to write this amount off which a would you need to credit (note: Only provide the account name, do not provide the amount) Question 50 (1 point) Blank #9 During 2021 $2,000 were deemed uncollectible. In order to write this amount off, which would you need to debit (note: Only provide the account name, do not provide the amount) Next Page Previous Page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts