Question: Plastic India makes moulded plastic objects (buckets, jugs, basins, boxes, plates, cups, etc.) and are trying to find the best method to calculate the total

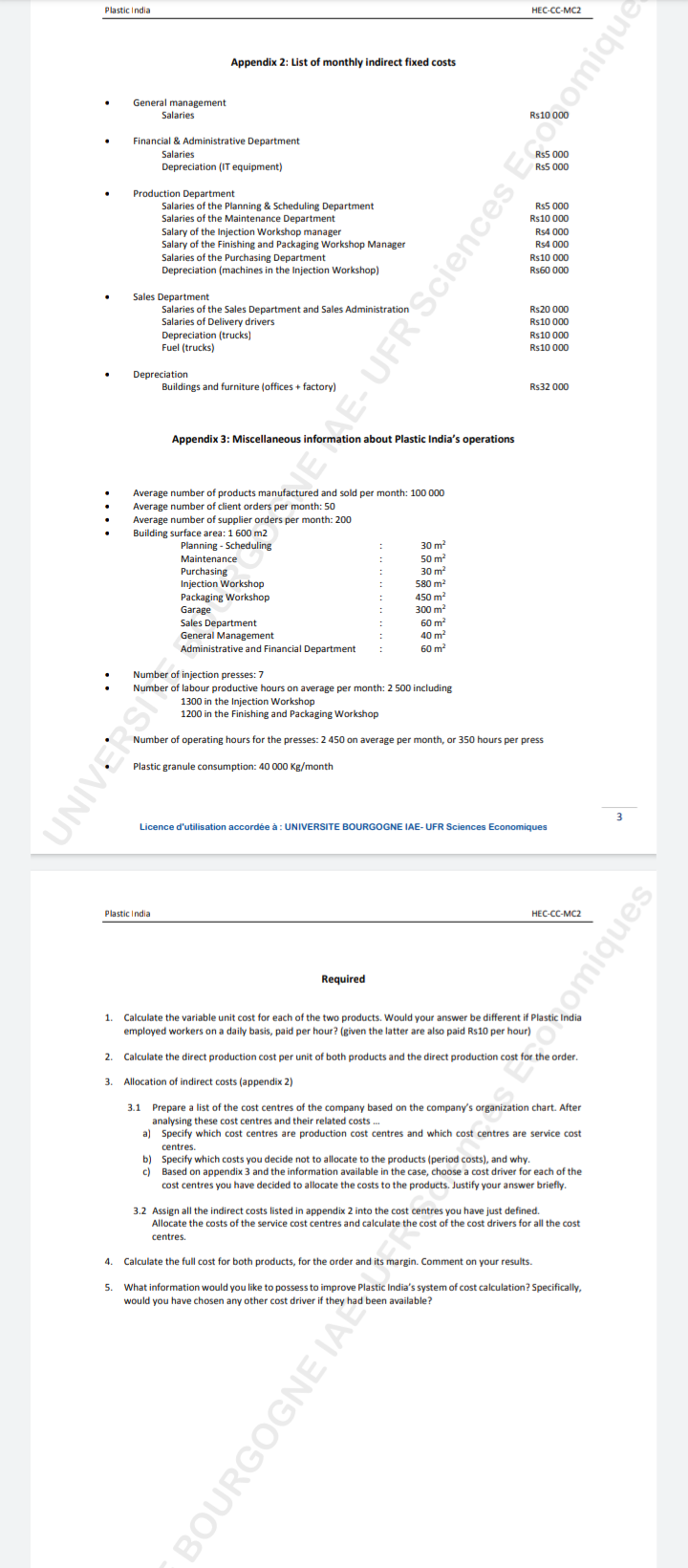

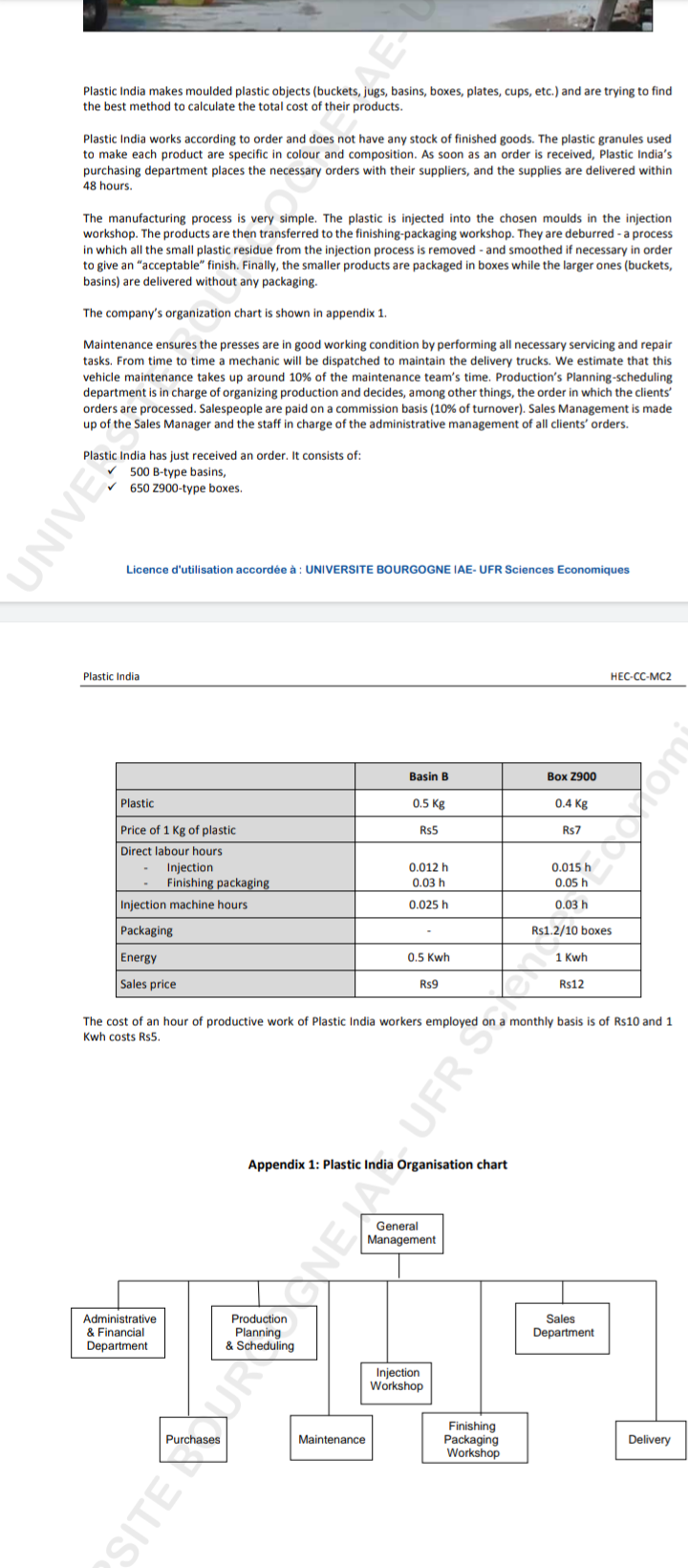

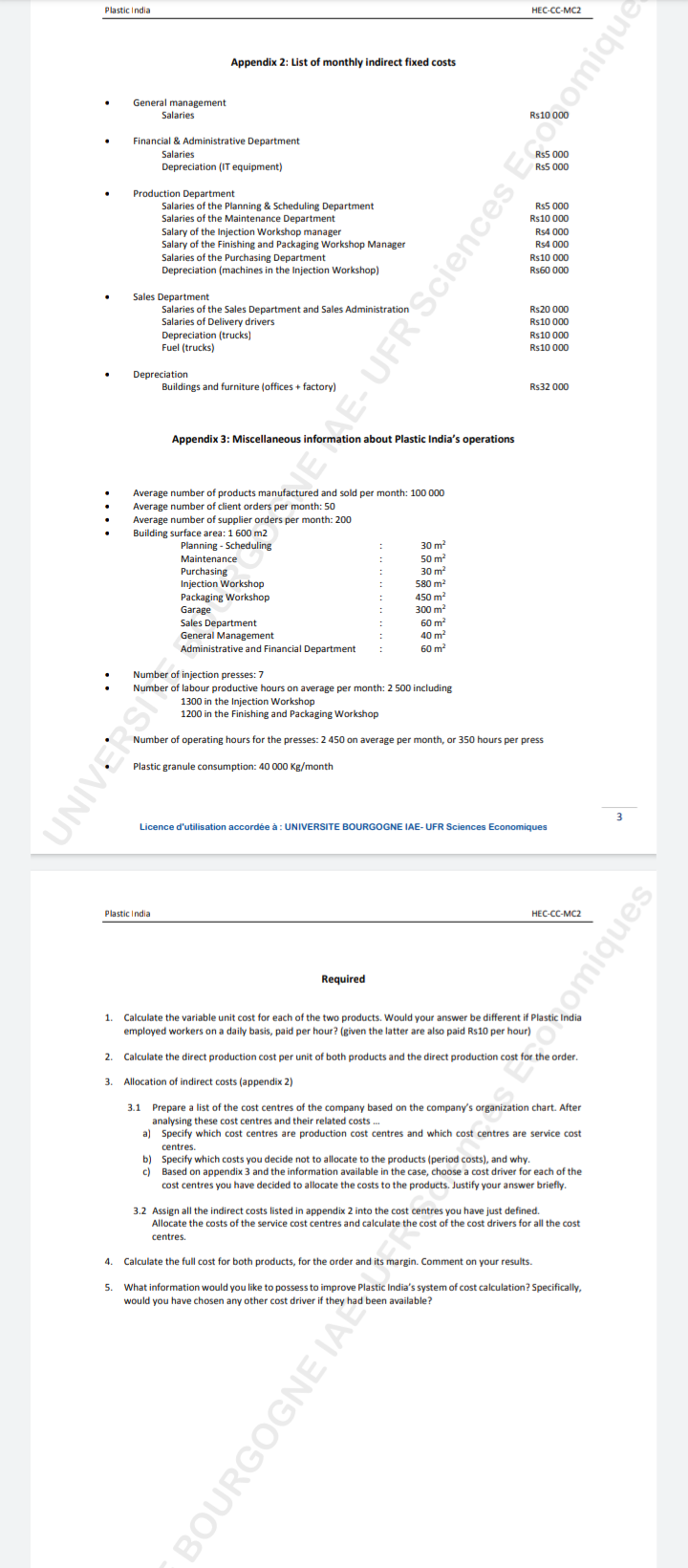

Plastic India makes moulded plastic objects (buckets, jugs, basins, boxes, plates, cups, etc.) and are trying to find the best method to calculate the total cost of their products. Plastic India works according to order and does not have any stock of finished goods. The plastic granules used to make each product are specific in colour and composition. As soon as an order is received, Plastic India's purchasing department places the necessary orders with their suppliers, and the supplies are delivered within 48 hours. The manufacturing process is very simple. The plastic is injected into the chosen moulds in the injection workshop. The products are then transferred to the finishing-packaging workshop. They are deburred - a process in which all the small plastic residue from the injection process is removed - and smoothed if necessary in order to give an "acceptable" finish. Finally, the smaller products are packaged in boxes while the larger ones (buckets, basins) are delivered without any packaging. The company's organization chart is shown in appendix 1. Maintenance ensures the presses are in good working condition by performing all necessary servicing and repair tasks. From time to time a mechanic will be dispatched to maintain the delivery trucks. We estimate that this vehicle maintenance takes up around 10% of the maintenance team's time. Production's Planning-scheduling department is in charge of organizing production and decides, among other things, the order in which the clients' orders are processed. Salespeople are paid on a commission basis ( 10% of turnover). Sales Management is made up of the Sales Manager and the staff in charge of the administrative management of all clients' orders. Plastic India has just received an order. It consists of: 500 B-type basins, 650 Z900-type boxes. Licence d'utilisation accorde : UNIVERSITE BOURGOGNE IAE- UFR Sciences Economiques Plastic India HEC-CC-MC2 The cost of an hour of productive work of Plastic India workers employed on a monthly basis is of Rs10 and 1 Kwh costs Rs5. Appendix 3: Miscellaneous information about Plastic India's operations - Average number of products manufactured and sold per month: 100000 - Average number of client orders per month: 50 - Average number of supplier orders per month: 200 - Buildina eurfara araa. 1 fnn m2 - Number of injection presses: 7 - Number of labour productive hours on average per month: 2500 including 1300 in the Injection Workshop 1200 in the Finishing and Packaging Workshop - Number of operating hours for the presses: 2450 on average per month, or 350 hours per press - Plastic granule consumption: 40000Kg/month Licence d'utilisation accorde : UNIVERSITE BOURGOGNE IAE- UFR Sciences Economiques Plastic India HEC-CC-MC2 Required 1. Calculate the variable unit cost for each of the two products. Would your answer be different if Plastic India employed workers on a daily basis, paid per hour? (given the latter are also paid Rs10 per hour) 2. Calculate the direct production cost per unit of both products and the direct production cost for the order. 3. Allocation of indirect costs (appendix 2) 3.1 Prepare a list of the cost centres of the company based on the company's organization chart. After analysing these cost centres and their related costs ... a) Specify which cost centres are production cost centres and which cost centres are service cost centres. b) Specify which costs you decide not to allocate to the products (period costs), and why. c) Based on appendix 3 and the information available in the case, choose a cost driver for each of the cost centres you have decided to allocate the costs to the products. Justify your answer briefly. 3.2 Assign all the indirect costs listed in appendix 2 into the cost centres you have just defined. Allocate the costs of the service cost centres and calculate the cost of the cost drivers for all the cost centres. 4. Calculate the full cost for both products, for the order and its margin. Comment on your results. 5. What information would you like to possess to improve Plastic India's system of cost calculation? Specifically, would you have chosen any other cost driver if they had been available? Plastic India makes moulded plastic objects (buckets, jugs, basins, boxes, plates, cups, etc.) and are trying to find the best method to calculate the total cost of their products. Plastic India works according to order and does not have any stock of finished goods. The plastic granules used to make each product are specific in colour and composition. As soon as an order is received, Plastic India's purchasing department places the necessary orders with their suppliers, and the supplies are delivered within 48 hours. The manufacturing process is very simple. The plastic is injected into the chosen moulds in the injection workshop. The products are then transferred to the finishing-packaging workshop. They are deburred - a process in which all the small plastic residue from the injection process is removed - and smoothed if necessary in order to give an "acceptable" finish. Finally, the smaller products are packaged in boxes while the larger ones (buckets, basins) are delivered without any packaging. The company's organization chart is shown in appendix 1. Maintenance ensures the presses are in good working condition by performing all necessary servicing and repair tasks. From time to time a mechanic will be dispatched to maintain the delivery trucks. We estimate that this vehicle maintenance takes up around 10% of the maintenance team's time. Production's Planning-scheduling department is in charge of organizing production and decides, among other things, the order in which the clients' orders are processed. Salespeople are paid on a commission basis ( 10% of turnover). Sales Management is made up of the Sales Manager and the staff in charge of the administrative management of all clients' orders. Plastic India has just received an order. It consists of: 500 B-type basins, 650 Z900-type boxes. Licence d'utilisation accorde : UNIVERSITE BOURGOGNE IAE- UFR Sciences Economiques Plastic India HEC-CC-MC2 The cost of an hour of productive work of Plastic India workers employed on a monthly basis is of Rs10 and 1 Kwh costs Rs5. Appendix 3: Miscellaneous information about Plastic India's operations - Average number of products manufactured and sold per month: 100000 - Average number of client orders per month: 50 - Average number of supplier orders per month: 200 - Buildina eurfara araa. 1 fnn m2 - Number of injection presses: 7 - Number of labour productive hours on average per month: 2500 including 1300 in the Injection Workshop 1200 in the Finishing and Packaging Workshop - Number of operating hours for the presses: 2450 on average per month, or 350 hours per press - Plastic granule consumption: 40000Kg/month Licence d'utilisation accorde : UNIVERSITE BOURGOGNE IAE- UFR Sciences Economiques Plastic India HEC-CC-MC2 Required 1. Calculate the variable unit cost for each of the two products. Would your answer be different if Plastic India employed workers on a daily basis, paid per hour? (given the latter are also paid Rs10 per hour) 2. Calculate the direct production cost per unit of both products and the direct production cost for the order. 3. Allocation of indirect costs (appendix 2) 3.1 Prepare a list of the cost centres of the company based on the company's organization chart. After analysing these cost centres and their related costs ... a) Specify which cost centres are production cost centres and which cost centres are service cost centres. b) Specify which costs you decide not to allocate to the products (period costs), and why. c) Based on appendix 3 and the information available in the case, choose a cost driver for each of the cost centres you have decided to allocate the costs to the products. Justify your answer briefly. 3.2 Assign all the indirect costs listed in appendix 2 into the cost centres you have just defined. Allocate the costs of the service cost centres and calculate the cost of the cost drivers for all the cost centres. 4. Calculate the full cost for both products, for the order and its margin. Comment on your results. 5. What information would you like to possess to improve Plastic India's system of cost calculation? Specifically, would you have chosen any other cost driver if they had been available