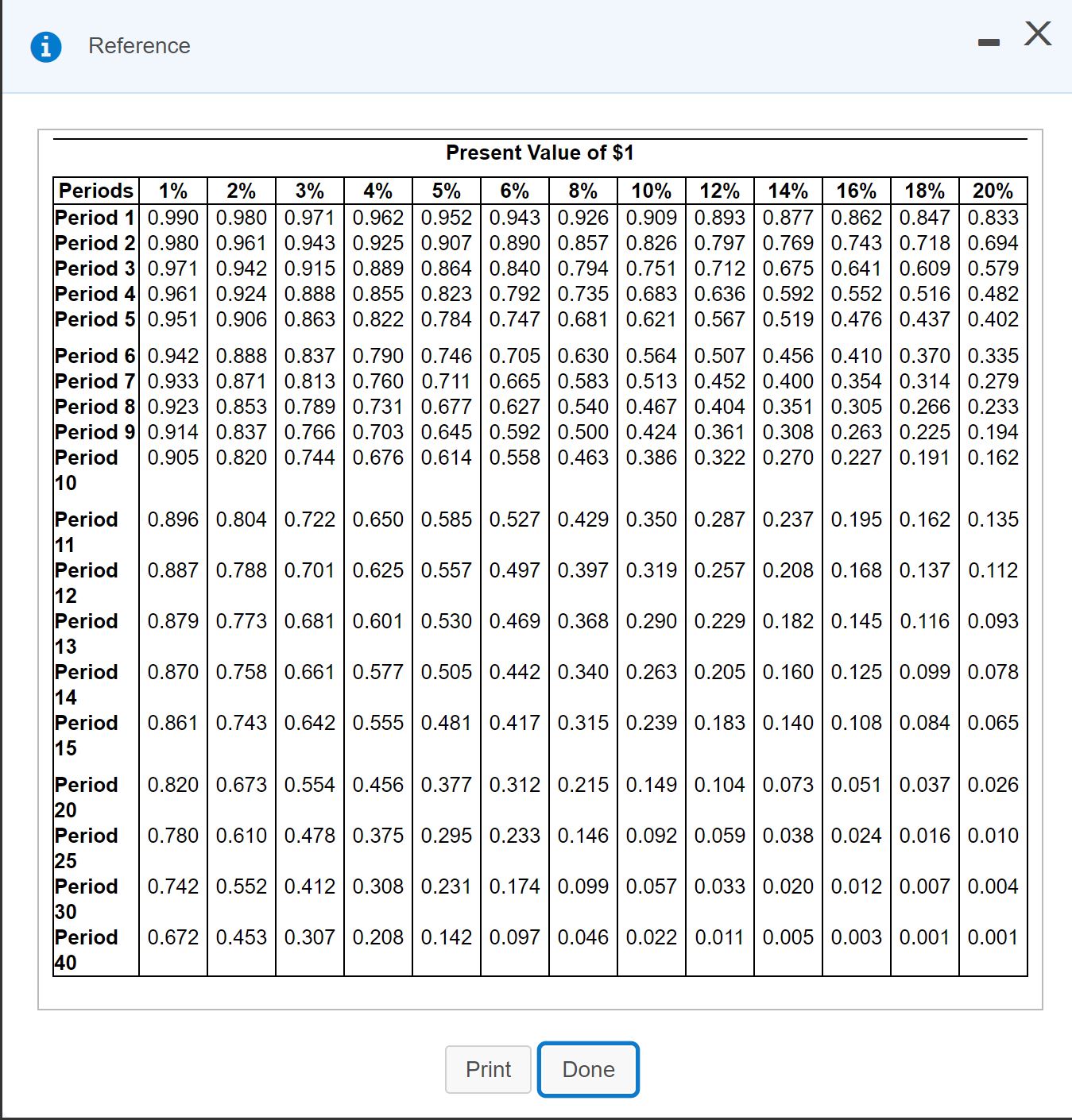

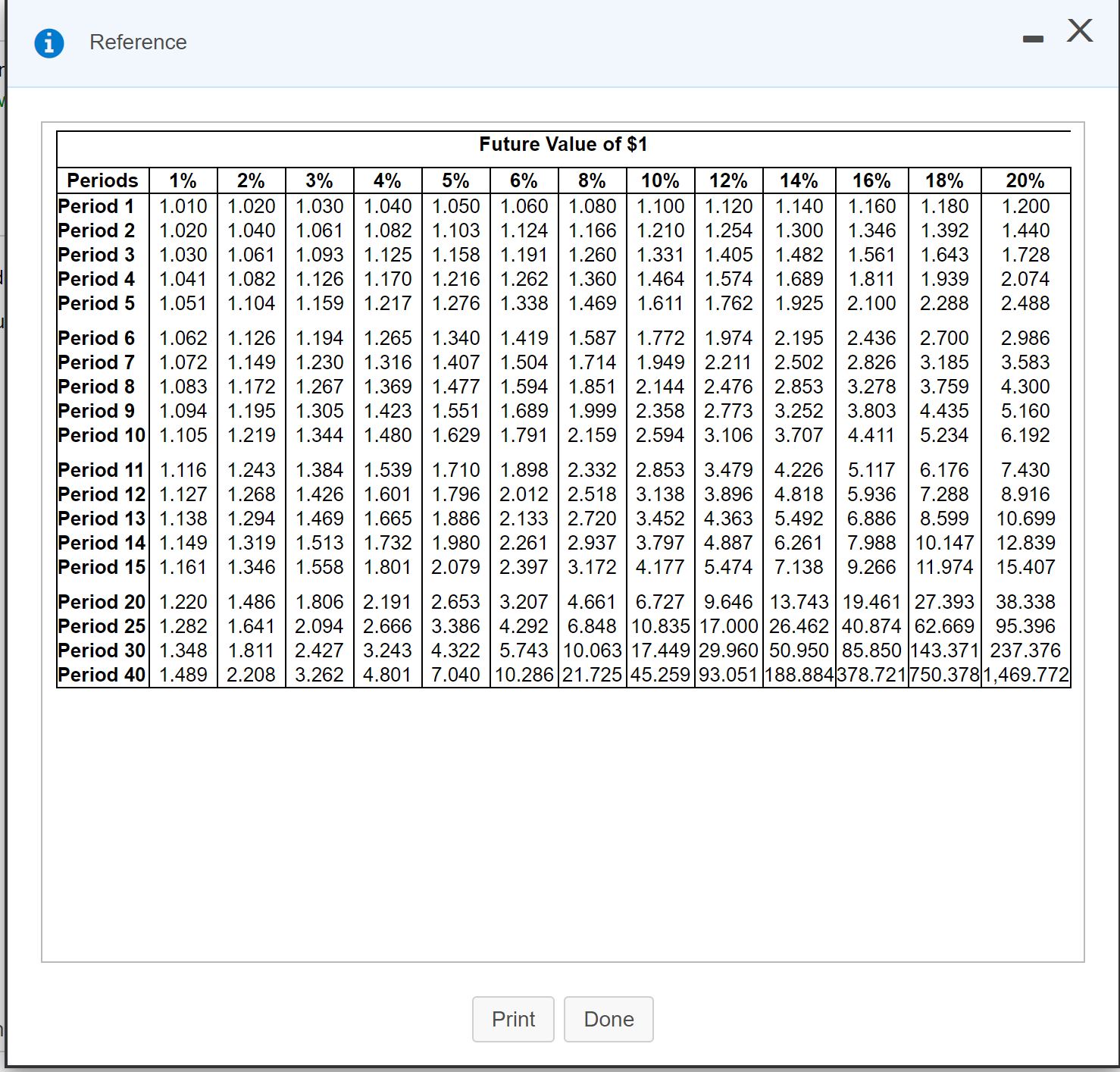

Question: plea fffffffff ff0 Reference Future Value of $1 Period1 1.010 1.020 1.030 1.040 1.050 1.060 1.080 1.100 1.120 1.140 1.160 1.180 1.200 Period2 1.061 1.082

pleafffffffff

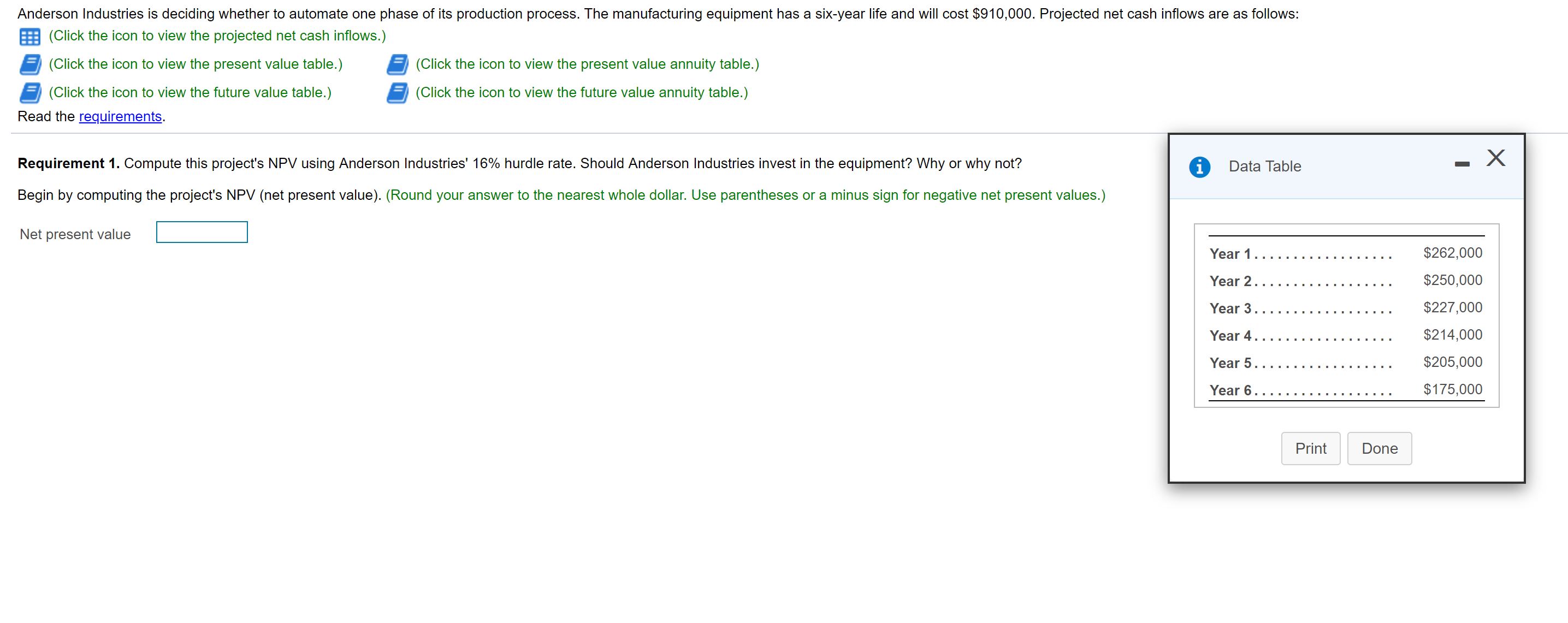

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock