Question: Pleaae explain answer choice, thank you. And please use Verizon to answer this question Select a company from Yahoo! Finance or another online source. Pick

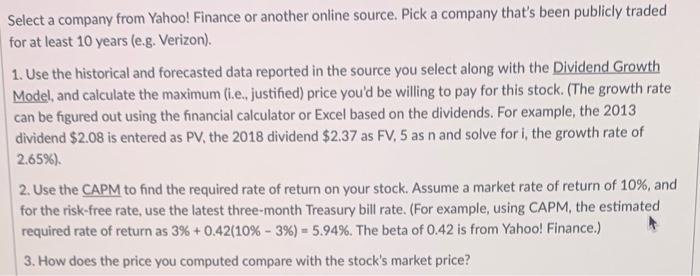

Select a company from Yahoo! Finance or another online source. Pick a company that's been publicly traded for at least 10 years (e.g. Verizon). 1. Use the historical and forecasted data reported in the source you select along with the Dividend Growth Model, and calculate the maximum (i.e., justified) price you'd be willing to pay for this stock. (The growth rate can be figured out using the financial calculator or Excel based on the dividends. For example, the 2013 dividend $2.08 is entered as PV, the 2018 dividend $2.37 as FV,5 as n and solve for i, the growth rate of 2.65\%). 2. Use the CAPM to find the required rate of return on your stock. Assume a market rate of return of 10%, and for the risk-free rate, use the latest three-month Treasury bill rate. (For example, using CAPM, the estimated required rate of return as 3%+0.42(10%3%)=5.94%. The beta of 0.42 is from Yahoo! Finance.) 3. How does the price you computed compare with the stock's market price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts