Question: pleaae show me how to do the bottome part because i keep getting it wrong. its a semi-annual paymet so for millers bond for year

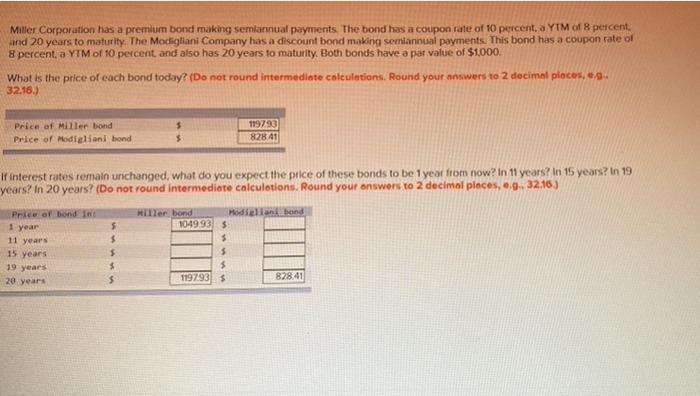

Miller Corporation has a premium bond making semiannual payments. The bond has a coupon rate of 10 percent, a YIM of 8 percent and 20 years to maturity. The Modigliani Company has a discount bond making semiannual payments. This bond has a coupon rate of 8 percent, a YTM of 10 percent and also has 20 years to maturity. Both bonds have a par value of $1,000. What is the price of each bond today? (Do not found intermediate calculations. Round your answers to 2 decimal places, .. 32.16.) Price of Miller bond Price of Medialani hond 119793 82841 If interest rates remain unchanged, what do you expect the price of these bonds to be 1 year from now? in 11 years? in 15 years? In 19 years? In 20 years? (Do not round intermediate calculations. Round your answers to 2 decimal places,..9.. 32.16) Price of bond in 1 year 11 years 15 years 19 years 20 years 5 $ 5 $ Her bond Hola band 1049 935 $ 5 $ 1197935 828.41 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts