Question: pleads help Currently, Forever Flowers Inc, has a capital structure consisting of 25% debt and 75% equity. Forever's debt currently has an B% yleld to

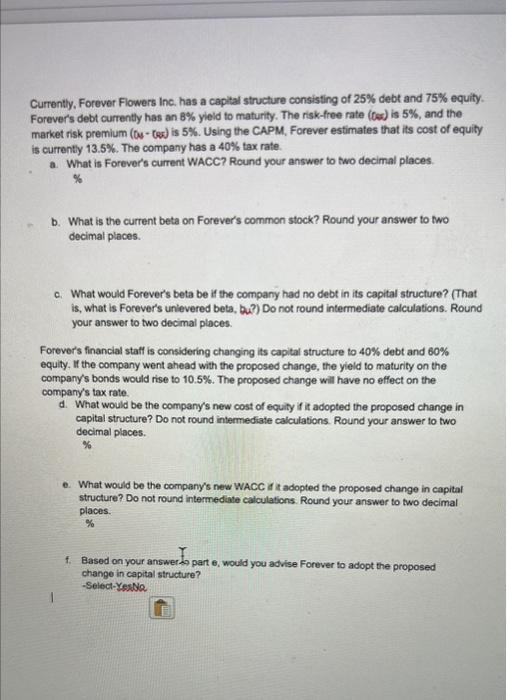

Currently, Forever Flowers Inc, has a capital structure consisting of 25% debt and 75% equity. Forever's debt currently has an B\% yleld to maturity. The risk-free rate (fos) is 5%, and the market risk premium (os- () is 5\%. Using the CAPM, Forever estimates that its cost of equity is currently 13.5%. The compeny has a 40% tax rate a. What is Forever's current WACC? Round your answer to two decimal places % b. What is the current beta on Forever's common stock? Round your answer to two decimal pleces. c. What would Forever's beta be if the company had no debt in its capital structure? (That is, what is Forever's unievered beta, bu?) Do not round intermediate calculations. Round your answer to two decimal ploces. Forever's financial stafl is considering changing its capital structure to 40% debt and 60% equity. It the company went ahead with the proposed change, the yield to maturity on the company's bonds would rise to 10.5%. The proposed change will have no effect on the company's tax rate. d. What would be the company's new cost of equity if it adopted the proposed change in capital structure? Do not round intermediate calculations. Round your answer to two decimal places. % e. What would be the company's new WACC if it adopted the proposed change in capital structure? Do not round intermediate calculations. Round your answer to two decimal places. % f. Based on your answer part 6 , would you advise Forever to adopt the proposed change in capital structure? -Select-Yestor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts