Question: Pleae help me with these two problems. N=No Effect, O=Overstated, U=Understated TB Problem 2-193 (Static) You are reviewing O'Brian Company's adjusted... You are reviewing O'Brian

Pleae help me with these two problems. N=No Effect, O=Overstated, U=Understated

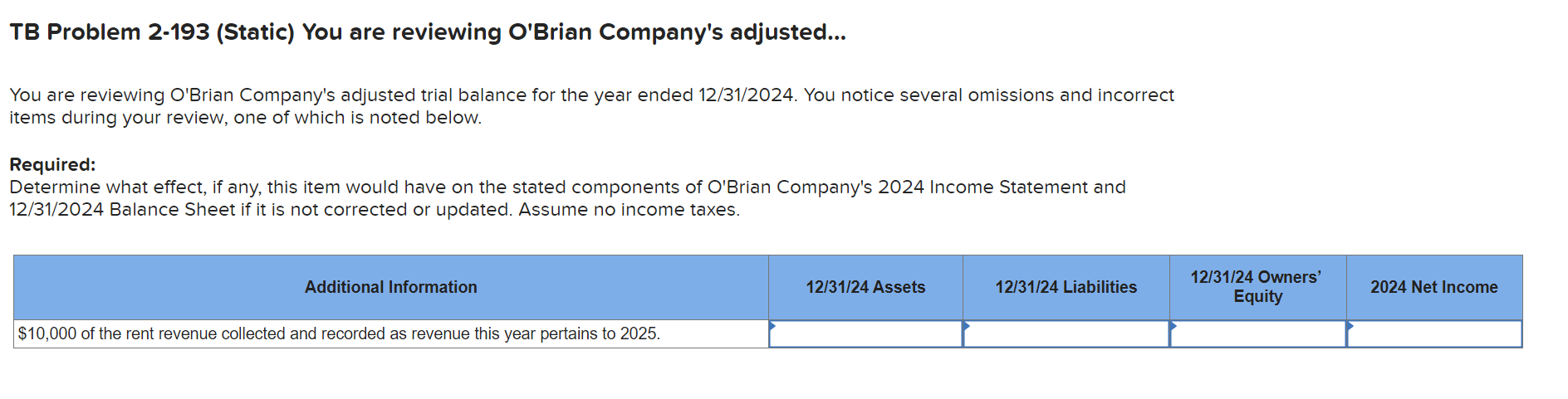

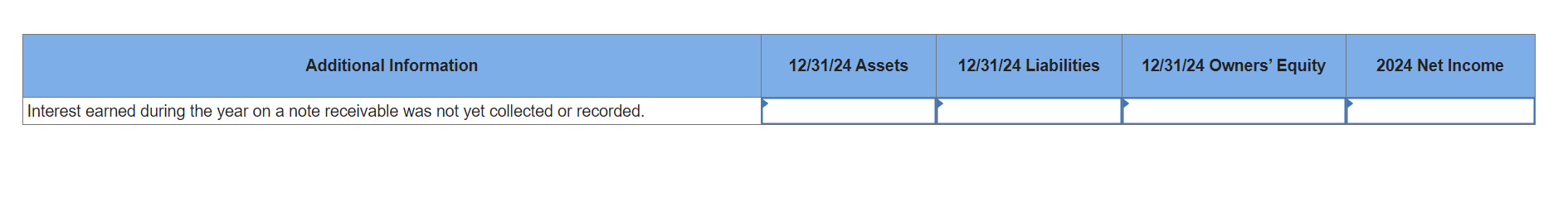

TB Problem 2-193 (Static) You are reviewing O'Brian Company's adjusted... You are reviewing O'Brian Company's adjusted trial balance for the year ended 12/31/2024. You notice several omissions and incorrect items during your review, one of which is noted below. Required: Determine what effect, if any, this item would have on the stated components of O'Brian Company's 2024 Income Statement and 12/31/2024 Balance Sheet if it is not corrected or updated. Assume no income taxes. \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{1}{|c|}{ Additional Information } & 12/31/24 Assets & 12/31/24 Liabilities & 12/31/24 Owners' Equity & 2024 Net Income \\ \hline Interest earned during the year on a note receivable was not yet collected or recorded. & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts