Question: pleae solve it using formulas not the financial calculator 2. A 5-year corporate bond with a 6.8% coupon rate is trading at $ 970 (the

pleae solve it using formulas not the financial calculator

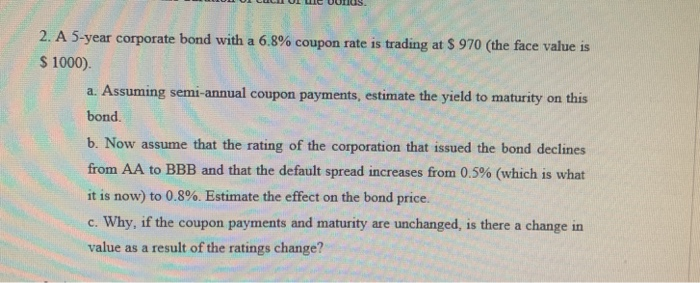

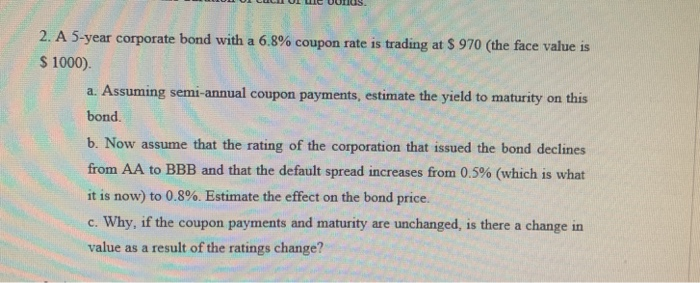

2. A 5-year corporate bond with a 6.8% coupon rate is trading at $ 970 (the face value is $ 1000) a. Assuming semi-annual coupon payments, estimate the yield to maturity on this bond b. Now assume that the rating of the corporation that issued the bond declines from AA to BBB and that the default spread increases from 0.5% (which is what it is now) to 0.8%. Estimate the effect on the bond price. c. Why, if the coupon payments and maturity are unchanged, is there a change in value as a result of the ratings change

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock