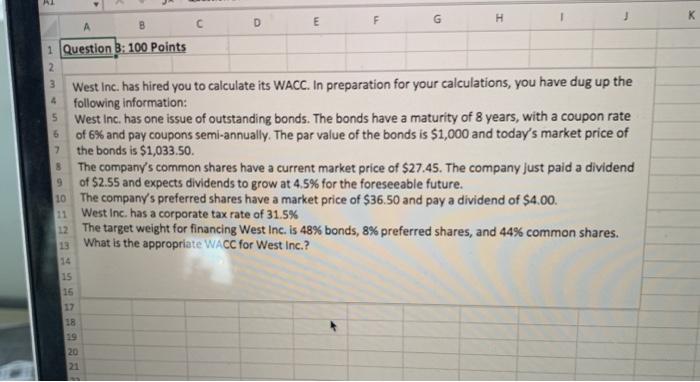

Question: pleaee include excel instuctions G H B E A D 1 Question B: 100 Points 2 3 West Inc. has hired you to calculate its

pleaee include excel instuctions

pleaee include excel instuctions G H B E A D 1 Question B: 100 Points 2 3 West Inc. has hired you to calculate its WACC. In preparation for your calculations, you have dug up the following information: West Inc. has one issue of outstanding bonds. The bonds have a maturity of 8 years, with a coupon rate of 6% and pay coupons semi-annually. The par value of the bonds is $1,000 and today's market price of the bonds is $1,033.50. The company's common shares have a current market price of $27.45. The company Just paid a dividend of $2.55 and expects dividends to grow at 4,5% for the foreseeable future. 10 The company's preferred shares have a market price of $36.50 and pay a dividend of $4.00. West Inc. has a corporate tax rate of 31.5% 12 The target weight for financing West Inc. is 48% bonds, 8% preferred shares, and 44% common shares. What is the appropriate WACC for West Inc.? 4 5 6 7 9 13 14 15 16 17 18 20 21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts