Question: Pleas help me out with the wrong answers Applying the Financial Statement Effects Template Camden Corporation agreed to build a warehouse for a client at

Pleas help me out with the wrong answers

Pleas help me out with the wrong answers

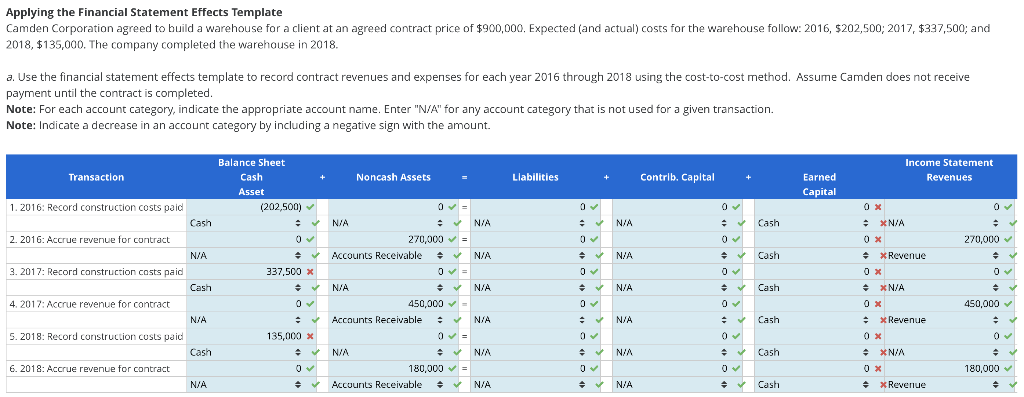

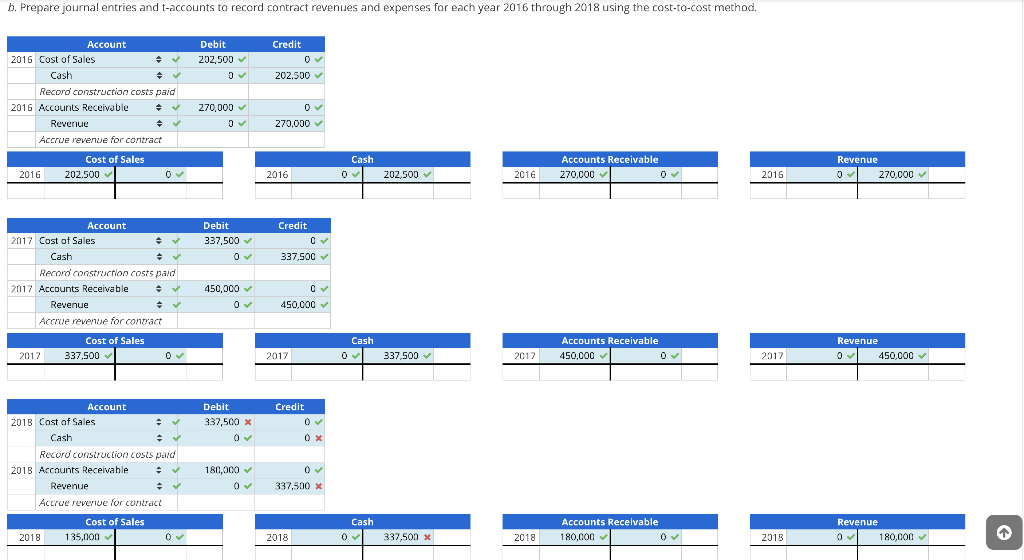

Applying the Financial Statement Effects Template Camden Corporation agreed to build a warehouse for a client at an agreed contract price of $900,000. Expected (and actual) costs for the warehouse follow: 2016, $202,500; 2017, $337,500; and 2018, $135,000. The company completed the warehouse in 2018. a. Use the financial statement effects template to record contract revenues and expenses for each year 2016 through 2018 using the cost-to-cost method. Assume Camden does not receive payment until the contract is completed. Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. Transaction Llabilities Contrib. Capital Income Statement Revenues + Earned Capital 1. 2016: Record construction costs paid : 0 Cash . N/A . Cash 2. 2016: Accrue revenue for contract 0 0 270,000 OX / XN/A 0X Revenue OX xN/A N/A N/A . Cash Balance Sheet Cash + Noncash Assets Asset (202,500) OE N/A N/A 270,000 = A Accounts Receivable N/A A 337,500 x O= N/A NA N/A 450,000 = . Accounts Receivable . N/A NA 135,000 X N/A N/A 0 180,000 - Accounts Receivable N/A 3. 2017: Record construction costs paid ov 0 Cash N/A Cash 4. 2017: Accrue revenue for contract 0 0 450,000 N/A . N/A Cash x Revenue 5.2018: Record construction Custs paid 0 0 OX 0 Cash . N/A Cash XN/A /A OX 0 x 6. 2018: Accrue revenue for contract 180,000 N/A N/A A Cash x Revenue b. Prepare journal entries and t-accounts to record contract revenues and expenses for each year 2016 through 2018 using the cost-to-cost method. Debit 202.500 D 0 Credit 0 202.500 Account 2016 Cost of Sales + Cash Record construction costs paid 2016 Accounts Receivable Revenue Accrue revenue for contract 270,000 0 270,000 Cash Cost of Sales 202.500 Accounts Receivable 270,000 0 Revenue 270,000 2016 2016 202,500 2016 2016 Credit Debit 337,500 0 O 337.500 Account 2017 Cost of Sales . Cash Record construction costs paid 2017 Accounts Receivable Revenue Accrue revenue for contract 450,000 450,000 Cost of Sales 337.500 Cash 0 Accounts Receivable 450,000 0 Revenue 450,000 2017 2017 337,500 2017 2017 Debit 337,500 x Credit 0 OX Account 2018 Cast af Sales . Cash Record construction costs pard 2018 Accounts Receivable Revenue Accrue revenue for contract 180,000 337,500 X Cash Cost of Sales 135,000 Accounts Recelvable 180,000 Revenue 180,000 2018 2018 0v 337,500 x 2018 2015

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts