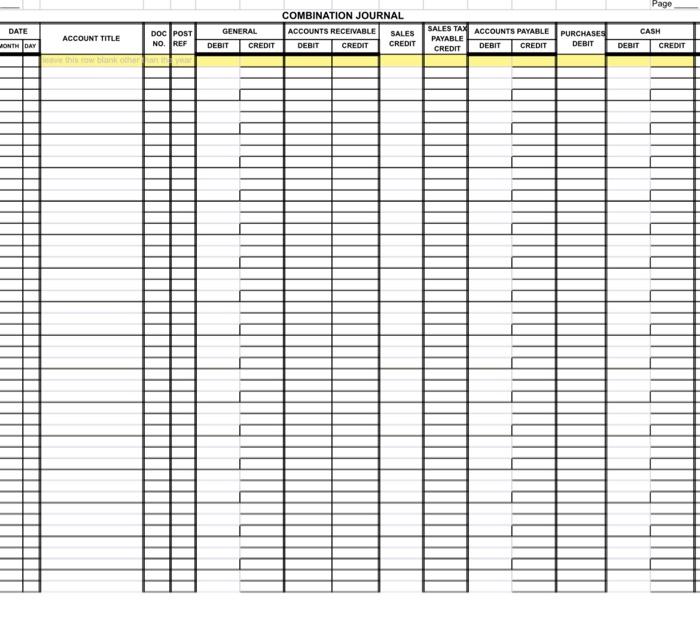

Question: pleas use the same format as the journal Page DATE CASH COMBINATION JOURNAL ACCOUNTS RECEIVABLE SALES DEBIT CREDIT CREDIT DOC POST NO REF ACCOUNT TITLE

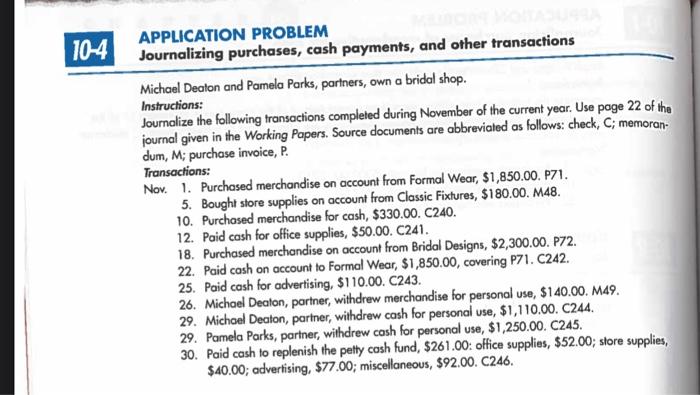

Page DATE CASH COMBINATION JOURNAL ACCOUNTS RECEIVABLE SALES DEBIT CREDIT CREDIT DOC POST NO REF ACCOUNT TITLE GENERAL DEBIT CREDIT SALES TAX ACCOUNTS PAYABLE PAYABLE DEBIT CREDIT CREDIT PURCHASES DEBIT JONTH DAY DEBIT CREDIT 10-4 APPLICATION PROBLEM Journalizing purchases, cash payments, and other transactions Michael Deaton and Pamela Parks, partners, own a bridal shop. Instructions: Journalize the following transactions completed during November of the current year. Use page 22 of the journal given in the Working Papers. Source documents are abbreviated as follows: check, C; memoran- dum, M; purchase invoice, P. Transactions: Nov. 1. Purchased merchandise on account from Formal Wear, $1,850.00. P71. 5. Bought store supplies on account from Classic Fixtures, $180.00. M48. 10. Purchased merchandise for cash, $330.00. C240. 12. Paid cash for office supplies, $50.00. C241. 18. Purchased merchandise on account from Bridal Designs, $2,300.00. P72. 22. Paid cash on account to Formal Wear, $1,850.00, covering P71. C242. 25. Paid cash for advertising, $110.00. C243. 26. Michael Deaton, partner , withdrew merchandise for personal use, $140.00, M49. 29. Michael Deaton, partner, withdrew cash for personal use, $1,110.00. C244. 29. Pamela Parks, partner, withdrew cash for personal use, $1,250.00. C245. 30. Paid cash to replenish the petty cash fund, $261.00: office supplies, $52.00; store supplies, $40.00; advertising, $77.00; miscellaneous, $92.00. C246

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts