Question: Please A, B and C. Please break down step by step the calculation of goodwill. Thank you! LO 1 E5.10 Consolidation Working Paper, Date of

Please A, B and C.

Please break down step by step the calculation of goodwill.

Thank you!

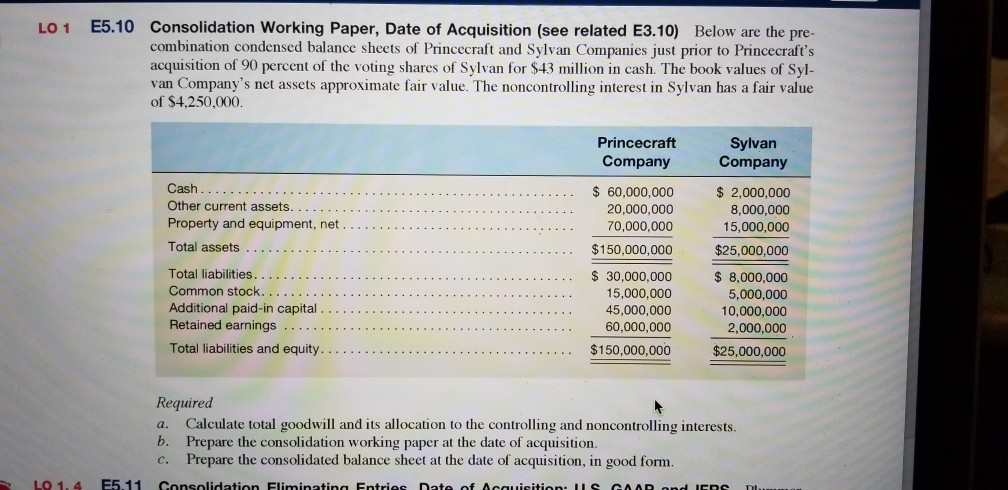

LO 1 E5.10 Consolidation Working Paper, Date of Acquisition (see related E3.10) Below are the pre- combination condensed balance sheets of Princecraft and Sylvan Companies just prior to Princecraft's acquisition of 90 percent of the voting shares of Sylvan for $43 million in cash. The book values of Syl- van Company's net assets approximate fair value. The noncontrolling interest in Sylvan has a fair value of $4,250,000. Princecraft Sylvan CompanyCompany .60,000,000 20,000,000 70,000,000 $ 2,000,000 8,000,000 15,000,000 Other current assets Property and equipment, net . . . Total assets. . . Total liabilities.... $150,000,000 $25,000,000 15,000,000 45,000,000 60,000,000 $150,000,000 s 30,000,000 8,000,000 5,000,000 10,000,000 2,000,000 $25,000,000 Additional paid-in capital Retained earnings... Required a. Calculate total goodwill and its allocation to the controlling and noncontrolling interests b. Prepare the consolidation working paper at the date of acquisition. c. Prepare the consolidated balance sheet at the date of acquisition, in good form

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts