Question: please actually answer the question this time instead with thw numbers instead of nothing For each of the listed transactions list: 1) the gain or

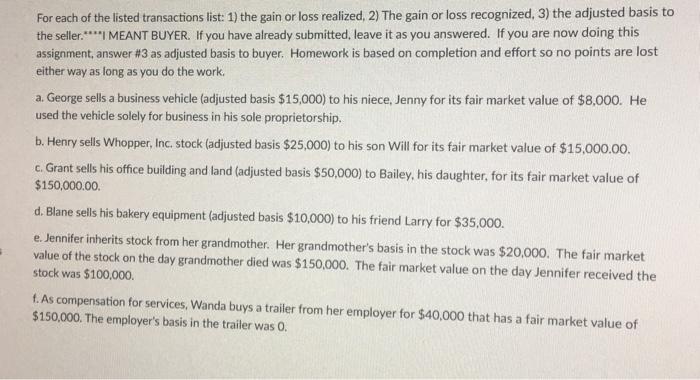

For each of the listed transactions list: 1) the gain or loss realized, 2) The gain or loss recognized, 3) the adjusted basis to the seller.**** MEANT BUYER. If you have already submitted, leave it as you answered. If you are now doing this assignment, answer #3 as adjusted basis to buyer. Homework is based on completion and effort so no points are lost either way as long as you do the work. a George sells a business vehicle (adjusted basis $15,000) to his niece, Jenny for its fair market value of $8,000. He used the vehicle solely for business in his sole proprietorship, b. Henry sells Whopper, Inc. stock (adjusted basis $25,000) to his son Will for its fair market value of $15,000.00 c. Grant sells his office building and land (adjusted basis $50,000) to Bailey, his daughter, for its fair market value of $150,000.00 d. Blane sells his bakery equipment (adjusted basis $10,000) to his friend Larry for $35,000. e Jennifer inherits stock from her grandmother. Her grandmother's basis in the stock was $20,000. The fair market value of the stock on the day grandmother died was $150,000. The fair market value on the day Jennifer received the stock was $100,000 t. As compensation for services, Wanda buys a trailer from her employer for $40,000 that has a fair market value of $150,000. The employer's basis in the trailer was 0. For each of the listed transactions list: 1) the gain or loss realized, 2) The gain or loss recognized, 3) the adjusted basis to the seller.**** MEANT BUYER. If you have already submitted, leave it as you answered. If you are now doing this assignment, answer #3 as adjusted basis to buyer. Homework is based on completion and effort so no points are lost either way as long as you do the work. a George sells a business vehicle (adjusted basis $15,000) to his niece, Jenny for its fair market value of $8,000. He used the vehicle solely for business in his sole proprietorship, b. Henry sells Whopper, Inc. stock (adjusted basis $25,000) to his son Will for its fair market value of $15,000.00 c. Grant sells his office building and land (adjusted basis $50,000) to Bailey, his daughter, for its fair market value of $150,000.00 d. Blane sells his bakery equipment (adjusted basis $10,000) to his friend Larry for $35,000. e Jennifer inherits stock from her grandmother. Her grandmother's basis in the stock was $20,000. The fair market value of the stock on the day grandmother died was $150,000. The fair market value on the day Jennifer received the stock was $100,000 t. As compensation for services, Wanda buys a trailer from her employer for $40,000 that has a fair market value of $150,000. The employer's basis in the trailer was 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts