Question: please add EXCEL instructions - Need to see how uou calculatwd the anawer in Excel and full explanation - Thanka so very much 3. Assume

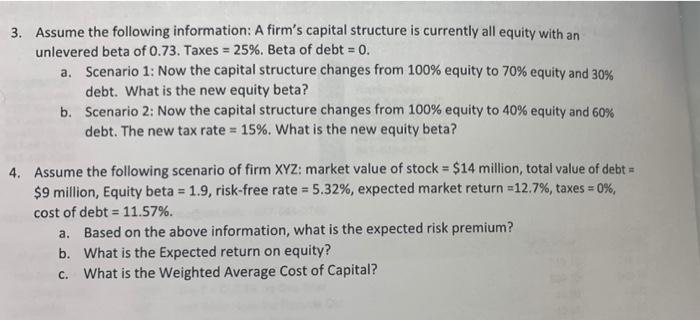

3. Assume the following information: A firm's capital structure is currently all equity with an unlevered beta of 0.73. Taxes = 25%. Beta of debt = 0. a. Scenario 1: Now the capital structure changes from 100% equity to 70% equity and 30% debt. What is the new equity beta? b. Scenario 2: Now the capital structure changes from 100% equity to 40% equity and 60% debt. The new tax rate = 15%. What is the new equity beta? 4. Assume the following scenario of firm XYZ: market value of stock = $14 million, total value of debt $9 million, Equity beta = 1.9, risk-free rate = 5.32%, expected market return =12.7%, taxes = 0%, cost of debt = 11.57%. a. Based on the above information, what is the expected risk premium? b. What is the Expected return on equity? c. What is the Weighted Average Cost of Capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts