Question: Please add excel sheet so I can make sure I did this correctly :) Dr. Harold Wolf of Medical Research Corporation (MRC) was thrilled with

Please add excel sheet so I can make sure I did this correctly :)

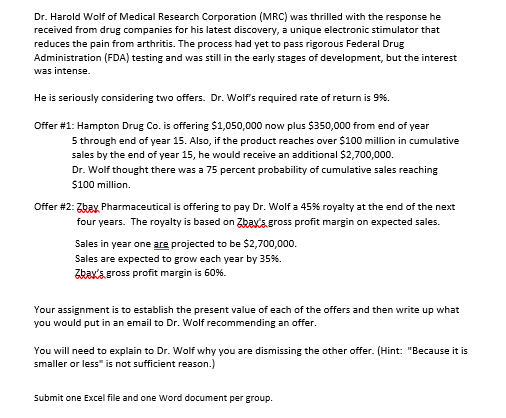

Dr. Harold Wolf of Medical Research Corporation (MRC) was thrilled with the response he received from drug companies for his latest discovery, a unique electronic stimulator that reduces the pain from arthritis. The process had yet to pass rigorous Federal Drug Administration (FDA) testing and was still in the early stages of development, but the interest was intense. He is seriously considering two offers. Dr. Wolf's required rate of return is 9%. Offer #1: Hampton Drug Co. is offering $1,050,000 now plus $350,000 from end of year 5 through end of year 15 . Also, if the product reaches over $100 million in cumulative sales by the end of year 15 , he would receive an additional $2,700,000. Dr. Wolf thought there was a 75 percent probability of cumulative sales reaching $100 milion. Offer #2: 76 bay Pharmaceutical is offering to pay Dr. Wolf a 45% royalty at the end of the next four years. The royalty is based on Zbayis gross profit margin on expected sales. Sales in year one are projected to be $2,700,000. Sales are expected to grow each year by 35%. Zbex's gross profit margin is 60%. Your assignment is to establish the present value of each of the offers and then write up what you would put in an email to Dr. Wolf recommending an offer. You will need to explain to Dr. Wolf why you are dismissing the other offer. (Hint: "Because it is smaller or less" is not sufficient reason.) Submit one Excel file and one Word document per group

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts