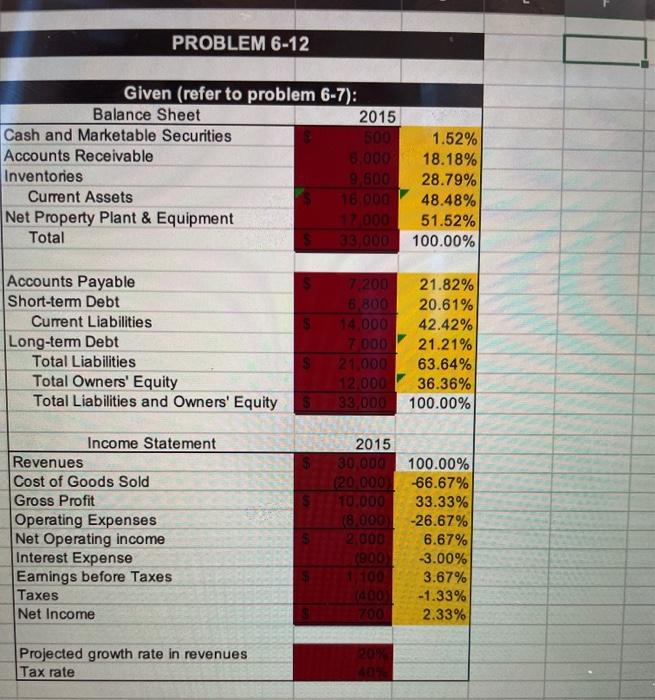

Question: please add in formulas PROBLEM 6-12 Given (refer to problem 6-7): Balance Sheet 2015 Cash and Marketable Securities 600 1.52% Accounts Receivable 5.000 18.18% Inventories

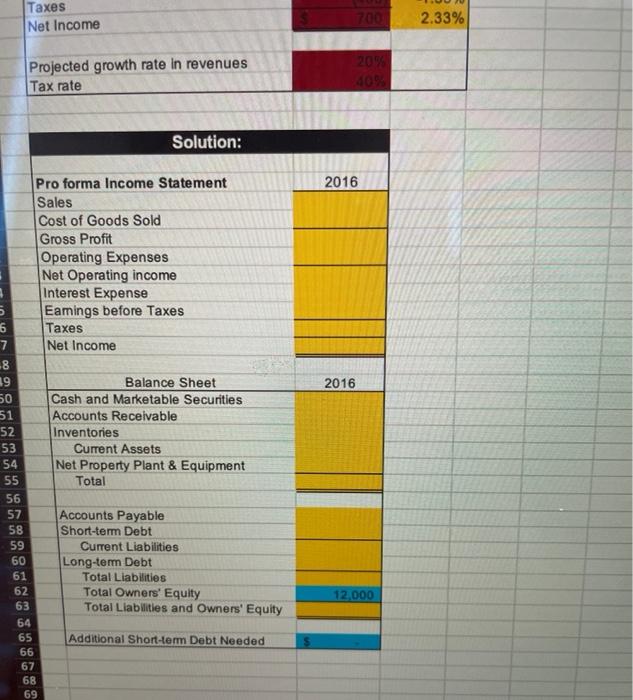

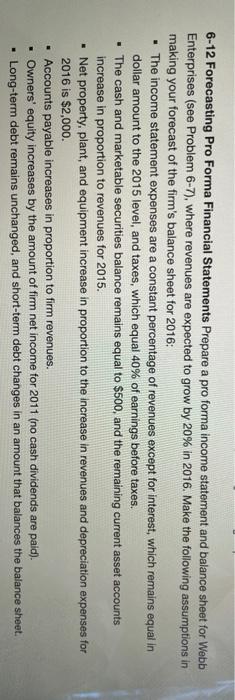

PROBLEM 6-12 Given (refer to problem 6-7): Balance Sheet 2015 Cash and Marketable Securities 600 1.52% Accounts Receivable 5.000 18.18% Inventories 9.600 28.79% Current Assets 16.000 48.48% Net Property Plant & Equipment 17 000 51.52% Total 33.000 100.00% Accounts Payable Short-term Debt Current Liabilities Long-term Debt Total Liabilities Total Owners' Equity Total Liabilities and Owners' Equity 7200 21.82% 6 800 20.61% 14.000 42.42% 7000 21.21% 21.000 63.64% 12 000 36.36% 33.000 100.00% S Income Statement Revenues Cost of Goods Sold Gross Profit Operating Expenses Net Operating income Interest Expense Eamings before Taxes Taxes Net Income 2015 30,000 100.00% 120.000 66.67% 10.000 33.33% (8.000 -26.67% 2.000 6.67% (800 3.00% 100 3.67% 100 -1.33% 2.33% Projected growth rate in revenues Tax rate Taxes Net Income 700 2.33% Projected growth rate in revenues Tax rate 209 409 Solution: 2016 2016 Pro forma Income Statement Sales Cost of Goods Sold Gross Profit Operating Expenses Net Operating income Interest Expense 5 Eamings before Taxes 6 Taxes 7 Net Income .8 19 Balance Sheet 50 Cash and Marketable Securities 51 Accounts Receivable 52 Inventories 53 Current Assets 54 Net Property Plant & Equipment 55 Total 56 57 Accounts Payable 58 Short-term Debt 59 Current Liabilities 60 Long-term Debt 61 Total Liabilities 62 Total Owners' Equity 63 Total Liabilities and Owners' Equity 64 65 Additional Short-term Debt Needed 66 67 68 69 12.000 6-12 Forecasting Pro Forma Financial Statements Prepare a pro forma income statement and balance sheet for Webb Enterprises (see Problem 6-7), where revenues are expected to grow by 20% in 2016. Make the following assumptions in making your forecast of the firm's balance sheet for 2016: . The income statement expenses are a constant percentage of revenues except for interest, which remains equal in dollar amount to the 2015 level, and taxes, which equal 40% of earnings before taxes. The cash and marketable securities balance remains equal to $500, and the remaining current asset accounts increase in proportion to revenues for 2015. Net property, plant, and equipment increase in proportion to the increase in revenues and depreciation expenses for 2016 is $2,000. Accounts payable increases in proportion to firm revenues. Owners' equity increases by the amount of firm net income for 2011 (no cash dividends are paid). . Long-term debt remains unchanged, and short-term debt changes in an amount that balances the balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts