Question: Please add the adjustment type and dates. Thank you Identify whether each account would appear on the Balance Sheet or the Income Statement. Fuel Expense

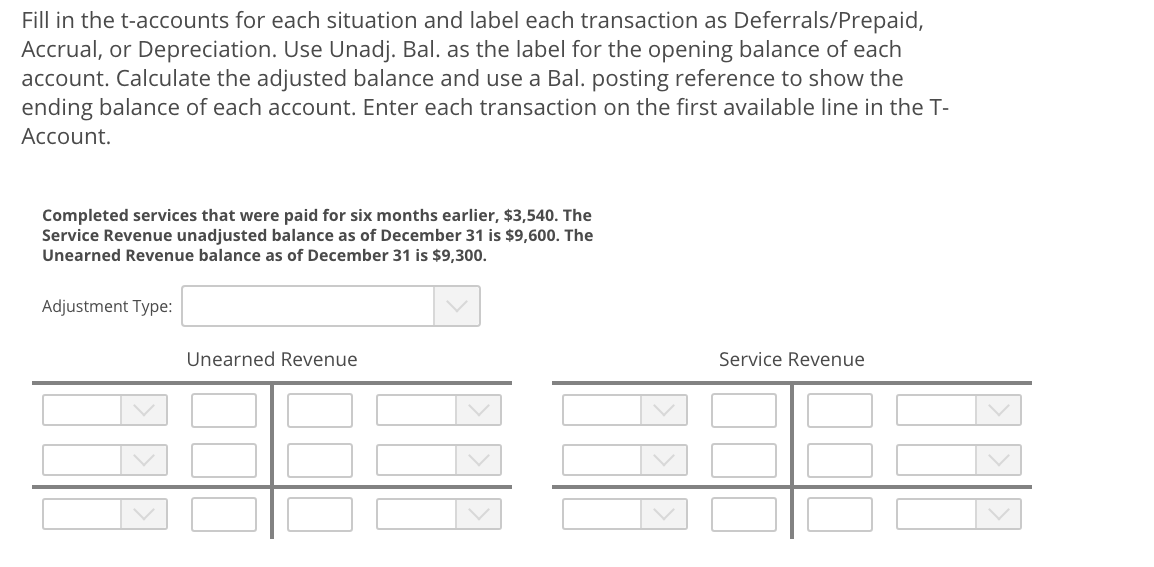

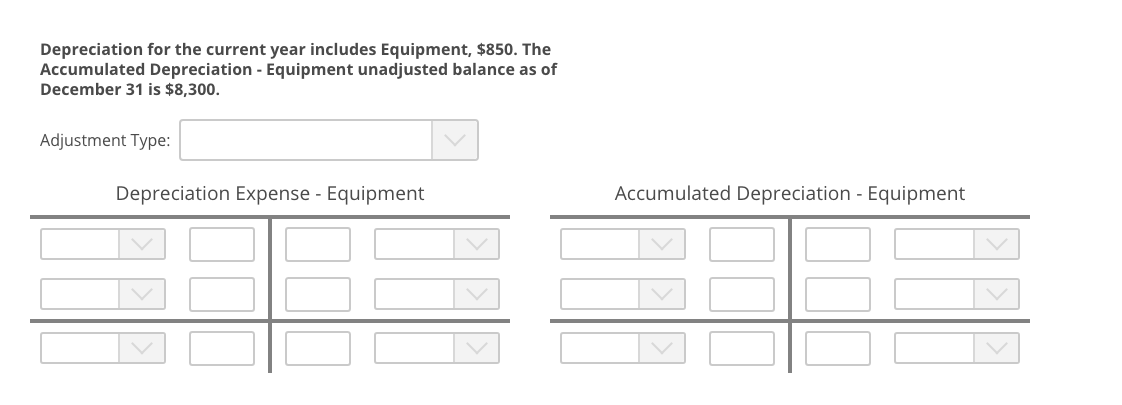

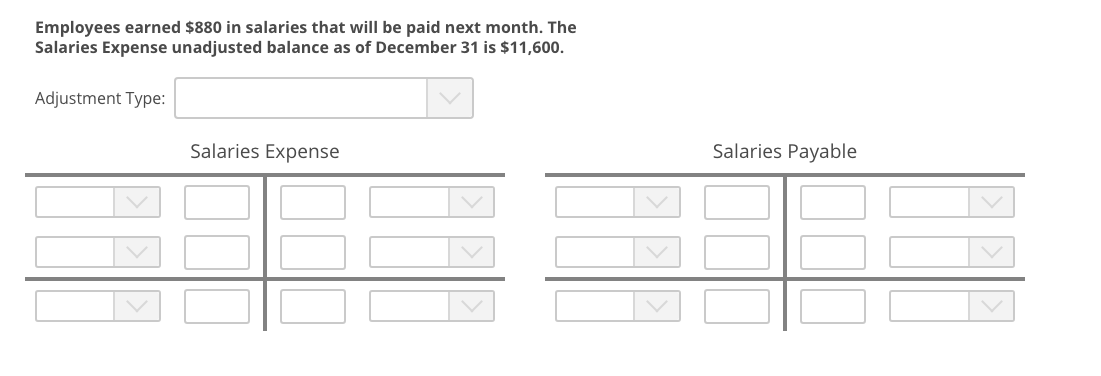

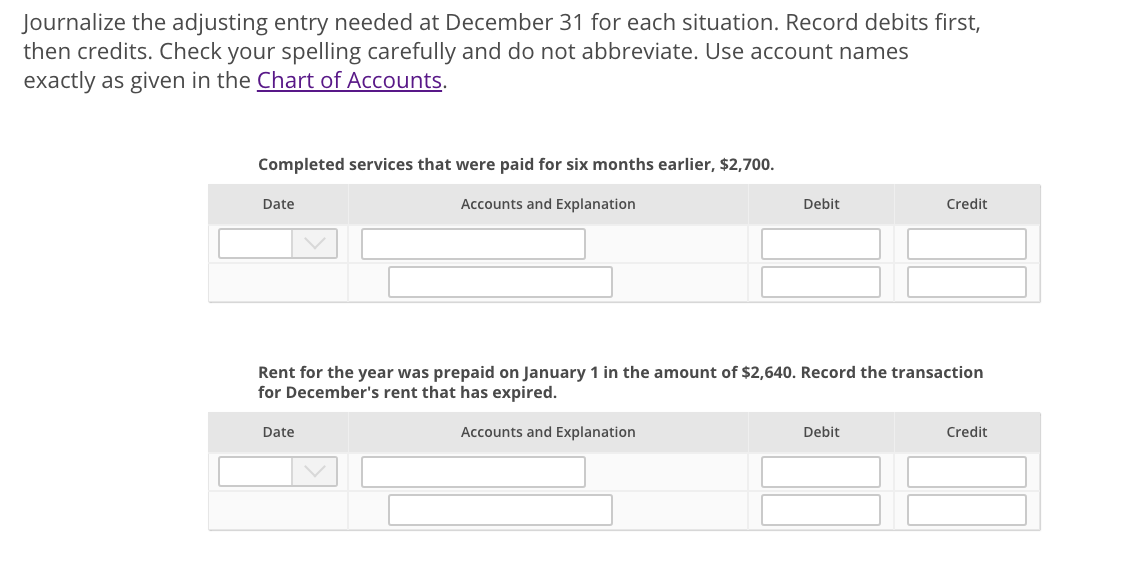

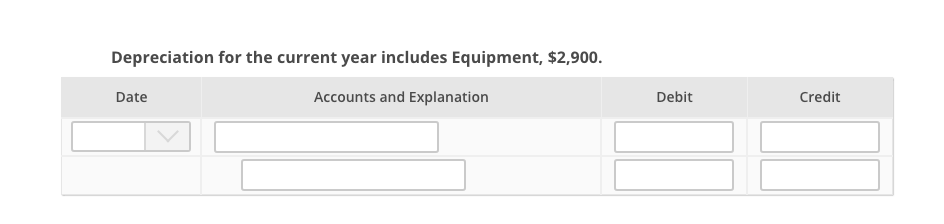

Please add the adjustment type and dates. Thank you

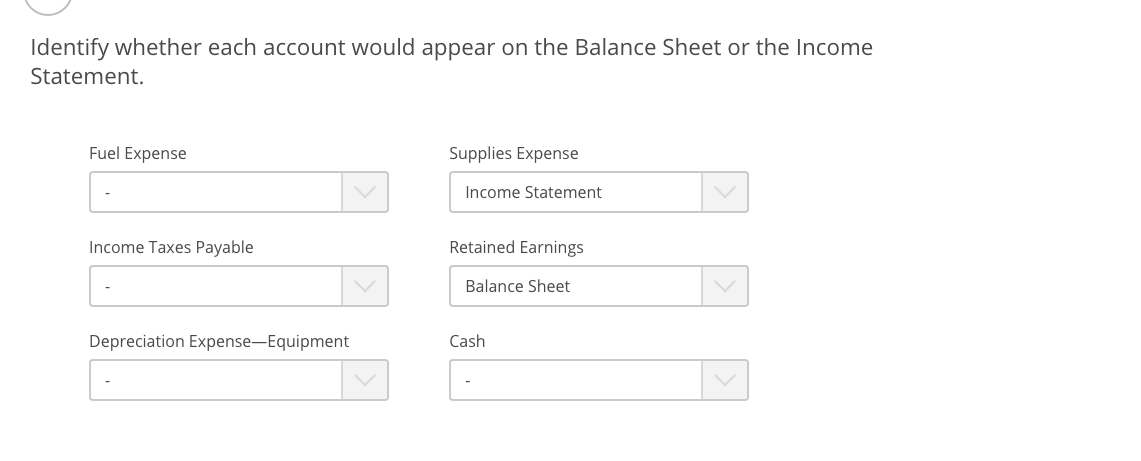

Identify whether each account would appear on the Balance Sheet or the Income Statement. Fuel Expense Supplies Expense Income Statement Income Taxes Payable Retained Earnings Balance Sheet Depreciation Expense-Equipment Cash Fill in the t-accounts for each situation and label each transaction as Deferrals/Prepaid, Accrual, or Depreciation. Use Unadj. Bal. as the label for the opening balance of each account. Calculate the adjusted balance and use a Bal. posting reference to show the ending balance of each account. Enter each transaction on the first available line in the T- Account. Completed services that were paid for six months earlier, $3,540. The Service Revenue unadjusted balance as of December 31 is $9,600. The Unearned Revenue balance as of December 31 is $9,300. Adjustment Type: Unearned Revenue Service Revenue Depreciation for the current year includes Equipment, $850. The Accumulated Depreciation - Equipment unadjusted balance as of December 31 is $8,300. Adjustment Type: Depreciation Expense - Equipment Accumulated Depreciation - Equipment Employees earned $880 in salaries that will be paid next month. The Salaries Expense unadjusted balance as of December 31 is $11,600. Adjustment Type: Salaries Expense Salaries Payable Journalize the adjusting entry needed at December 31 for each situation. Record debits first, then credits. Check your spelling carefully and do not abbreviate. Use account names exactly as given in the Chart of Accounts. Completed services that were paid for six months earlier, $2,700. Date Accounts and Explanation Debit Credit Rent for the year was prepaid on January 1 in the amount of $2,640. Record the transaction for December's rent that has expired. Date Accounts and Explanation Debit Credit Depreciation for the current year includes Equipment, $2,900. Date Accounts and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts