Question: please advise if this is correct on.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fpost.blackboard.com%252Fw... Saved He mework i ULITUILV UHU VUHILL JU (Damarcus, Janine Jr., Michael, and Candice). The couple received salary

please advise if this is correct

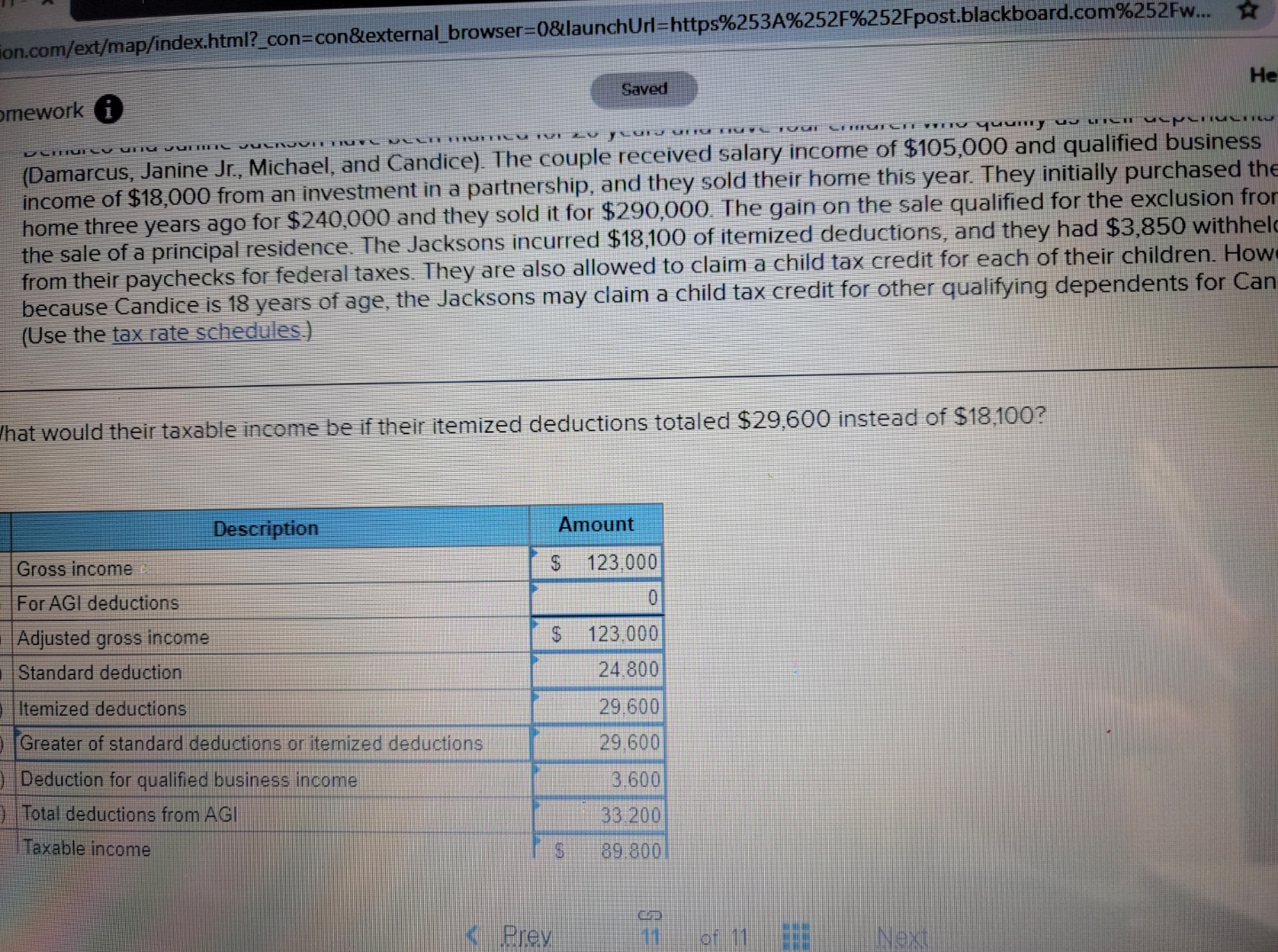

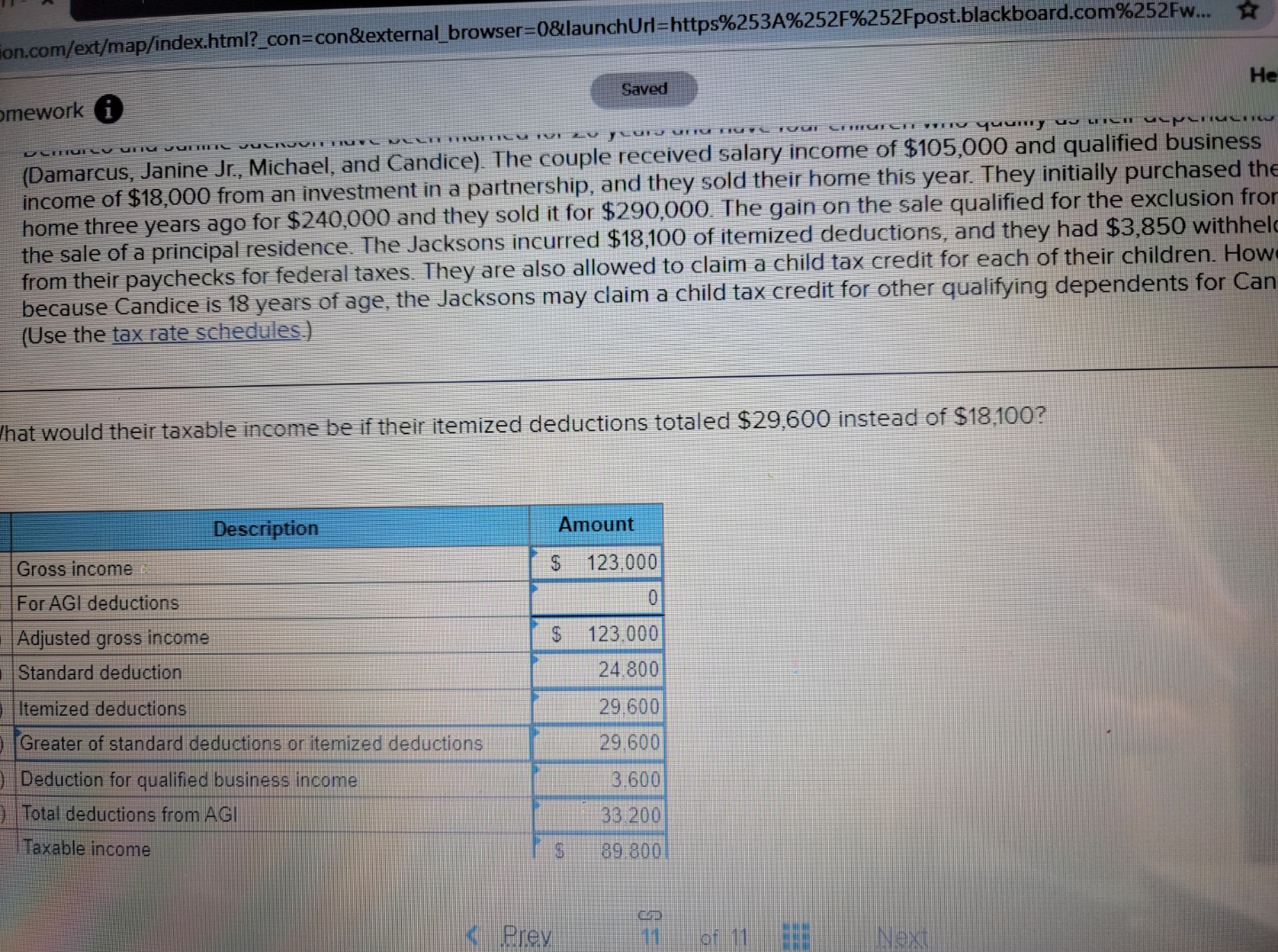

on.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fpost.blackboard.com%252Fw... Saved He mework i ULITUILV UHU VUHILL JU (Damarcus, Janine Jr., Michael, and Candice). The couple received salary income of $105,000 and qualified business income of $18,000 from an investment in a partnership, and they sold their home this year. They initially purchased the home three years ago for $240,000 and they sold it for $290,000. The gain on the sale qualified for the exclusion from the sale of a principal residence. The Jacksons incurred $18,100 of itemized deductions, and they had $3,850 withheld from their paychecks for federal taxes. They are also allowed to claim a child tax credit for each of their children. How because Candice is 18 years of age, the Jacksons may claim a child tax credit for other qualifying dependents for Car (Use the tax rate schedules.) that would their taxable income be if their itemized deductions totaled $29,600 instead of $18,100? Description Amount Gross income $ 123,000 For AGI deductions 0 Adjusted gross income $ 123.000 Standard deduction 24.800 Itemized deductions 29,600 Greater of standard deductions or itemized deductions 29,600 Deduction for qualified business income 3.600 Total deductions from AGI 33.200 Taxable income S 89.800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts