Question: Please advise the solution for part a to part c 2.0 20 2. Mr. Ting owns a portfolio with the following characteristics. Assume that returns

Please advise the solution for part a to part c

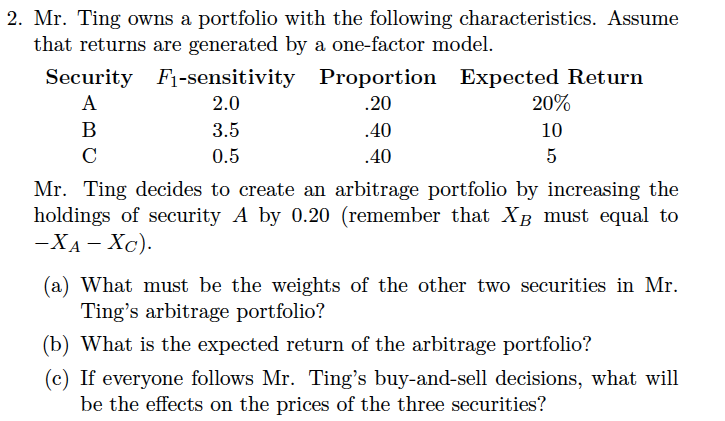

2.0 20 2. Mr. Ting owns a portfolio with the following characteristics. Assume that returns are generated by a one-factor model. Security F1-sensitivity Proportion Expected Return 20% 3.5 .40 10 0.5 .40 Mr. Ting decides to create an arbitrage portfolio by increasing the holdings of security A by 0.20 (remember that XB must equal to -XA- Xc). (a) What must be the weights of the other two securities in Mr. Ting's arbitrage portfolio? (b) What is the expected return of the arbitrage portfolio? (C) If everyone follows Mr. Ting's buy-and-sell decisions, what will be the effects on the prices of the three securities? 2.0 20 2. Mr. Ting owns a portfolio with the following characteristics. Assume that returns are generated by a one-factor model. Security F1-sensitivity Proportion Expected Return 20% 3.5 .40 10 0.5 .40 Mr. Ting decides to create an arbitrage portfolio by increasing the holdings of security A by 0.20 (remember that XB must equal to -XA- Xc). (a) What must be the weights of the other two securities in Mr. Ting's arbitrage portfolio? (b) What is the expected return of the arbitrage portfolio? (C) If everyone follows Mr. Ting's buy-and-sell decisions, what will be the effects on the prices of the three securities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts