Question: Please all work must be done on paper, no spreadsheet software! 6. What is the expected return of the optimally risky portfolio? Round to the

Please all work must be done on paper, no spreadsheet software!

6. What is the expected return of the optimally risky portfolio? Round to the nearest 0.01%

7. What is the standard deviation of the optimally risky portfolio? Round to the nearest 0.01.

8. What is the optimal allocation of risk-free assets in the complete portfolio? Assume a risk aversion of 2. Round to the nearest 0.01%.

9.What is the optimal weight of the equity in the complete portfolio? Round to the nearest 0.01%.

10. What is the Sharpe ratio of the optimally risky portfolio? Round to the nearest 0.01.

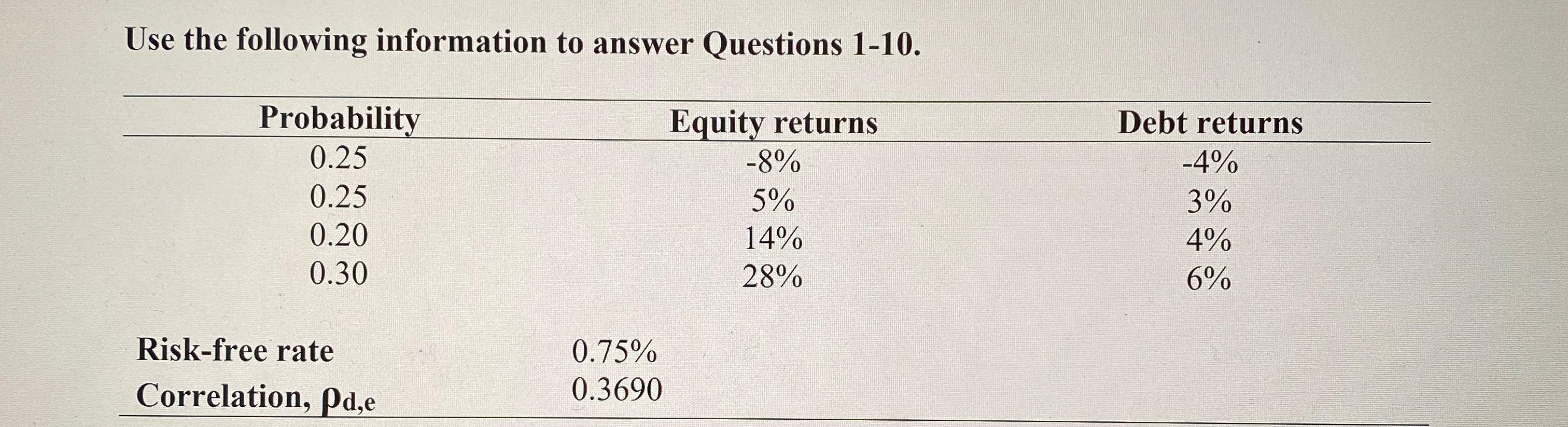

Use the following information to answer Questions 1-10. Probability 0.25 0.25 0.20 0.30 Equity returns -8% 5% 14% 28% Debt returns -4% 3% 4% 6% Risk-free rate Correlation, Pd,e 0.75% 0.3690 Use the following information to answer Questions 1-10. Probability 0.25 0.25 0.20 0.30 Equity returns -8% 5% 14% 28% Debt returns -4% 3% 4% 6% Risk-free rate Correlation, Pd,e 0.75% 0.3690

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts